Embarking on a Journey of Options Trading

Imagine being granted the power to control your financial destiny, navigate market fluctuations, and potentially turn a profit from both rising and falling stock prices. Enter the thrilling realm of option trading, a sophisticated financial strategy that empowers investors to harness the potential of the stock market. My own initiation into this captivating world began serendipitously with a modest investment that yielded an unexpected windfall, igniting a deep fascination within me.

Image: www.angelone.in

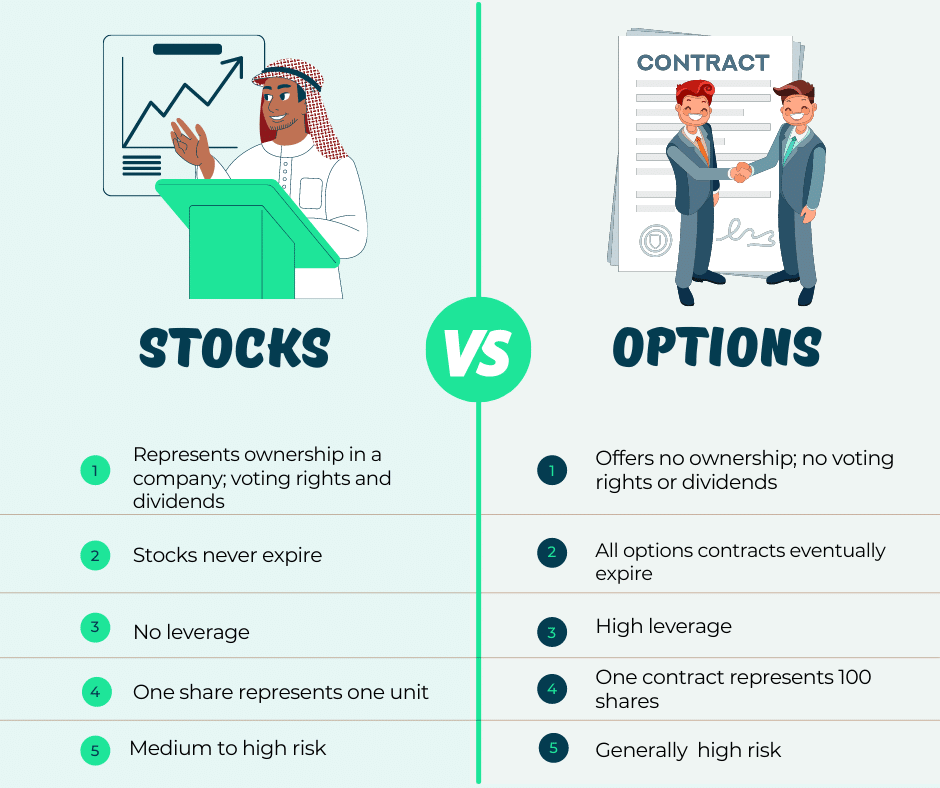

Option trading involves acquiring contracts that grant you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. This flexibility empowers you to speculate on the future direction of the market, pursue both bullish and bearish strategies, and potentially generate income through premiums.

Understanding Options Trading Concepts

Call Options: Profiting from Rising Stocks

Call options grant you the right to buy a specified number of shares of an underlying stock at a predetermined strike price on or before a certain date. When the market price of the stock rises above the strike price, the call option becomes valuable, as it allows you to purchase the shares at a favorable price, potentially reaping substantial profits.

Put Options: Harnessing Bearish Trends

Put options, on the other hand, provide the right to sell a specified number of shares of an underlying stock at a predetermined strike price on or before a certain date. They derive their value when the market price of the stock falls below the strike price, enabling you to profit from the stock’s decline.

Image: www.projectfinance.com

Options Trading Strategies: A Navigator’s Guide

Covered Call Strategy: Generating Premium Income

This conservative strategy involves selling a call option against an equivalent number of shares of the underlying stock that you already own. As long as the stock price stays below the strike price, you collect premium income. If the stock price rises above the strike price, you may be forced to sell your shares at that price, potentially limiting your potential profit.

Uncovered Call Strategy: Higher Risk, Higher Reward

This more aggressive strategy involves selling a call option without owning the underlying shares. If the stock price remains below the strike price, you retain the premium received. However, if the stock price rises significantly, you may be forced to purchase the shares at the strike price to fulfill your obligation, potentially resulting in losses.

Put Options Strategies: Hedging and Profiting from Downward Trends

Put options offer a range of strategies for downside protection or profiting from declining stock prices. For example, purchasing a put option provides insurance against potential losses or limits the risk of a long stock position when expecting a downward trend. Selling put options, on the other hand, can generate premium income or potentially profit from expectations of a stable or slightly rising stock price.

Tips and Expert Advice for Options Trading Success

1. Educate Yourself: Begin by thoroughly researching options trading concepts, strategies, and market trends. Attend webinars, study books, and seek mentorship from experienced traders.

2. Start Small: Avoid risking more than you can afford to lose. Begin with small trades and gradually increase your investment size as you gain experience.

3. Choose Liquid Options: Select options that have sufficient trading volume, ensuring that you can enter and exit trades with minimal slippage and execution delays.

4. Manage Risk: Utilize stop-loss orders, limit orders, and proper position sizing to minimize your potential losses in case of adverse market movements.

FAQ: Empowering Investors with Knowledge

Q: What is the biggest risk in options trading?

A: The primary risk associated with options trading is the potential for large financial losses, especially in uncovered positions.

Q: How much money do I need to start options trading?

A: You can start options trading with a relatively small amount of capital, but it is essential to carefully consider your risk tolerance.

Q: Can I make a lot of money through options trading?

A: While options trading has the potential for high returns, it is important to approach it with realistic expectations. Success requires skill, knowledge, and a disciplined trading strategy.

How To Invest In Option Trading

Image: ritholtz.com

Conclusion: Embracing the Future of Investing

Options trading offers a potent tool for savvy investors seeking greater control over their financial outcomes. By harnessing the power of option contracts, you unlock the ability to adapt to market dynamics, potentially generate significant profits, and protect your portfolio against downside risks. Embark on this exciting journey of financial exploration, but always remember to prioritize education, risk management, and a well-informed approach.

Are you ready to delve into the intricacies of options trading and seize the opportunities it presents? Share your thoughts and experiences in the comments below and let’s unravel the secrets of this fascinating financial instrument together.