Traditionally, option trading has been shrouded in complexity, perceived as a labyrinthine world reserved for the financial elite. However, with the advent of contemporary trading strategies like option pinning, this enigmatic domain is becoming increasingly accessible to discerning traders. In this article, we will delve into the intricacies of option pinning, deciphering its mechanics and exploring how it can be harnessed to generate potentially lucrative trading ideas.

Image: steadyoptions.com

Defining Option Pinning: Unraveling the Strategy

Option pinning is an ingenious trading maneuver that involves simultaneously buying and selling options at the same strike price but with varying expiration dates. This strategic pairing creates a scenario known as “pinning,” where the price of the underlying asset is effectively locked or “pinned” within a narrow range. Seasoned traders employ this strategy to exploit market inefficiencies and capitalize on time-bound discrepancies between options.

Decoding Option Pinning: A Case Study

To illustrate the practical application of option pinning, let’s dissect a hypothetical scenario. Assume that the stock XYZ is trading at $100 per share. A trader identifies a market inefficiency where the January 2023 Call option with a strike price of $105 is trading at $5, while the January 2024 Call option with the same strike price is trading at $10.

By purchasing the January 2023 Call option and selling the January 2024 Call option at these prices, the trader effectively “pins” the stock price within a range of $100 to $105. If the stock price remains within this range, both options will expire worthless, netting the trader a profit from the difference in premiums paid and received.

Unveiling the Benefits of Option Pinning: A Treasure Trove of Advantages

Option pinning offers a constellation of compelling advantages for astute traders:

-

Premium Buffer: Pinning provides traders with a buffer or “cushion” against unpredictable price fluctuations. By limiting potential losses, it mitigates the inherent uncertainties that plague option trading.

-

Enhanced Yield Generation: The strategy allows traders to generate income from the time decay of options. As options approach their expiration dates, their value diminishes, providing traders with a consistent stream of premium revenue.

-

Capital Efficiency: Compared to buying options outright, option pinning requires a lower upfront capital investment. This attribute makes it particularly attractive for traders with limited resources.

-

Versatile Applications: Option pinning finds diverse applications in various market conditions. It can be employed in neutral, bullish, or bearish market scenarios, providing traders with adaptable trading opportunities.

Image: www.gfxtra31.com

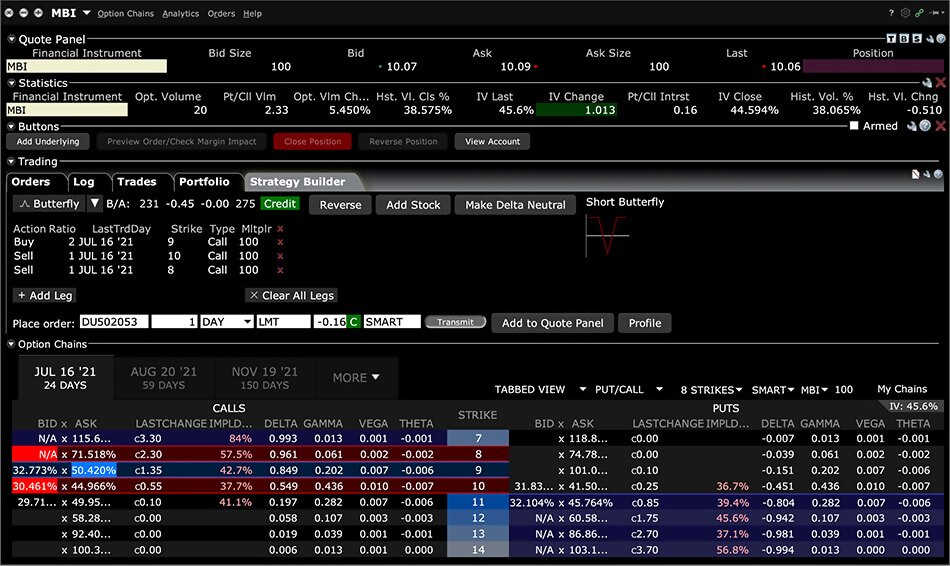

How To Use Option Pinning To Generate A Trading Idea

Image: www.interactivebrokers.com

Conclusion

Option pinning has emerged as a potent trading tool, empowering traders to navigate the volatile waters of the financial markets. By harnessing its ability to “pin” the price of an underlying asset, traders can generate potentially lucrative trading ideas while mitigating risks. As with any trading strategy, thorough research and a comprehensive understanding of market dynamics are paramount for successful implementation. With calculated execution and prudent risk management, option pinning can