Introduction

In the realm of digital finance, options trading has emerged as a sophisticated tool for investors seeking to capitalize on market volatility while managing risk. Crypto options, in particular, offer a unique opportunity to trade on the price movements of cryptocurrencies, providing advanced strategies for both beginners and seasoned traders alike. In this comprehensive guide, we will delve into the world of crypto options trading, exploring its concepts, strategies, and expert advice to empower you with the knowledge and skills needed to navigate this exhilarating market.

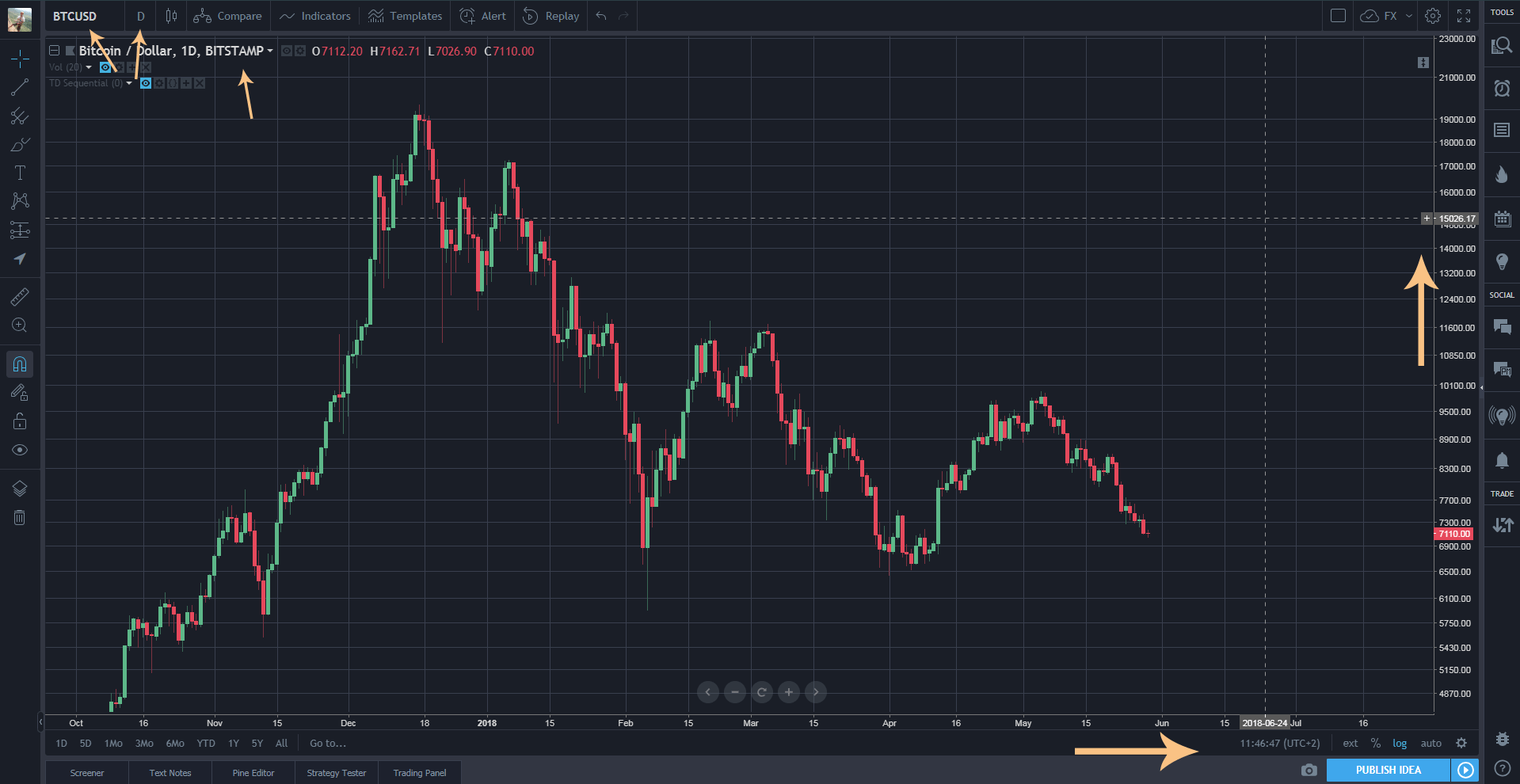

Image: coincentral.com

Unveiling the Mechanics of Crypto Options

An option contract grants the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specified date (expiration date). In the context of cryptocurrencies, options allow traders to speculate on the future price movements of digital assets, offering a spectrum of strategies that cater to varying market scenarios.

By purchasing a call option, traders bet that the underlying cryptocurrency will rise in value, giving them the right to purchase it at the strike price, irrespective of the prevailing market price. Conversely, a put option empowers traders to wager on a price decline, giving them the right to sell the asset at the strike price, regardless of its actual market value.

Mastering Crypto Options Strategies

-

Covered Call Strategy: This conservative strategy involves selling a call option on an underlying asset you possess. If the market price falls, you retain the asset while generating additional income from the option premium. However, if the market price rises above the strike price, you may have to sell the asset at the predetermined price, potentially missing out on further gains.

-

Protective Put Strategy: As the name suggests, this strategy is designed to protect against downside risk. By purchasing a put option, you secure the right to sell your underlying asset at a predetermined price, safeguarding it from price declines. However, this strategy entails paying an option premium, which represents the cost of protection.

-

Covered Put Strategy: Similar to the covered call, this strategy involves selling a put option against your existing asset. If the market price remains above the strike price, you continue to hold the asset while collecting the option premium. However, if the market price falls below the strike price, you may be obligated to sell the asset at the predetermined price, even if the market price has not recovered.

-

