Options trading offers a potentially lucrative way to invest, but it also comes with risks. To trade options safely, it’s crucial to understand the ins and outs of the market and follow prudent risk management strategies. This article will guide you through the basics of options trading safety, empowering you to navigate the markets with confidence.

Image: tradewithmarketmoves.com

Before diving into options trading, it’s essential to educate yourself thoroughly. Take courses, read books, and seek mentorship from experienced traders. A solid understanding of the complexities of options trading will lay the foundation for informed decision-making.

Understanding Options and Their Risks

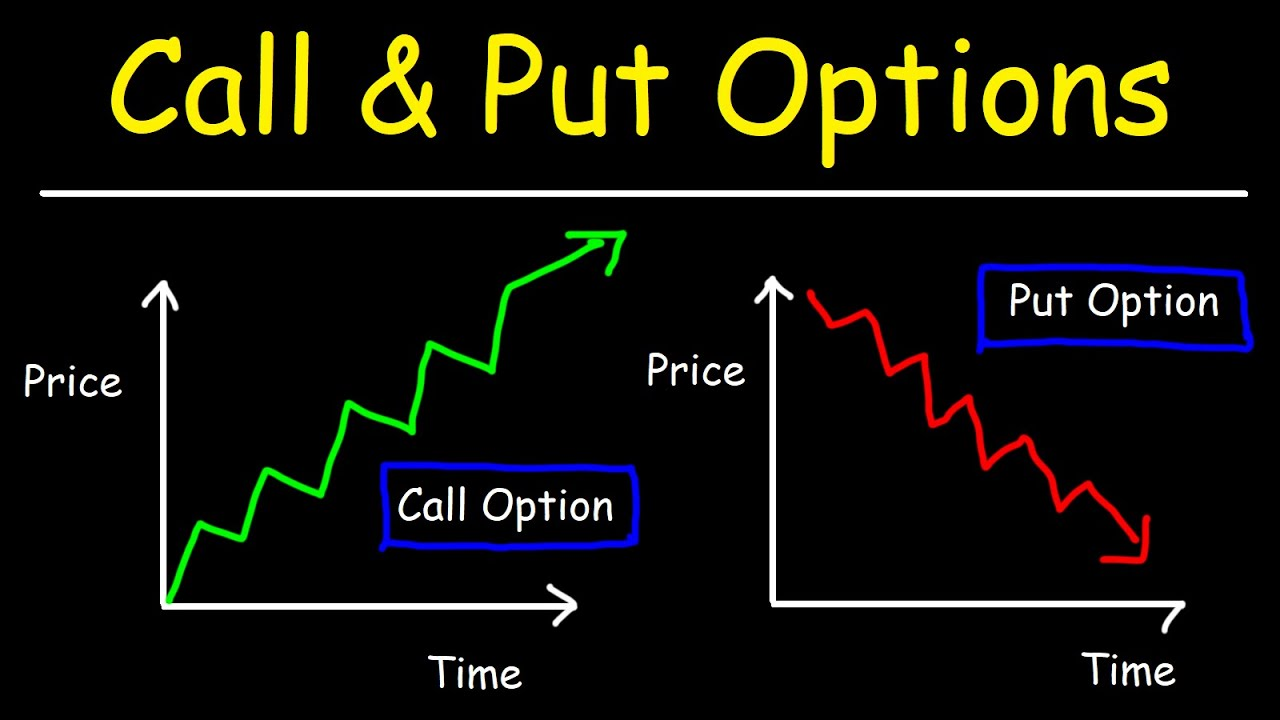

Options are financial contracts that convey the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date. They derive their value from the underlying asset’s price fluctuations.

Options carry both rewards and risks. The potential for profit is limited to the premium paid, while the risk of loss can be significant. It’s crucial to recognize that options trading involves speculating on the future direction of the underlying asset. Volatility, time decay, and the bid-ask spread are among the factors that can impact option performance.

Risk Management Strategies for Options Trading

To trade options safely, implement robust risk management strategies. These include:

- Know your budget: Determine the amount of capital you can afford to risk and stick to it.

- Diversify your portfolio: Spread your risk by trading options on different underlying assets and employing various strategies.

- Control positions: Limit the number of options contracts you trade simultaneously to manage potential losses.

- Manage leverage: Options can amplify gains and losses. Use leverage judiciously and considerhedging strategies to reduce risk.

- Monitor regularly: Keep track of option positions and underlying asset performance to make timely adjustments.

Tips and Expert Advice for Safer Options Trading

Experienced options traders offer valuable advice for safe trading:

- Start small: Begin with small trades to gain experience and confidence.

- Understand option Greeks: Learn the significance of metrics such as delta, gamma, and theta to assess risk and potential outcomes.

- Stay disciplined: Adhere to your trading plan, avoid impulsive decisions, and don’t chase losses.

- Manage emotions: Keep emotions in check, as fear and greed can lead to poor trading decisions.

- Seek professional guidance: Consult financial advisors or brokers for personalized guidance and support.

Image: www.snideradvisors.com

FAQs on Options Trading Safety

Q: What is the best way to learn options trading?

A: Combine online courses, books, and mentorship from experienced traders.

Q: What are the primary risks of options trading?

A: Limited profit potential, significant loss risk due to volatility and time decay.

Q: How do I calculate the potential profit or loss from an option trade?

A: Use option pricing models that consider factors like the underlying asset’s price, strike price, expiration date, and volatility.

How To Do Options Trading Safely

Image: 1investing.in

Conclusion

Options trading can be a rewarding but potentially risky endeavor. By adhering to sound risk management strategies, seeking education, and acquiring expert advice, you can navigate the markets more safely and confidently. Remember to trade within your means, monitor market dynamics, and stay disciplined. Options trading requires patience, perseverance, and a commitment to continuous learning. Engage in this exciting investment opportunity with a well-informed and responsible approach, and you’ll be well on your way to maximizing your chances of success.

Are you ready to explore the world of options trading safely? Begin your journey by educating yourself and seeking expert guidance. Stay tuned for more insights and practical advice on this fascinating and potentially lucrative investment vehicle.