Introduction

Are you wondering if Lloyds’ share dealing account is right for your options trading needs? In this comprehensive guide, we’ll provide an overview of the account, including its features, benefits, and drawbacks. Whether you’re a seasoned trader or new to options trading, this article will give you the information you need to make an informed decision.

Image: buyshares.co.uk

Lloyds Bank is a leading financial institution in the United Kingdom, offering various banking, investment, and insurance products. Its share dealing account allows investors to buy and sell shares, ETFs, and options. For options traders, Lloyds offers a range of products and services designed to meet the needs of different trading styles.

Understanding Share Dealing Account Options Trading

Options trading involves buying or selling contracts that give the holder the right but not the obligation to buy or sell an underlying asset at a predetermined price on or before a certain date. Lloyds’ share dealing account offers a wide variety of options contracts, including:

- Call options: These contracts give the holder the right to buy an asset at a specific price on or before a certain date.

- Put options: These contracts give the holder the right to sell an asset at a specific price on or before a certain date.

When you trade options, you are speculating on the future price movement of the underlying asset. If you believe the price will rise, you can buy a call option. If you believe the price will fall, you can buy a put option.

Benefits of Lloyds’ Share Dealing Account for Options Trading

There are several benefits to using Lloyds’ share dealing account for options trading:

- **Wide range of options contracts:** Lloyds offers a wide variety of options contracts, including contracts for major indices, stocks, ETFs, and currencies.

- **Competitive pricing:** Lloyds offers competitive pricing on its options contracts.

- **Advanced trading platform:** Lloyds’ online trading platform provides access to a powerful set of trading tools and resources.

- **Dedicated support:** Lloyds provides dedicated support to its options trading customers.

Drawbacks of Lloyds’ Share Dealing Account for Options Trading

There are also a few drawbacks to using Lloyds’ share dealing account for options trading:

- **High minimum investment:** Lloyds requires a minimum investment of £2,000 to open an options trading account.

- **Limited number of order types:** Lloyds only offers a limited number of order types for options trading.

- **Limited trading hours:** Lloyds’ options trading hours are limited to the London Stock Exchange’s trading hours.

