Have you ever wondered how ordinary individuals can reap the rewards of the stock market’s growth? The answer lies in stock options trading. Unlike stock purchases, options trading offers a unique opportunity to potentially amplify returns with limited capital. Embark on this captivating journey as we delve into the intricacies of this exciting investment strategy, empowering you with the knowledge to navigate the dynamic world of options trading.

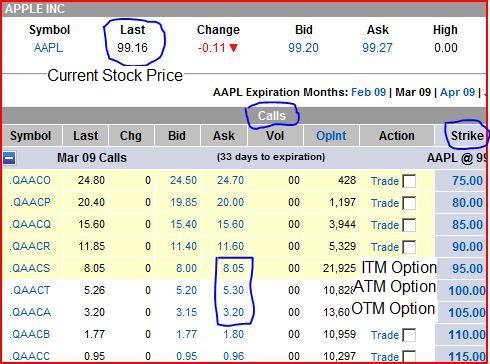

Image: www.youtube.com

Navigating the Basics of Stock Options

A stock option is a contract that grants the buyer the right, but not the obligation, to buy or sell a specific number of shares of an underlying stock at a predetermined price (strike price) on or before a certain date (expiration date). This flexibility opens up a wide range of trading strategies, from hedging risk to speculating on price movements.

Types of Options

Stock options come in two primary flavors: calls and puts. When you buy a call, you expect the stock price to rise, giving you the option to buy the stock at a lower price than the market price. Conversely, when you buy a put, you anticipate a decline in the stock price, allowing you to sell the stock at a higher price than the market price.

Mastery through Options Pricing

The pricing of stock options is a complex interplay of factors, including the underlying stock price, time to expiration, strike price, interest rates, and volatility. Understanding these factors is crucial for determining the potential value of an option and making informed trading decisions.

Image: javaee.github.io

Unveiling the Strategies of Successful Options Traders

Successful options trading requires a combination of strategic planning and skillful execution. Here are some time-tested strategies:

Covered Call Writing

An effective strategy for generating income involves selling covered calls. You write an option to sell a portion of the shares you already own. By doing so, you collect the premium from the buyer while maintaining ownership of the underlying shares. This approach provides income generation with limited downside risk.

Bullish Butterfly Spread

For those with a bullish outlook on a stock, a bullish butterfly spread can amplify profits. This involves buying one option at the strike price, selling two options at a slightly higher strike price, and buying one option at an even higher strike price. The strategy benefits from a modest gain in the stock price.

Buy-Write Strategy

The buy-write strategy involves simultaneously purchasing a stock and writing a covered call against it. This approach reduces the cost basis of the stock by the premium received from selling the call, making the strategy appealing for long-term investors seeking additional income.

A Glimpse into Future Trends and Developments

The world of stock options trading is constantly evolving. Stay ahead of the curve by keeping an eye on these emerging trends:

Rise of Artificial Intelligence (AI)

AI is transforming options trading by automating trade execution, sentiment analysis, and risk management. AI-powered algorithms analyze vast amounts of data and identify trading opportunities, making it easier for traders to make informed decisions.

Growth of Exchange-Traded Funds (ETFs)

ETFs based on options strategies are gaining popularity. They provide investors with a diversified exposure to options trading without the complexities of managing individual options positions.

Expert Advice for Navigating the Options Landscape

Mastering options trading takes time and dedication, but here are some invaluable tips to get you started:

Start Small

Begin with small trades until you gain confidence and experience. Risk management is paramount, so avoid committing more capital than you can afford to lose.

Education is Paramount

Invest in educating yourself about stock options, strategies, and market dynamics. Knowledge empowers you to make wiser trading decisions.

Emotional Mastery

Options trading can be a rollercoaster ride. Cultivate emotional discipline to avoid making impulsive decisions when markets are volatile.

FAQs to Illuminate your Path

Here are common questions and concise answers to reinforce your understanding of stock options trading:

Q: What is the key difference between stocks and options?

A: Stocks represent ownership in a company, while options provide the right, not the obligation, to buy or sell an underlying asset at a specific price on a future date.

Q: Can I lose more money than I invest in options trading?

A: Yes, options trading involves leverage, meaning potential losses can exceed the initial investment.

Q: What are the risks associated with options trading?

A: The risks include the possibility of losing the entire investment, unlimited loss potential for sold options, and time decay for purchased options.

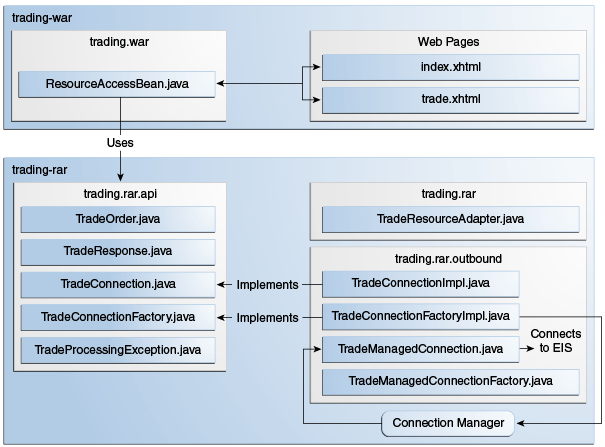

Learn-Stock-Options-Trading Rar

Image: www.learn-stock-options-trading.com

Conclusion

Exploring the realm of stock options trading can unveil a world of exciting opportunities and substantial returns. Embracing the right strategies, expert advice, and continuous learning sets you on the path to success. Whether you are a novice or a seasoned trader, the journey of options trading offers endless possibilities for financial growth. Are you ready to join the ranks of discerning investors and conquer the dynamic world of stock options trading?