Fancy yourself a savvy investor seeking to conquer the financial realm? Obsidian options trading may be your elusive gem, waiting to be unearthed and exploited for bountiful gains. Prepare to embark on an enthralling journey as we delve into the captivating depths of obsidian options trading, deciphering its intricacies and empowering you to wield its potent capabilities with precision.

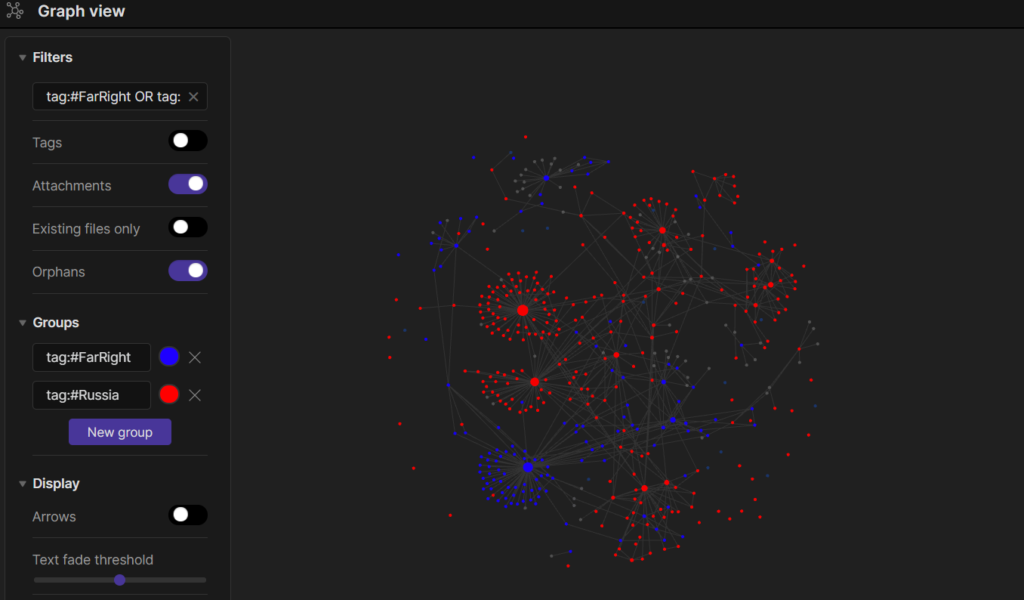

Image: www.vikingsecblog.com

Obsidian Options Trading: A Crucible for Opportunities

Obsidian options trading, a vibrant facet of the financial landscape, harnesses the power of options, granting traders the flexibility to navigate market complexities with refined strategy. An option, in essence, is a contract that bestows upon its holder the right, but not the obligation, to buy (in the case of a call option) or sell (in the case of a put option) a specific asset at a predetermined price, known as the strike price, before a specified date, known as the expiration date. Obsidian options, specifically, are traded on the esteemed Cboe Options Exchange, a global marketplace where traders gather to trade a wide array of options contracts, including those based on stocks, indices, and other financial instruments.

Anatomy of an Obsidian Option

To master obsidian options trading, it’s imperative to dissect its structural components. Obsidian options, like all options, possess distinctive attributes that define their characteristics and value:

-

Type: Call options confer the right to buy an asset, while put options grant the right to sell.

-

Strike Price: This is the predetermined price at which the underlying asset can be bought (in the case of a call option) or sold (in the case of a put option).

-

Expiration Date: This delineates the final day until which the option contract can be exercised.

-

Premium: The premium represents the price that must be paid by the buyer of an option contract to the seller to acquire the right to buy or sell the underlying asset.

Harnessing Obsidian Options for Lucrative Strategies

Obsidian options trading offers a versatile arsenal of strategies that savvy traders can wield to capture market opportunities and mitigate risks. Here are some popular obsidian options trading strategies:

-

Covered Calls: Generate income by selling call options on assets that you already possess.

-

Protective Put: Hedge against downside risk by purchasing put options on assets that you own.

-

Iron Condor: Construct a neutral strategy designed to profit from low volatility and limited price movement.

-

Strangle: Capitalize on increased volatility by simultaneously buying both call and put options with different strike prices.

