Investing in options can be a powerful way to enhance your portfolio’s performance. However, choosing the right options trading broker is crucial to ensure a seamless and profitable trading experience.

Image: www.pinterest.com

Reliable Options Trading Brokers

Navigating the vast pool of options trading brokers can be daunting. To assist you, here are some of the top brokerages that excel in this domain:

- Tastyworks: Known for its exceptional platform and low fees, Tastyworks is an ideal choice for active options traders.

- TD Ameritrade: This established brokerage provides comprehensive research tools and educational resources, making it suitable for both beginners and experienced traders.

- *ETrade:* ETrade excels in offering a user-friendly interface and a vast range of options trading tools cater to a diverse trader base.

Understanding Options Trading

Options are financial instruments that provide the buyer with the right, not the obligation, to buy (in the case of a call option) or sell (in the case of a put option) an underlying asset at a specified price, called the strike price, on or before a predetermined date, known as the expiration date.

Options offer a unique combination of flexibility and leverage, enabling traders to potentially amplify gains and manage risk effectively. However, it’s important to note that options trading involves substantial risk and should only be undertaken with a thorough understanding of its intricacies and potential pitfalls.

Types of Options

There are two primary types of options:

- Call Options: These options give the buyer the right to purchase the underlying asset at the strike price by the expiration date. Call options are typically purchased when an underlying asset’s value is anticipated to rise.

- Put Options: Put options confer upon the buyer the right to sell the underlying asset at the strike price by the expiration date. Put options are often employed when a decline in the underlying asset’s value is forecasted.

Image: www.danielstrading.com

Key Terms in Options Trading

- Premium: The price paid by the buyer of an option to acquire the right to exercise it.

- Strike Price: The predetermined price at which the underlying asset can be bought or sold according to the type of option held.

- Expiration Date: The date by which the option can be exercised.

- Intrinsic Value: For at-the-money, this is the difference between the market price of the underlying asset and the strike price.

Benefits and Risks of Options Trading

Options trading offers numerous advantages, including:

- Leverage for both gains and losses.

- Flexibility to tailor investments to specific risk profiles.

- Access to potential income through option premiums.

However, it is equally important to be aware of the risks involved:

- The loss of the entire premium invested in the option if it expires unexercised.

- Unlimited risk for the option seller (who holds the obligation to fulfill the option’s terms).

- Short-term options can fluctuate in value rapidly and potentially result in significant losses.

Latest Trends and Developments in Options Trading

The options trading space is constantly evolving. Here are some recent trends and developments:

- Artificial Intelligence (AI): AI algorithms are increasingly being applied to options trading for strategies like automated option pricing and hedging.

- Low-Latency Trading: Technological advances have enabled traders to execute options trades in fractions of a second, providing a potential advantage in fast-moving markets.

- Social Trading: Platforms are emerging that allow traders to follow and copy the strategies of experienced options traders.

Expert Tips for Options Trading

To enhance your success in options trading, consider the following tips:

- Understand the Basics: Gain a comprehensive grasp of options terminologies, strategies, and risks before allocating capital.

- Choose the Right Broker: Select a broker that aligns with your trading style and provides the tools and support you need.

- Manage Risk Wisely: Employ a robust risk management strategy that incorporates position sizing and hedging techniques to mitigate potential losses.

- Utilize Market Analysis: Conduct thorough technical analysis and utilize market data to make informed trading decisions.

- Learn from Experienced Traders: Engage with online forums and seasoned traders to garner valuable insights and refine your trading approach.

Frequently Asked Questions on Options Trading

-

Q: Can I lose money in options trading?

A: Yes, you can lose all or more of your invested capital by opting to sell options. -

Q: Which options strategy is best for beginners?

A: Simple strategies like covered calls or cash-secured puts offer limited downside risk and can be suitable for beginners. -

Q: What is the difference between a market order and a limit order in options trading?

A: A market order executes immediately at the prevailing market price, while a limit order only executes at or better than a specified price.

