Delve into the Realm of Option Trading

In the multifaceted realm of finance, options trading stands as a powerful tool, enabling investors to navigate market fluctuations with precision. As technology continues its relentless march forward, online option trading brokers have emerged as indispensable gateways to this lucrative world. This article embarks on an in-depth exploration of these brokers, unveiling their essential features, exploring their myriad offerings, and guiding readers towards a well-informed decision-making process.

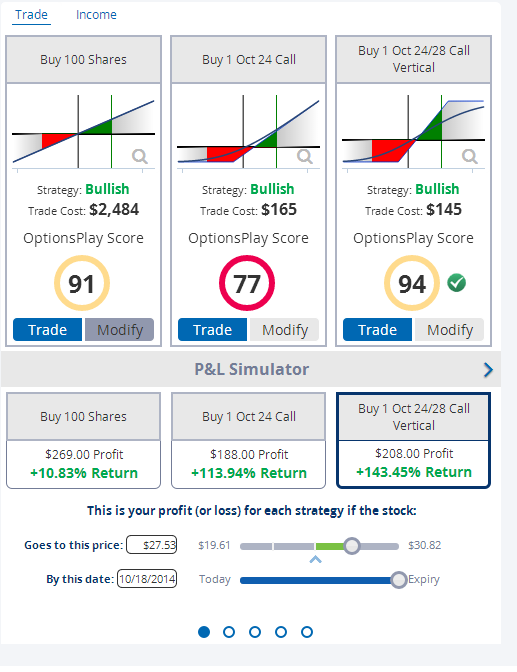

Image: s3.amazonaws.com

Navigating the Online Option Trading Landscape

Online option trading brokers serve as intermediaries between investors and the options market, providing a seamless platform for executing trades. They offer a plethora of services, including access to a wide range of underlying assets, flexible trading options, and advanced charting and analysis tools. By harnessing the power of these brokers, investors can reap the benefits of option trading without the complexities associated with traditional methods.

The ABCs of Option Trading

Options are financial instruments that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specified date. The two primary types of options are calls and puts. Calls bestow the right to buy, while puts confer the right to sell. Successful option trading hinges on correctly predicting the direction of the underlying asset’s price movement.

Embracing the Advantages of Online Option Trading Brokers

The benefits of utilizing online option trading brokers are manifold. They provide:

- Convenience and Flexibility: Trade from anywhere with an internet connection, at any time that suits your schedule.

