Introduction:

Image: db-excel.com

In the ever-evolving landscape of financial markets, options trading has emerged as a sophisticated strategy for traders seeking to harness volatility and amplify potential returns. Among the various options trading strategies, monthly options stand out for their unique advantages and opportunities. This insightful weekly guide will demystify monthly options trading, empowering you with the knowledge and insights to navigate the market with confidence.

Understanding Monthly Options: A Foundational Primer

Monthly options are contracts that convey the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price on or before a specific date. In contrast to weekly or daily options, which expire within a shorter timeframe, monthly options offer extended duration, providing traders with greater flexibility and strategic options.

Navigating the Monthly Options Trading Landscape

Monthly options trading involves meticulous planning and thoughtful execution. Here are key considerations to guide your journey:

1. Identify Underlying Assets and Trading Goals:

The choice of underlying assets, such as stocks, commodities, or indices, is paramount. Align your asset selection with your investment objectives, risk tolerance, and research insights.

2. Understand Option Terminology and Contract Specifications:

Grasp the nuances of option terminology, including strike price, expiration date, and the associated premium. A clear understanding of contract characteristics empowers you to make informed decisions.

3. Research and Analyze Market Trends:

Diligent market analysis is the bedrock of successful options trading. Monitor price fluctuations, historical data, and economic indicators to discern potential trading opportunities.

4. Exercise Strategic Execution:

The timing and execution of your trades are crucial. Consider factors like market sentiment, volatility, and support/resistance levels to optimize your entry and exit strategies.

5. Manage Risk and Protect Your Capital:

Risk management is a non-negotiable aspect of options trading. Implement protective measures such as stop-loss orders, position sizing, and hedging strategies to safeguard your capital.

Expert Insights: Gaining an Edge in Monthly Options Trading

Enrich your trading acumen by tapping into the wisdom of experienced traders:

1. Seek Guidance from Seasoned Professionals:

Connect with industry experts, attend workshops, and engage with trading communities to glean valuable insights and best practices.