Https Investormint.Com Investing Top-Options-Trading-Brokers

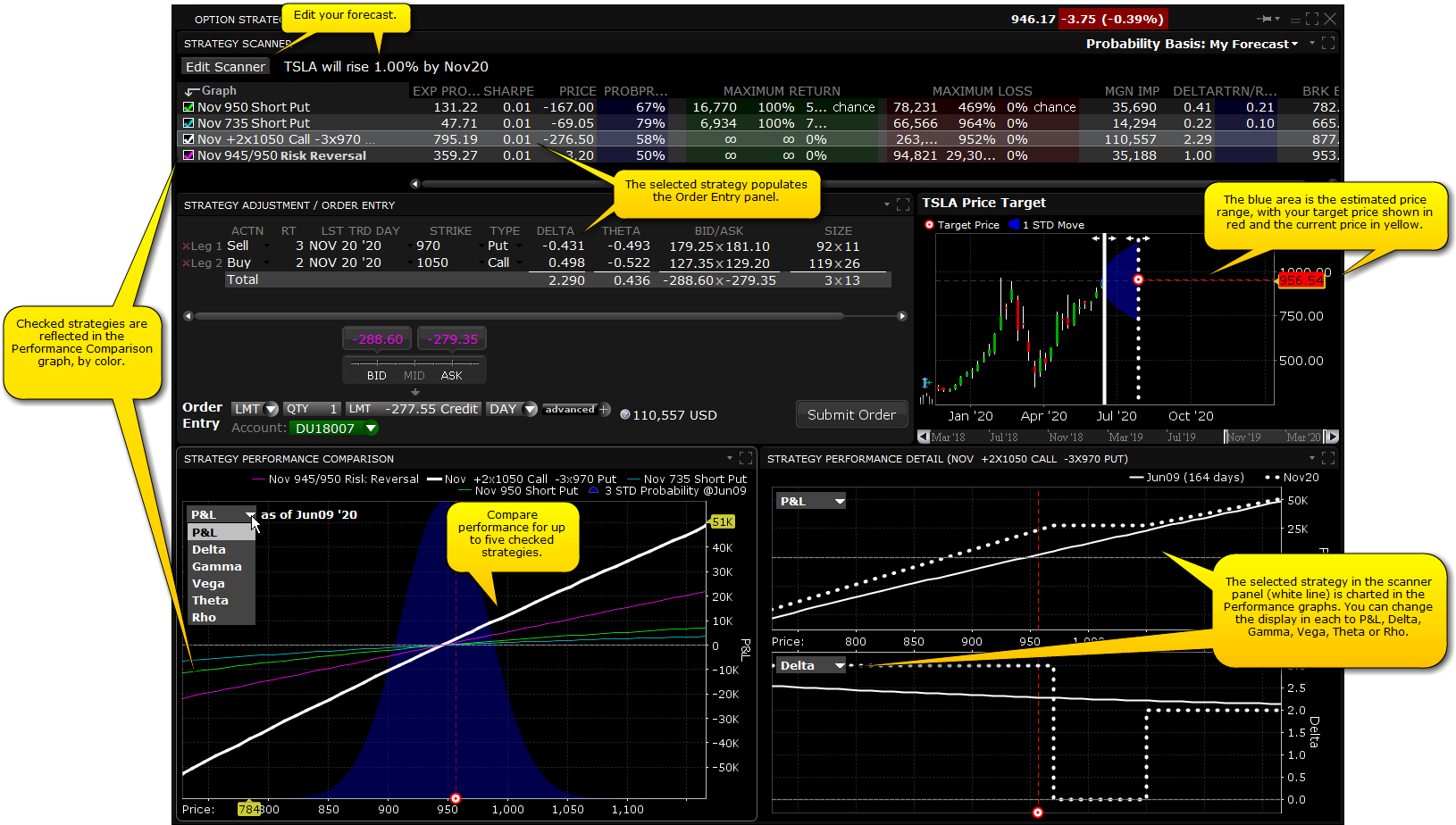

Image: ibkrguides.com

Conclusion: Embark on the World of Options Trading with Confidence

Options trading presents a unique opportunity for investors to augment their portfolios with potentially significant returns. By choosing a reputable options trading broker and adhering to sound trading principles, you can navigate the markets with increased confidence and maximize your chances of investment success. Are you ready to explore the captivating realm of options trading?