Bull Call Spread: This strategy involves buying a lower strike price call option while simultaneously selling a higher strike price call option on the same underlying asset. The profit potential is limited to the difference between the two strike prices minus the net premium paid. This strategy benefits from a moderate rise in the underlying asset’s price.

-

Bear Put Spread: Conversely, this strategy involves selling a lower strike price put option and buying a higher strike price put option. The profit potential is capped at the difference between the two strike prices minus the premium paid. This strategy is suitable for scenarios where the trader anticipates a price decline in the underlying asset.

Insights from the Crypto Market and Expert Advice

Crypto options trading offers immense opportunities, but it also poses unique challenges. Staying abreast of the latest market trends and seeking guidance from experienced traders is crucial for success.

-

Recent Developments and Emerging Trends: The crypto options market has witnessed a significant surge in popularity, with major exchanges launching dedicated platforms and introducing a wide range of options instruments. Retail investors are increasingly embracing options to enhance their risk management and speculative strategies.

-

Expert Tips and Market Insights: Seasoned traders recommend a balanced approach, combining fundamental analysis with technical indicators to make informed trading decisions. They emphasize the importance of proper risk management, sound position sizing, and a disciplined trading plan.

Image: quantmatter.com

FAQ on Crypto Options Trading

-

Q: What is the difference between a call and a put option?

A: A call option grants the right to buy an asset, while a put option grants the right to sell an asset. -

Q: What is the significance of the strike price?

A: The strike price determines the price at which you can buy or sell the underlying asset if you exercise your option. -

Q: What are the risks associated with options trading?

A: Options trading can be a risky endeavor, involving the potential for significant losses. Leverage can amplify both profits and losses.

Crypto Options Trading Strategy

Conclusion

The world of crypto options trading presents a fascinating blend of opportunity and risk. By embracing the strategies discussed in this guide, seeking expert advice, and continuously refining your skills, you can harness the power of options to enhance your crypto trading prowess. Remember, the journey to mastery begins with a single step. Are you ready to embark on your crypto options trading odyssey?