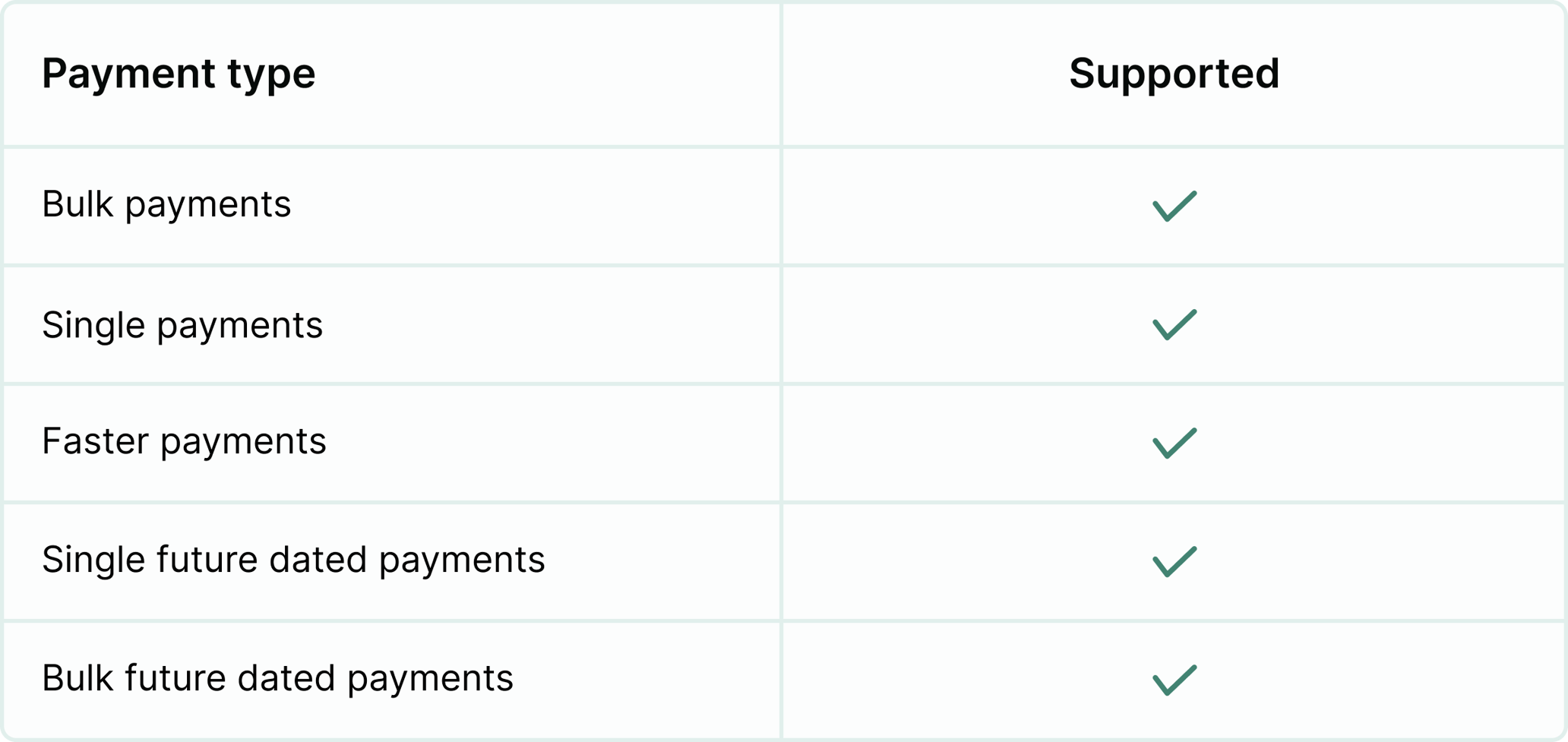

Image: bolaplastiik.blogspot.com

Tips for Using Lloyds’ Share Dealing Account for Options Trading

If you’re interested in using Lloyds’ share dealing account for options trading, here are a few tips to help you get started:

- **Do your research:** Before you start trading options, it’s important to do your research and understand the risks and rewards involved.

- **Start small:** When you first start trading options, it’s important to start small. This will help you limit your risk and learn the ropes of trading.

- **Use stop-loss orders:** Stop-loss orders can help you limit your losses in the event that the market moves against you.

- **Be patient:** Options trading can be a volatile business. It takes time to learn the ropes and develop a successful trading strategy.

FAQ about Lloyds’ Share Dealing Account for Options Trading

Here are some frequently asked questions about Lloyds’ share dealing account for options trading:

- **Q: What is the minimum investment required to open an options trading account with Lloyds?**

A: The minimum investment required to open an options trading account with Lloyds is £2,000. - **Q: What are the different types of options contracts available through Lloyds?**

A: Lloyds offers a wide variety of options contracts, including contracts for major indices, stocks, ETFs, and currencies. - **Q: How much does it cost to trade options with Lloyds?**

A: Lloyds offers competitive pricing on its options contracts. The cost of trading options with Lloyds will vary depending on the type of contract and the size of your trade.

Lloyds Share Dealing Account Options Trading

Image: support.crezco.com

Conclusion

Lloyds’ share dealing account is a robust option for options traders. It offers a wide range of options contracts, competitive pricing, and a powerful trading platform. However, it is important to remember that options trading can be risky and unsuitable for all investors. It is important to do your research and understand the risks involved before you start trading options. If you’re interested in learning more about options trading, you can visit Lloyds’ website or speak to a financial advisor.

Are you interested in learning more about options trading? If so, please leave a comment below! I am happy to provide you with additional resources.