The Enigma of Options Trading

Image: learnpriceaction.com

Navigating the turbulent waters of options trading can be a daunting task. Amidst the myriad strategies and indicators, one stands out as a lighthouse amidst the storm – the moving average. Picture yourself as a ship’s captain, with the moving average as your compass, guiding you towards a profitable horizon.

Unraveling the Moving Average’s Essence

In essence, a moving average (MA) is a price smoothing tool. It calculates the average price of an asset over a defined period, acting as a barometer of its underlying trend. By filtering out short-term fluctuations, MAs reveal the longer-term direction, empowering traders to make informed decisions.

Different Strokes for Different Strokes: Types of Moving Averages

The moving average family boasts a diverse lineage, each with its unique qualities. The most prominent are:

- Simple Moving Average (SMA): The workhorse of the group, it simply tallies prices over a fixed period and divides by the number of periods.

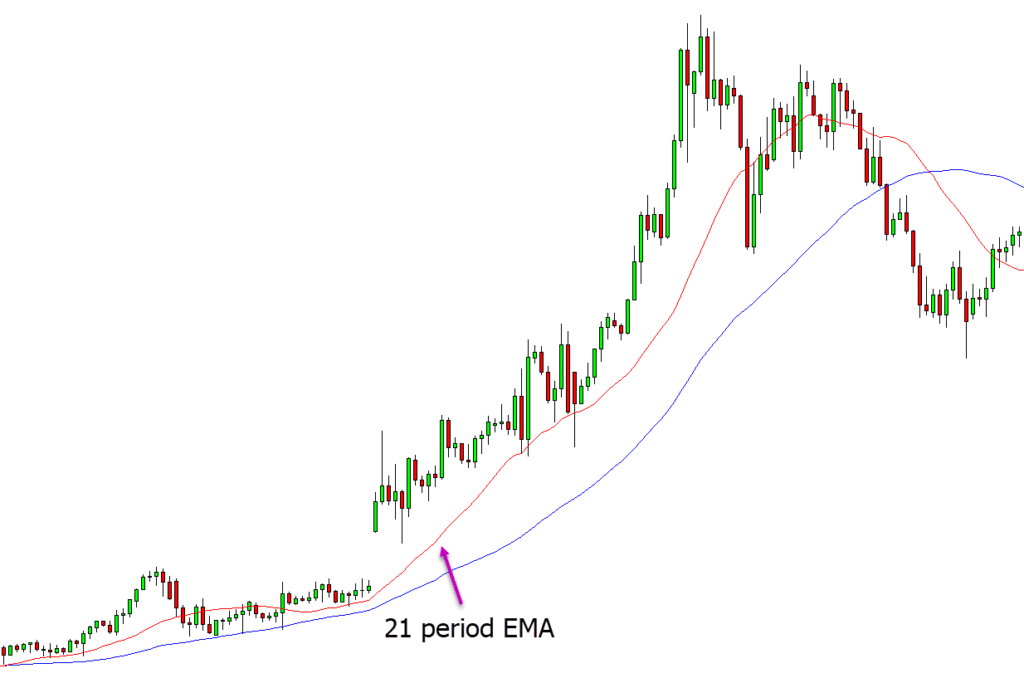

- Exponential Moving Average (EMA): Like the SMA, but it gives greater weight to recent prices, making it more responsive to price swings.

- Weighted Moving Average (WMA): Assigns higher weight to more recent prices, providing a smoother trend line than the SMA.

Unlocking the Power of MAs for Options Trading

MAs are not mere numbers on a chart. They are valuable tools that can enhance your options trading strategies:

- Trend Identification: By revealing the prevailing trend, MAs help you determine whether to buy or sell options. A rising MA suggests an uptrend, while a falling MA indicates a downtrend.

- Support and Resistance Levels: MAs often act as support and resistance levels. When the price touches a MA, it may bounce off or reverse its direction.

- Trade Confirmation: MAs can corroborate your trading ideas. If your analysis aligns with the MA’s trend, it’s a positive sign.

Expert Insights: Wisdom from the Trading Trenches

- “MAs provide me with a reliable roadmap for my trading decisions.” – Peter, seasoned trader

- “The WMA’s sensitivity to recent prices helps me identify short-term trading opportunities.” – Tina, active trader

- “MAs are not infallible, but they offer invaluable insights into market trends.” – William, trading veteran

Actionable Tips: Empowering Your Trading Journey

- Choose the Right MA: Select the MA type that suits your trading style. SMAs are great for detecting long-term trends, while EMAs are ideal for short-term trading.

- Combine MAs: Using multiple MAs of different periods allows you to gain a more comprehensive view of the market.

- Set Alerts: Create price alerts based on MA crossovers to receive notifications when potential trading opportunities arise.

Conclusion: Embracing the Moving Average Advantage

Moving averages are not merely technical indicators. They are a beacon of knowledge, guiding options traders through the treacherous waters of the market. By understanding their essence, types, and applications, you can harness their power to enhance your trading strategies and navigate the path towards profitability. Remember, the moving average is your compass, guiding you towards a successful options trading odyssey.

Image: www.tradingwithrayner.com

Moving Average For Options Trading

Image: www.wavesstrategy.com