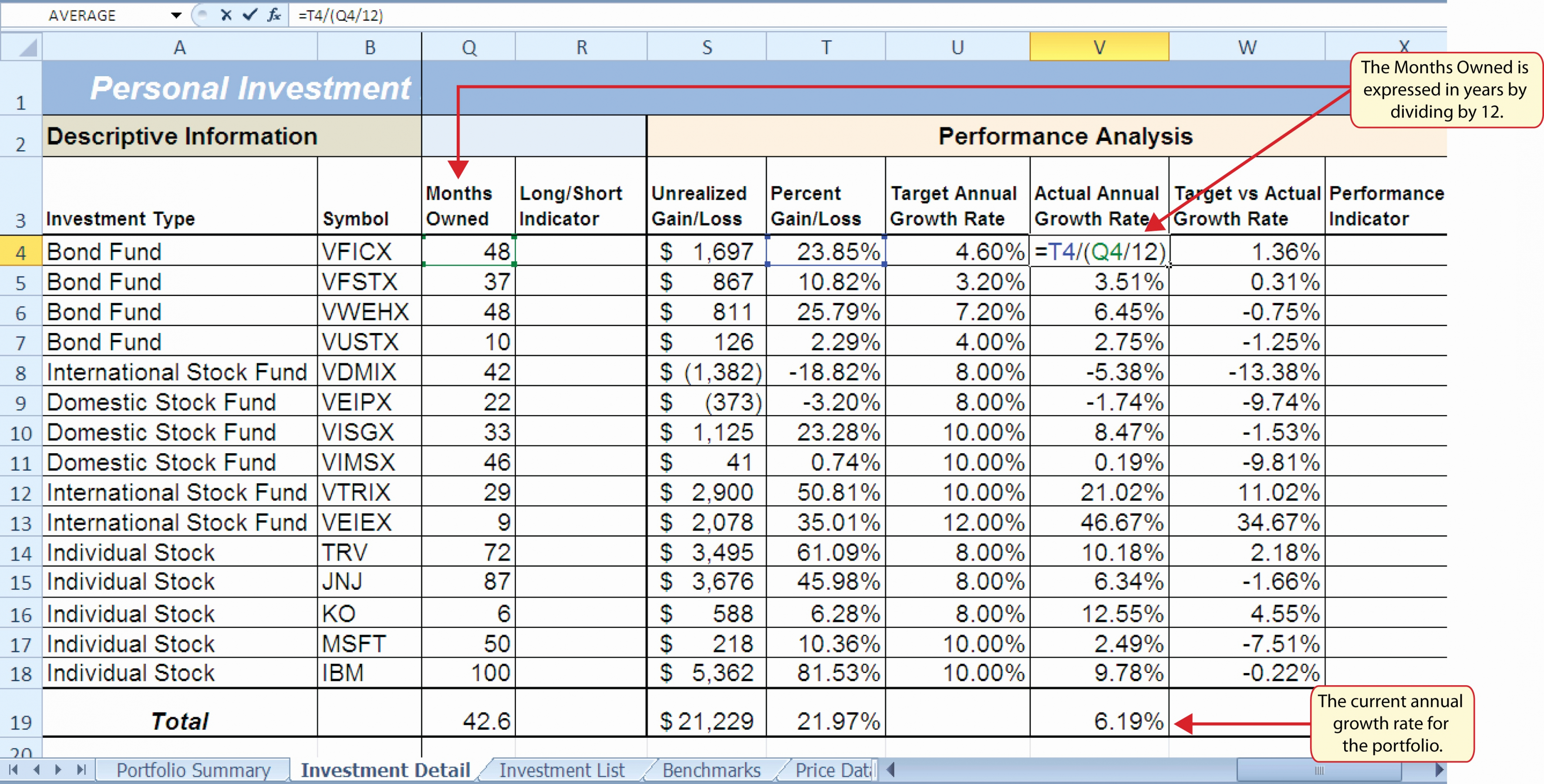

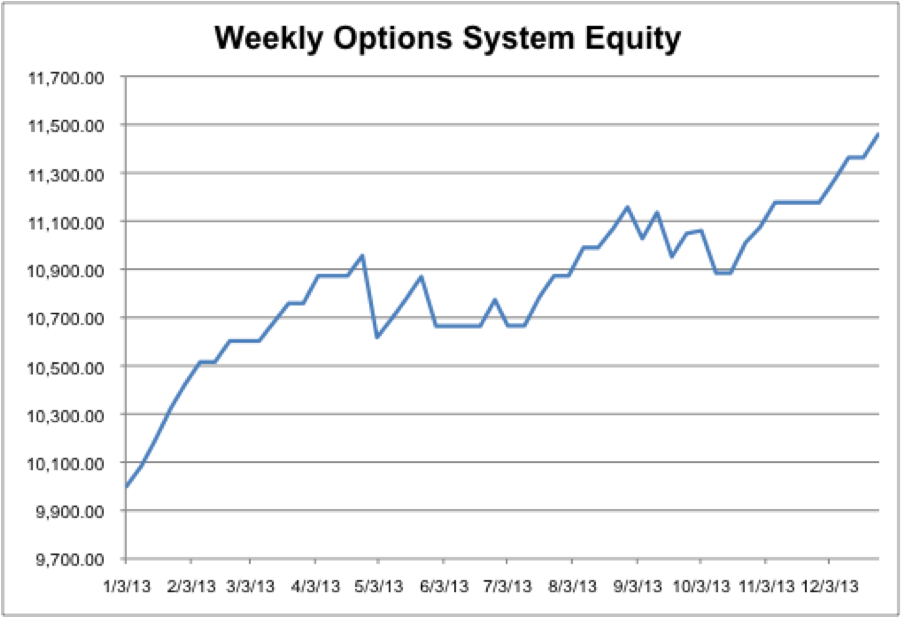

2. Analyze Case Studies and Trading Performance:

Learn from real-world examples and analyze the performance of successful traders to identify winning strategies and avoid costly mistakes.

3. Embrace Technology and Automation:

Leverage trading platforms and automation tools to enhance your trading efficiency, improve decision-making, and minimize risks.

Conclusion:

Monthly options trading provides a powerful avenue for traders to amplify returns and manage risk. This weekly guide has equipped you with the foundational knowledge and practical insights to navigate the market with confidence. Remember to conduct thorough research, implement sound trading strategies, and seek guidance from experts as you embark on your monthly options trading journey. Embrace the opportunities and challenges of this dynamic market, and let your financial acumen soar to new heights.

Image: www.youtube.com

Monthly Options Trading Weekly

Image: ucynuqyde.web.fc2.com