The Anatomy of Effective Options Trading

In the intricate realm of financial markets, options trading stands as a sophisticated investment strategy that grants individuals the right, but not the obligation, to buy or sell an underlying asset at a predetermined price and within a specific timeframe. To navigate this complex arena successfully, meticulous planning and diligent record-keeping are paramount. Enter the trading journal spreadsheet—an indispensable tool that empowers options traders to monitor, analyze, and refine their strategies for optimal performance.

Image: tradersunion.com

The Trading Journal Spreadsheet: A Beacon of Clarity in a Market Maze

A trading journal spreadsheet is a meticulously crafted digital ledger that serves as a repository for vital information pertaining to each options trade executed. It is a comprehensive record-keeping system that captures a wealth of data, including trade details, market conditions, personal assessments, and performance metrics. By harnessing the power of this spreadsheet, traders gain unprecedented insights into their trading habits, enabling them to identify areas for improvement and enhance their overall profitability.

Benefits of Utilizing a Trading Journal Spreadsheet

-

Enhanced Discipline and Accountability: The act of meticulously recording every trade instills a sense of discipline and accountability in traders. They become acutely aware of each decision made, encouraging a more thoughtful and deliberate approach to trading.

-

Objective Performance Evaluation: The trading journal spreadsheet serves as an impartial observer, objectively documenting the trader’s performance. It provides concrete evidence of strengths and weaknesses, allowing for targeted improvement efforts.

-

Invaluable Educational Resource: Each trade recorded in the spreadsheet becomes a teachable moment. Traders can revisit past trades, analyze their performance, and extract valuable lessons to inform future decision-making.

-

Improved Emotional Control: By maintaining a comprehensive record of their trades, traders gain a clearer perspective on their emotional state during each transaction. This awareness empowers them to make more rational decisions, mitigating the impact of impulsive or error-prone trades.

-

Enhanced Risk Management: The trading journal spreadsheet facilitates effective risk management practices. Traders can meticulously track their risk exposure and make informed decisions to minimize potential losses.

Essential Considerations for a Comprehensive Trading Journal Spreadsheet

-

Tailor to Personal Trading Style: The spreadsheet should be tailored to the specific trading style of the individual, accommodating the unique data points and metrics they deem relevant.

-

Detailed Trade Information: Capture all pertinent trade details, including the underlying asset, option type, strike price, expiration date, entry and exit prices, and realized profit or loss.

-

Market Context: Record key market conditions prevailing at the time of each trade, such as market sentiment, volatility, and economic news.

-

Personal Insights: Encourage traders to include their personal observations, rationale behind each trade, and any lessons learned.

-

Performance Metrics: Incorporate performance metrics such as win rate, return on investment, and risk-reward ratio to quantify trading efficiency.

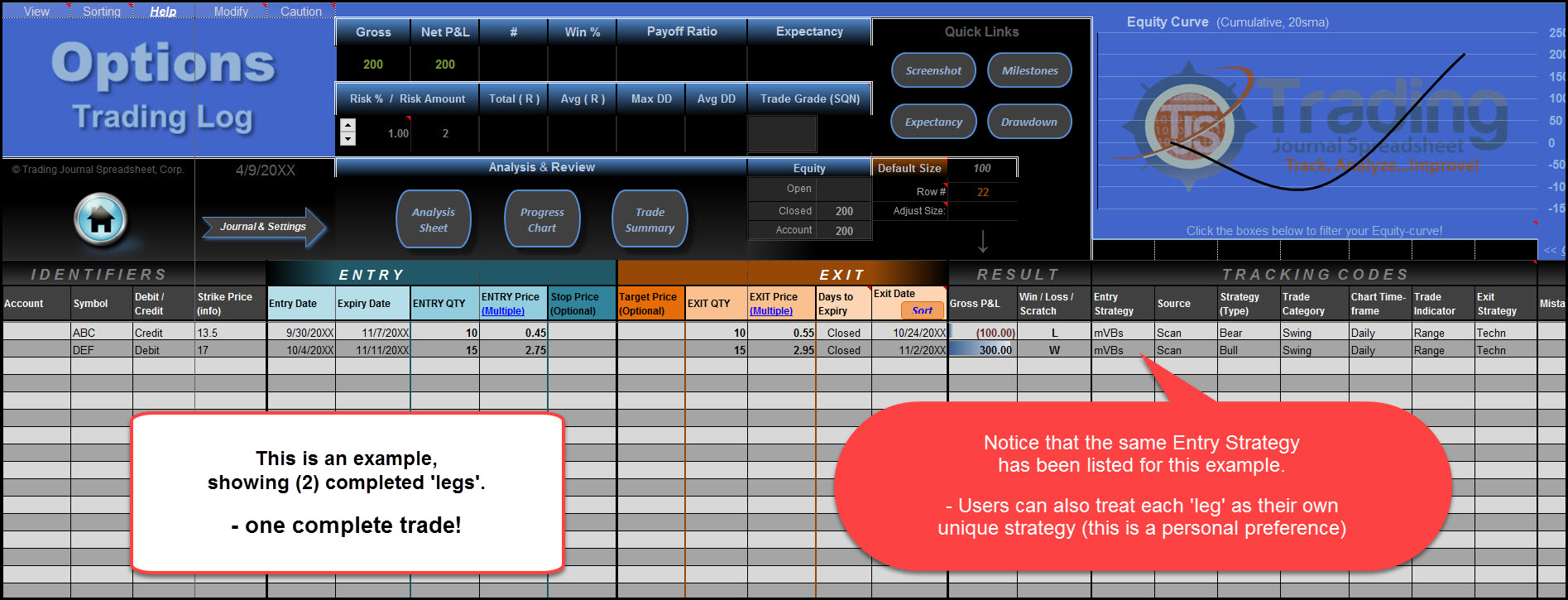

Image: trading-journal-spreadsheet.com

Harnessing the Power of Data Analysis

Once the trading journal spreadsheet is meticulously maintained, the true magic unfolds in the realm of data analysis. Traders can leverage the spreadsheet’s capabilities to identify patterns, pinpoint areas for improvement, and optimize their strategies. By studying the data, they can:

- Determine which strategies are most profitable under varying market conditions.

- Recognize recurring mistakes or behavioral biases that impact trading performance.

- Quantify the impact of emotions on trading decisions.

- Calibrate trading parameters, such as position sizing and risk appetite, to align with their risk tolerance.

Https Trading-Journal-Spreadsheet.Com Options-Trade-Input-Inquiry

Image: www.pinterest.jp

Conclusion

In the ever-evolving landscape of options trading, the trading journal spreadsheet stands as an invaluable tool, empowering traders with the knowledge and insights necessary to navigate market complexities and achieve sustainable success. By embracing the discipline and accountability it fosters, traders unlock a wealth of data that can propel their performance to new heights. As they delve into the intricacies of data analysis, they embark on a journey of continuous improvement, mastering the art of options trading and unlocking the potential for exceptional returns.