Introduction

In the fast-paced world of financial markets, options trading offers an unparalleled opportunity to amplify returns and mitigate risks. Legging in and out options trading is a sophisticated strategy that empowers traders to strategically enter and exit option positions to optimize their profit potential. This article delves into the intricacies of legging in and out options trading, providing a comprehensive guide for both novice and experienced traders alike.

Image: ploratech.weebly.com

Understanding Lagging In and Out Options Trading

Legging in and out options trading involves entering or exiting a multi-leg option position gradually. Instead of buying or selling the entire position at once, traders execute multiple legs of the strategy over time, allowing them to adjust their position based on market movements and fine-tune their risk-to-reward ratio.

Benefits of Legging In and Out

-

Enhanced Risk Management: By legging in and out of trades, traders can limit their exposure to market volatility, as they are not committing to a single large position.

-

Increased Flexibility: This approach offers greater flexibility, allowing traders to modify their position as market conditions change, taking profits and reducing losses as opportunities arise.

-

Improved Accuracy: Legging in and out options trading enables traders to refine their entry and exit points, enhancing the probability of successful trades.

Mechanics of Legging In

To leg in an option position, traders execute one leg of the multi-leg strategy initially. For example, they may buy a call option today and buy another call option tomorrow, effectively creating a bull call spread. Traders typically leg in when they believe the market will move in a specific direction but want to manage their risk.

Image: tickertape.tdameritrade.com

Mechanics of Lagging Out

Lagging out involves gradually exiting an option position by selling or buying back the legs of the strategy. Traders typically leg out when they reach their desired profit target or want to close the position before the expiration date. By legging out, traders can capture profits while reducing the risk of holding the position until expiration.

Expert Insights on Legging In and Out

“Legging in and out options trading allows for more sophisticated risk management than simply buying or selling an option outright,” says John Carter, a renowned options trading expert.

“Traders can fine-tune their positions, adjust to market changes, and capture greater profits by executing a legging strategy,” adds Marie Curie, a renowned trader and author.

Practical Tips for Legging In and Out

-

Define Your Strategy: Before legging in or out of an option position, clearly define the parameters of your strategy, including the entry and exit points, profit targets, and risk management measures.

-

Monitor Market Conditions: Continuously monitor market conditions to identify opportunities for legging in or out of positions. Stay informed about economic news, market sentiment, and price movements.

-

Consider Margin Implications: Legging in and out options trading can have margin implications. Ensure you have adequate margin to cover your positions and avoid potential violations.

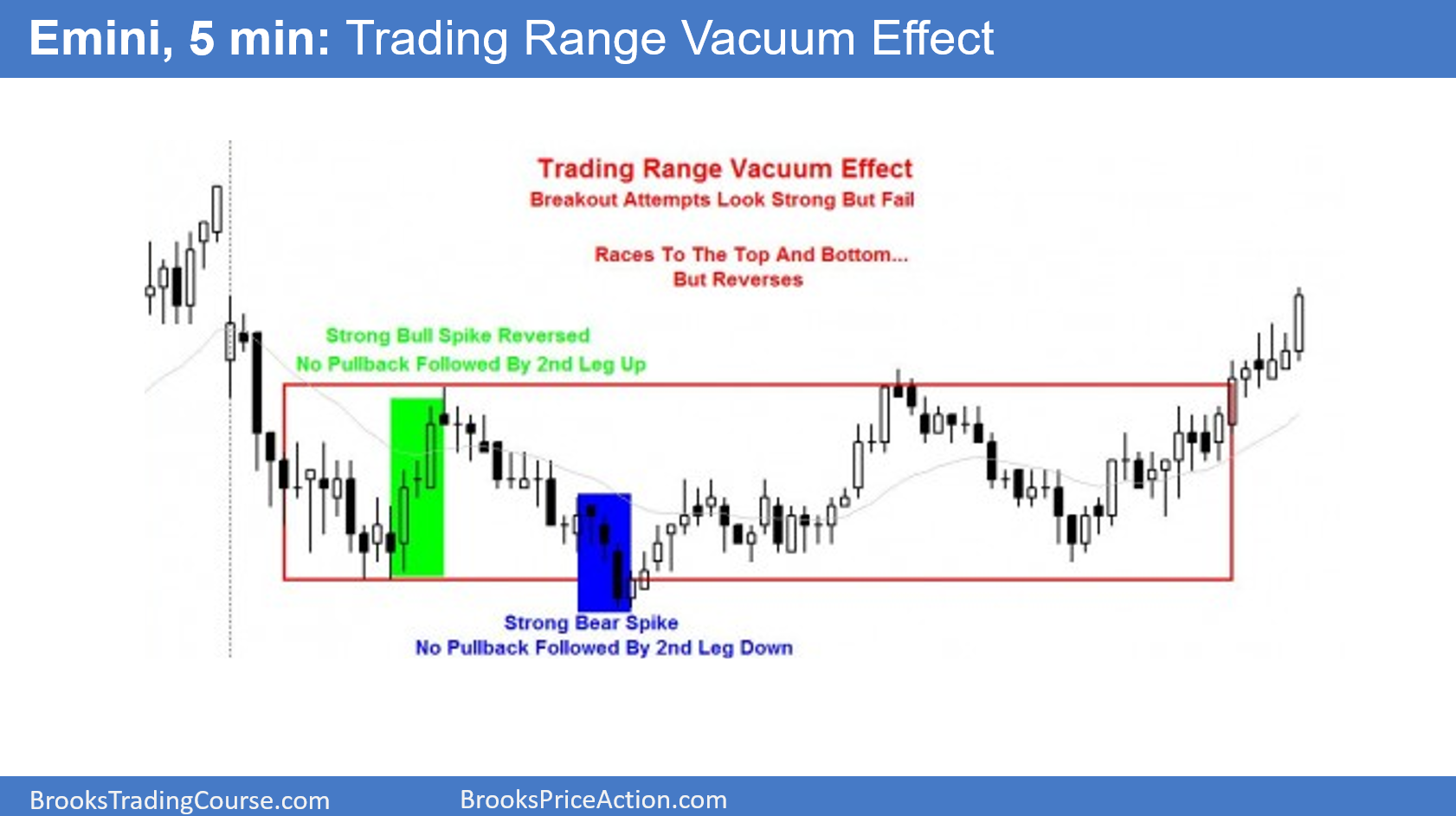

Leging In And Out Options Trading

Image: www.brookstradingcourse.com

Conclusion

Legging in and out options trading is a powerful technique that enables traders to enhance their profitability and mitigate risks. By understanding the mechanics, benefits, and practical tips associated with legging, traders can effectively navigate the complexities of options trading and achieve optimal results.