Introduction

In the realm of finance, where opportunities abound, day trading options has emerged as an intriguing avenue for investors seeking to capitalize on short-term market fluctuations. Day trading involves buying and selling financial instruments within the same trading session, aiming to profit from minor price movements. Options, on the other hand, are derivatives that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. Combining these two concepts, day trading options offers traders a unique and potentially lucrative strategy for generating income.

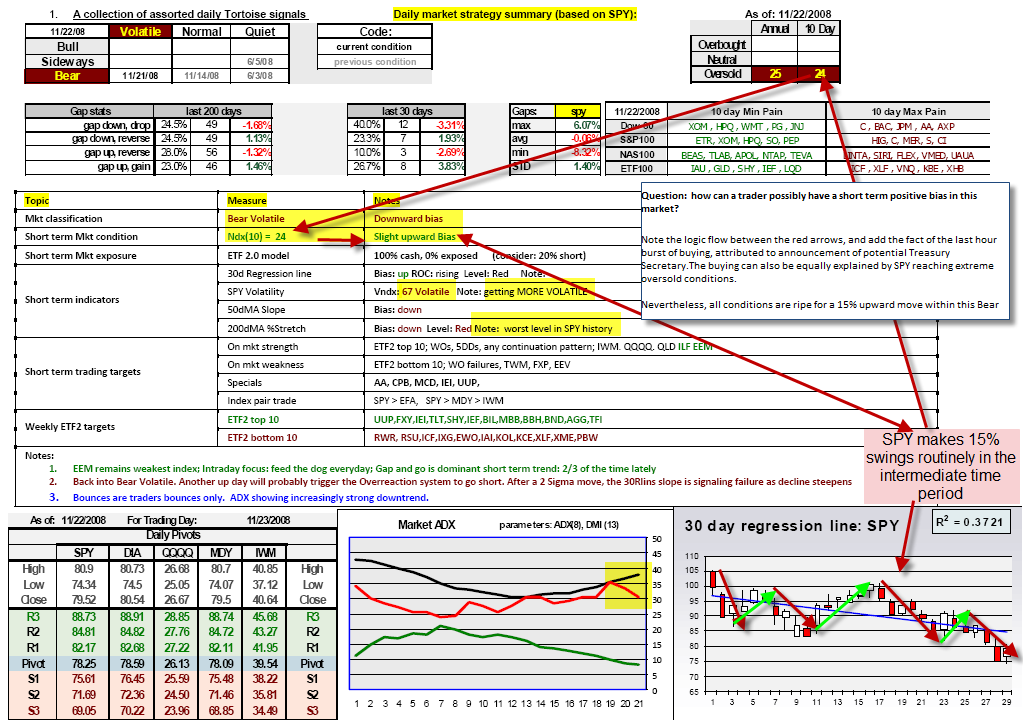

Image: www.youtube.com

This comprehensive guide will delve into the intricacies of day trading options, providing an in-depth understanding of the strategies, risks, and rewards involved. Whether you’re a seasoned trader or just starting your journey in the financial markets, this article will equip you with the knowledge and tools necessary to navigate the dynamic world of day trading options successfully.

Understanding Day Trading Options

Day trading options is a short-term trading strategy that involves buying and selling options contracts within the same trading day. Unlike traditional stock trading, where you own the underlying asset, day trading options allows you to speculate on the future price movement of an asset without actually taking ownership of it. This significantly reduces the capital required to trade, making it more accessible to traders with limited resources.

Options are versatile financial instruments that come in two main types: calls and puts. Call options give the holder the right to buy an underlying asset at a specified price (strike price) on or before the expiration date. Put options, on the other hand, grant the holder the right to sell an underlying asset at the strike price.

Key Concepts in Day Trading Options

To master the art of day trading options, it’s essential to understand several key concepts:

-

Expiration Date: Every options contract has a specific expiration date, which is the last day on which the option can be exercised.

-

Strike Price: The strike price is the predetermined price at which the underlying asset can be bought (in the case of call options) or sold (in the case of put options), if the option is exercised.

-

Premium: The premium is the price paid to purchase an options contract. Premiums fluctuate based on factors such as the volatility of the underlying asset, time to expiration, and market sentiment.

-

Delta: Delta measures the sensitivity of an option’s price to changes in the price of the underlying asset. It indicates the amount by which the option’s price will change for every $1 change in the underlying asset’s price.

-

Implied Volatility: Implied volatility is a measure of the market’s expectations for future volatility of the underlying asset. It influences the pricing of options contracts.

Types of Day Trading Options Strategies

There are numerous day trading options strategies, each with its unique risk-reward profile. Here are some common strategies:

-

Scalping: Scalping is entering and exiting trades quickly, profiting from small price movements throughout the trading day. Scalpers use tight stop-losses to manage risk and focus on maximizing profits from small price fluctuations.

-

Range Trading: Range traders identify assets trading within well-defined price ranges and look for opportunities to buy at support and sell at resistance levels. They aim to capture cyclical movements within the range and target high probability scenarios.

-

Momentum Trading: Momentum traders follow the trend of an asset, buying when it’s rising and selling when it’s falling. They identify entry and exit points using technical indicators like moving averages and trendlines.

-

Breakout Trading: Breakout traders look for assets that break out of key levels of support or resistance. They anticipate the price continuation after a significant breakout and aim to capture the initial momentum of the breakout.

Image: templates.rjuuc.edu.np

Risk Management in Day Trading Options

Risk management is paramount in day trading options. Here are some strategies to manage risk effectively:

-

Use Defined Risk: When selling options, clearly define the potential loss before entering the trade. Choose strike prices that limit the maximum possible loss.

-

Use Stop-Losses: Place stop-loss orders to automatically exit trades when the market moves against you, limiting losses and preserving capital.

-

Manage Position Size: Trade with appropriate position sizes that align with your risk appetite and account balance. Avoid putting a substantial portion of your capital on any single trade.

-

Use Technical Analysis: Identify support and resistance levels, trend indicators, and chart patterns to make informed trading decisions and assess potential risks.

Day Trading Options Example

Conclusion

Day trading options is a challenging but rewarding pursuit that can bring significant financial gains when approached correctly. By understanding the various concepts, strategies, and risks involved, traders can equip themselves with the knowledge and skills necessary to navigate the markets effectively. Remember,