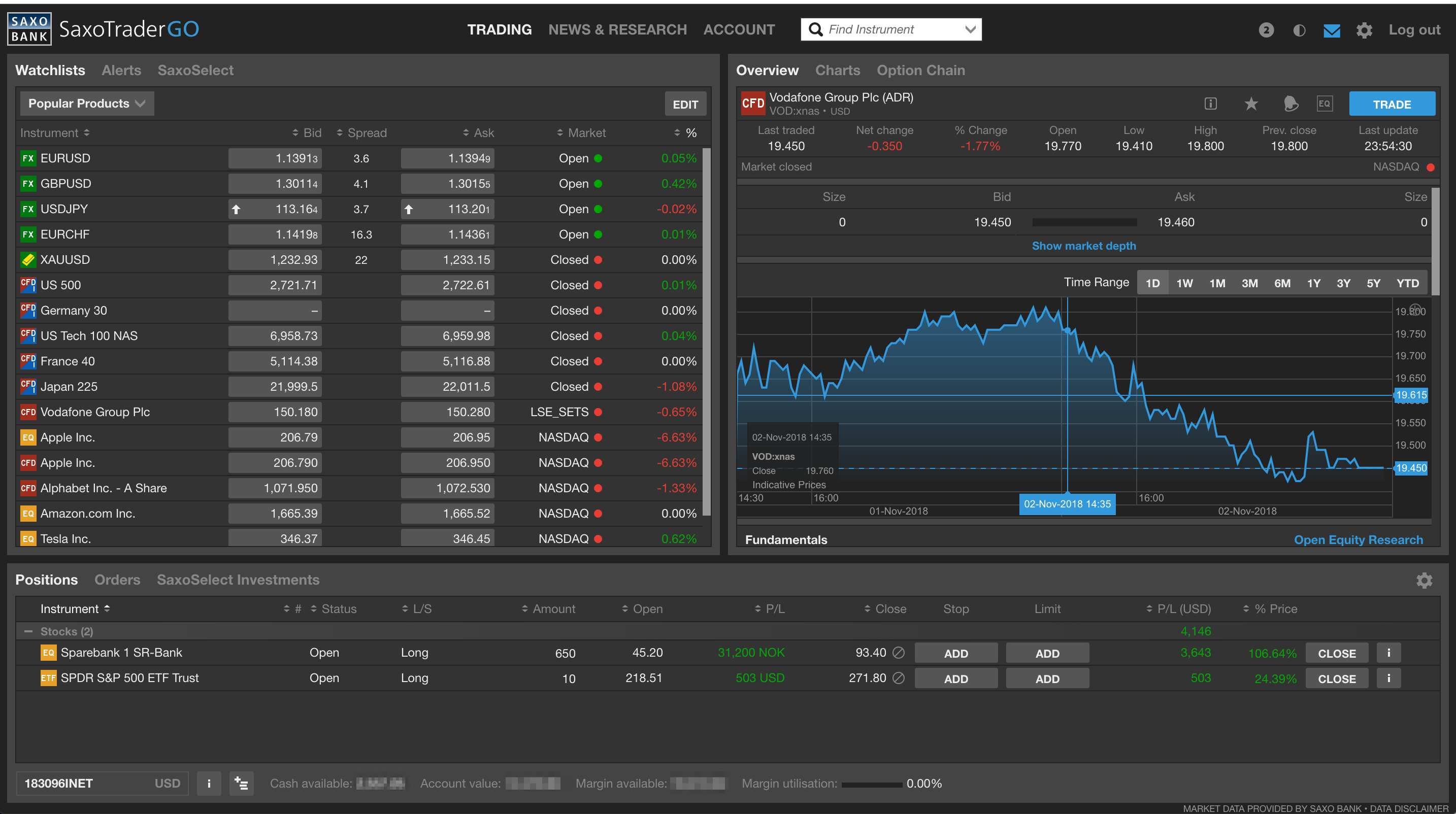

- Access to a Vast Market: Choose from a broad selection of underlying assets, including stocks, indices, commodities, and currencies.

- User-friendly Platforms: Intuitive and customizable interfaces empower traders of all experience levels.

- Advanced Tools and Resources: Leverage charting capabilities, technical indicators, and market analysis to optimize trading strategies.

- Reduced Trading Costs: Lower commissions and fees compared to traditional brokerage models.

Image: syarikat-comp.blogspot.com

Selecting the Right Broker for Your Needs

Choosing the ideal online option trading broker is crucial for a successful trading journey. Consider these factors:

- Reputation and Reliability: Seek brokers with a proven track record and strong regulatory compliance.

- Product Offerings: Ensure the broker provides the underlying assets and trading options that align with your investment goals.

- Trading Platform: Evaluate the user-friendliness, functionality, and responsiveness of the trading platform.

- Fees and Commissions: Compare the trading costs and determine which broker offers the most competitive rates.

- Customer Support: Assess the accessibility, responsiveness, and quality of the broker’s customer support team.

Empowering Traders with Education and Support

Reputable online option trading brokers recognize the importance of empowering their clients with knowledge and support. They offer a range of resources, including:

- Educational Materials: webinars, tutorials, and articles covering option trading strategies and market analysis.

- Technical Support: Dedicated teams to assist with platform troubleshooting and any technical issues.

- Community Forums: Platforms for traders to connect, share insights, and learn from each other.

Online Option Trading Brokers

Image: crowdfunding-platforms.com

Unlocking the Potential of Online Option Trading

Harnessing the power of online option trading brokers can unlock a world of financial opportunities for investors of all levels. By diligently researching brokers, carefully selecting the right one for your needs, and taking advantage of educational resources, you can embark on an informed and potentially profitable journey in the exciting world of option trading.