For day traders seeking to navigate the volatile world of options trading, Demark indicators offer a powerful tool. These technical analysis techniques, developed by renowned trader Tom Demark, provide invaluable insights into market trends and potential trading opportunities. Let’s delve deeper into Demark’s day trading strategy and discover how it can enhance your options trading skills.

Image: forexobroker.com

Demark Indicators: Historical Roots and Importance

Developed over decades of meticulous research and practical experience, Demark indicators have gained significant recognition among traders for their accuracy and reliability. Demark’s unique approach to technical analysis is based on the concept of time sequencing and Fibonacci ratios. By identifying recurring patterns in market behavior, traders can harness these indicators to anticipate market direction and pinpoint potential turning points.

Core Demark Indicators for Day Trading Options

Among Demark’s extensive suite of indicators, several stand out as particularly useful for day trading options. These core indicators include:

- TD Sequential Indicator: A versatile tool for recognizing trend reversals, the TD Sequential Indicator measures the strength of a trend through a series of 9 sequential steps.

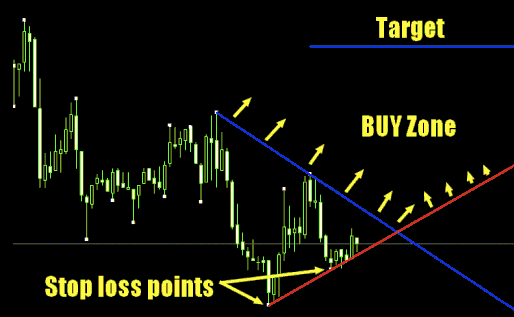

- TD Retracement System: Gauging the extent and duration of pullbacks or retracements, the TD Retracement System helps traders identify potential trading levels within the context of the prevailing trend.

- TD Perfect Count Indicator: A specialized indicator designed to anticipate strong trend reversals, the TD Perfect Count analyzes volume and price action to assess the likelihood of a trend shift.

Demark Strategies in Action: Practical Implementations

In day trading options, Demark’s indicators can be deployed in numerous strategies to enhance trading decisions. For instance:

- Trend Following Strategy: By pairing the TD Sequential Indicator with a moving average, traders can pinpoint potential trend reversals and capitalize on breakout opportunities.

- Counter-Trend Scalping Strategy: Combining the TD Retracement System with a momentum indicator, traders can identify short-term retracements and execute scalping trades within the larger trend.

- Swing Trading Strategy: Employing the TD Perfect Count Indicator alongside support and resistance levels, traders can capture long-term swings in the market and maximize profits.

Benefits and Drawbacks of Demark Indicators

While Demark indicators have proven valuable for many traders, they do come with certain considerations:

Benefits:

- Highly accurate in detecting trend reversals and potential trading opportunities

- Flexible enough to adapt to various market conditions

- Based on time-sequenced Fibonacci ratios, providing a unique and insightful perspective

Drawbacks:

- Require a comprehensive understanding of the methodology to interpret correctly

- Can generate multiple signals, making it challenging to filter high-probability trades

- May lead to false signals, especially during choppy market conditions

Mastering Demark Options: A Journey of Diligence and Refinement

Effective use of Demark indicators in day trading options demands a commitment to learning and practice. Aspiring traders should thoroughly study the concepts, experiment with various strategies, and fine-tune their trading approach through continuous evaluation and refinement. By embracing the power of Demark indicators and honing their trading skills, day traders can significantly improve their chances of success in the dynamic and challenging options market.

Image: www.tekportal.net

Demark On Day Trading Options