Trading options, a realm of limitless possibilities and unparalleled financial leverage, beckons traders of all levels to embark on a journey of wealth creation. In this comprehensive guide, we delve into the world of options trading, with a particular focus on Motilal Oswal, a trusted and well-established brokerage firm in India. Join us as we navigate the intricacies of this financial instrument, empower ourselves with expert insights, and craft actionable strategies to maximize our trading success.

Image: tradebrains.in

What are Options?

At the heart of options trading lies the concept of options contracts—unique financial agreements that grant the holder the right, not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (known as the strike price) on or before a specific date (known as the expiration date). Unlike futures contracts, which obligate buyers to purchase the underlying asset, options provide traders with flexibility and the potential to profit from price movements without taking ownership of the underlying asset.

Benefits of Trading Options with Motilal Oswal

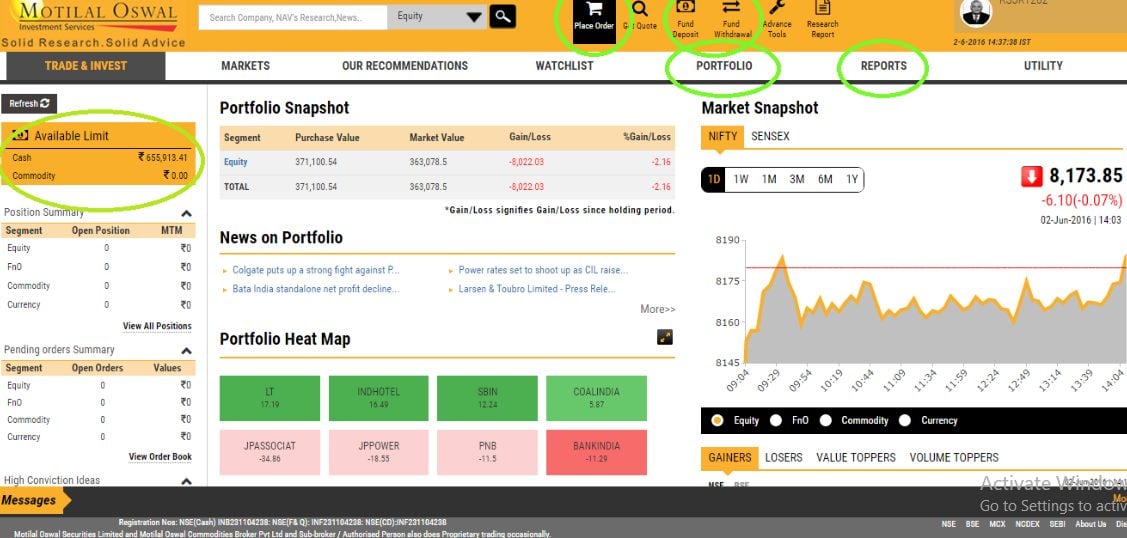

Choosing the right brokerage firm is paramount to successful options trading. Motilal Oswal stands out as a leading brokerage firm, offering a plethora of advantages to both novice and seasoned traders alike. Its robust trading platform, backed by advanced technology, empowers traders with seamless order execution, real-time market data, and comprehensive charting tools. Furthermore, Motilal Oswal’s dedicated team of experts provides invaluable guidance and support, helping traders navigate the intricacies of options trading with confidence.

Understanding the Options Market

The world of options trading unfolds within the vibrant ecosystem of stock exchanges. Here, buyers and sellers converge to trade standardized options contracts covering various underlying assets, including stocks, indices, currencies, and commodities. Each exchange establishes its own rules and regulations governing trading, ensuring transparency and fairness.

Image: top10stockbroker.com

Types of Options Trading Strategies

Options trading offers a vast array of strategies, catering to different trading styles and risk appetites. Covered calls, cash-secured puts, bull put spreads, and bear call spreads are just a few examples of the diverse strategies employed by traders. By combining different types of options contracts, traders can create tailored strategies that align with their unique trading goals.

Expert Insights: Mastering Options Trading

To delve deeper into the art of options trading, we seek wisdom from the masters. Veteran traders and financial experts share their invaluable insights, offering practical guidance and actionable tips to help traders navigate the complexities of this market. From risk management strategies to advanced trading techniques, these expert insights empower traders with the knowledge and confidence to make informed trading decisions.

Case Studies: Success Stories from the Trading Trenches

Real-life success stories serve as a testament to the transformative power of options trading. We present inspiring case studies of traders who have harnessed the potential of options to achieve their financial objectives. By sharing their journeys, these successful traders provide a glimpse into the strategies, mindset, and unwavering determination that paved their way to trading triumph.

Motilal Oswal Options Trading Brokerage

.png)

Image: www.topteninsider.com

Conclusion: Embracing the Power of Options Trading

Options trading, when approached with knowledge and strategy, opens up a world of possibilities for savvy traders. By partnering with a trusted brokerage firm like Motilal Oswal and harnessing the wisdom shared by experts, we can embark on our options trading journey with confidence and enthusiasm. Remember, successful trading is not a destination but an ongoing process of learning, refining strategies, and embracing the ever-evolving financial landscape.