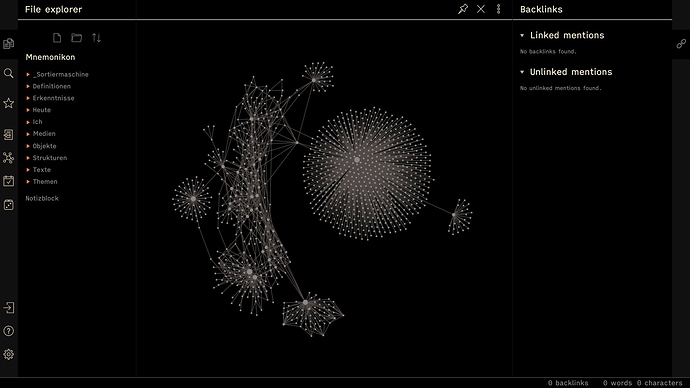

Image: forum.obsidian.md

Navigating Obsidian Options Trading: Key Considerations

To succeed in obsidian options trading, it’s essential to navigate the nuances of this intricate market. Here are a few prudent considerations to guide your endeavors:

-

Exercise or Expire? Carefully weigh the pros and cons of exercising your option before it expires versus allowing it to expire worthless.

-

Volatility and Time: Volatility plays a pivotal role in options pricing, as it gauges price movement and uncertainty. Time decay erodes the value of options as they approach expiration.

-

Risk Management: Obsidian options trading involves substantial risk. Employ sound risk management practices to protect your capital.

Unveiling the Allure of Obsidian Options Trading

Obsidian options trading has captivated traders worldwide for myriad reasons:

-

Flexibility: Options trading empowers traders to tailor strategies to suit their risk tolerance and market outlook.

-

Income Generation: Selling options can provide a steady stream of income, akin to collecting rent from a property.

-

Risk Mitigation: Options can be used as defensive tools to safeguard investments against unfavorable market conditions.

-

Speculation: Obsidian options offer opportunities for traders to speculate on future market movements.

Obsidian Options Trading

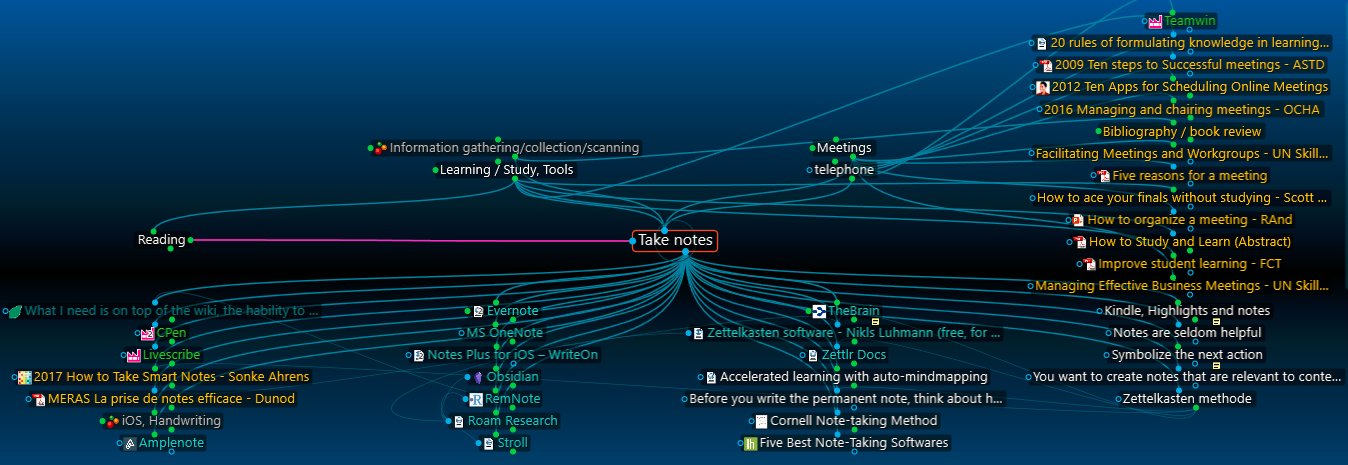

Image: forum.obsidian.md

Embark on Your Obsidian Options Trading Odyssey

The world of obsidian options trading beckons, enticing traders with its potential rewards and challenges. Whether you’re a seasoned veteran or a curious novice, delving into this captivating arena can unveil a path to financial empowerment. Research, practice, and a resolute spirit are the indispensable tools you’ll need to forge your path towards obsidian options trading mastery.