Option trading, a derivative trading strategy that offers the potential for significant returns but also carries inherent risks, requires a thoughtful approach to loss mitigation. Options contracts involve complex interactions between underlying asset prices, time decay, implied volatility, and other factors, making understanding the underlying dynamics crucial for successful navigation. In this comprehensive guide, we delve into practical strategies to reduce loss and enhance the profitability of your option trading endeavors.

Image: dailypriceaction.com

Understanding Option Trading Risks

Before embarking on option trading, it is essential to acknowledge the inherent risks involved. As options contracts derive their value from the underlying asset’s price and other variables, market fluctuations can swiftly erode gains, sometimes leading to substantial losses. Additionally, time decay, the decline in option value as expiration approaches, can be a potent force to contend with, particularly for short-term options. To manage these risks effectively, a disciplined and structured approach is paramount.

The Art of Risk Management

At the heart of mitigating loss in option trading lies a meticulous risk management strategy. Delineate clear financial boundaries by determining the maximum loss you are willing to tolerate on each trade. Never exceed this threshold, as it serves as a vital safeguard against catastrophic losses. Furthermore, diversification plays a fundamental role in risk reduction. By spreading your investments across multiple underlying assets, option types, and expiration dates, you lessen the impact of adverse price movements in any single security.

Choosing the Right Options Strategy

Selecting the appropriate option strategy is pivotal to successful trading. Assess your trading goals, risk tolerance, and market outlook before choosing a strategy. Covered calls, for instance, are a conservative strategy that involves selling (or “writing”) a call option while owning the underlying asset, aiming to generate income from premiums while limiting downside risk. Conversely, selling naked options, where you lack the underlying asset, magnifies both profit potential and loss exposure. Prudent traders exercise caution with such strategies, employing them only after thoroughly comprehending the risks involved.

Image: www.angelone.in

Monitoring Market Conditions

Consistent monitoring of market conditions is crucial for option traders. Stay abreast of macroeconomic events, industry news, and geopolitical developments that could potentially influence underlying asset prices. Utilize technical analysis tools, such as charts and indicators, to identify market trends, support and resistance levels, and potential trading opportunities. By understanding the market landscape, you can make informed decisions and adapt your trading strategies accordingly, mitigating the risk of substantial losses.

Fine-Tuning Your Execution

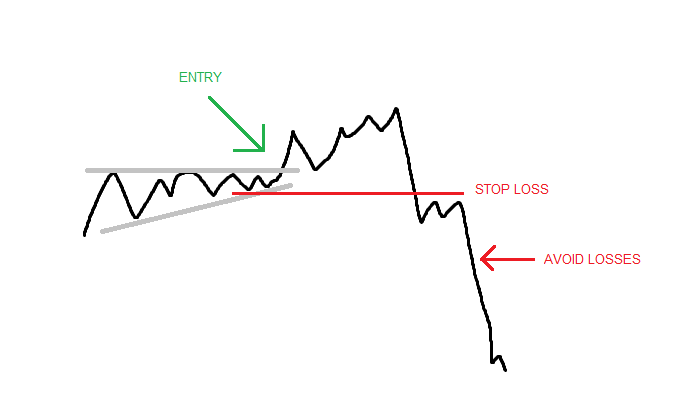

Efficient order execution is essential in option trading. Determine the type of order that best suits your trading needs, whether it’s a market order for immediate execution, a limit order to specify a desired price, or a stop order to initiate a trade when the market reaches a predetermined price. Additionally, consider using trailing stop orders to protect profits and limit losses by automatically adjusting the stop price as the market moves in your favor.

The Power of Discipline

Maintaining discipline is paramount in option trading. Resist the temptation to chase losses or deviate from your predefined trading plan. Clearly define your trading rules and adhere to them consistently, even during market turbulence. Emotional decision-making can cloud judgment, leading to impulsive trades that compromise your financial objectives. By maintaining discipline, you increase the likelihood of long-term profitability.

Learning from Losses

Losses are an inevitable part of option trading. Instead of fearing them, view them as learning opportunities to refine your strategies. Analyze losing trades objectively, identifying mistakes, and pinpoint areas for improvement. Embrace a mindset that seeks to extract valuable lessons from each adverse outcome, transforming losses into catalysts for future success.

How To Reduce Loss In Option Trading

Image: www.buildalpha.com

Conclusion

Navigating the dynamic and often unpredictable world of option trading requires a multifaceted approach to risk management. By implementing the strategies outlined in this comprehensive guide, you can mitigate losses, safeguard your profits, and position yourself for greater success in this challenging yet rewarding financial arena.