Introduction:

Options trading is a powerful and versatile investment strategy that allows you to speculate on the future price movement of stocks, indices, and other financial instruments. As a beginner, it’s essential to understand the ins and outs of options trading before diving in. In this comprehensive guide, we will delve into the intricacies of options trading, empowering you to make informed decisions and navigate the complexities of the market.

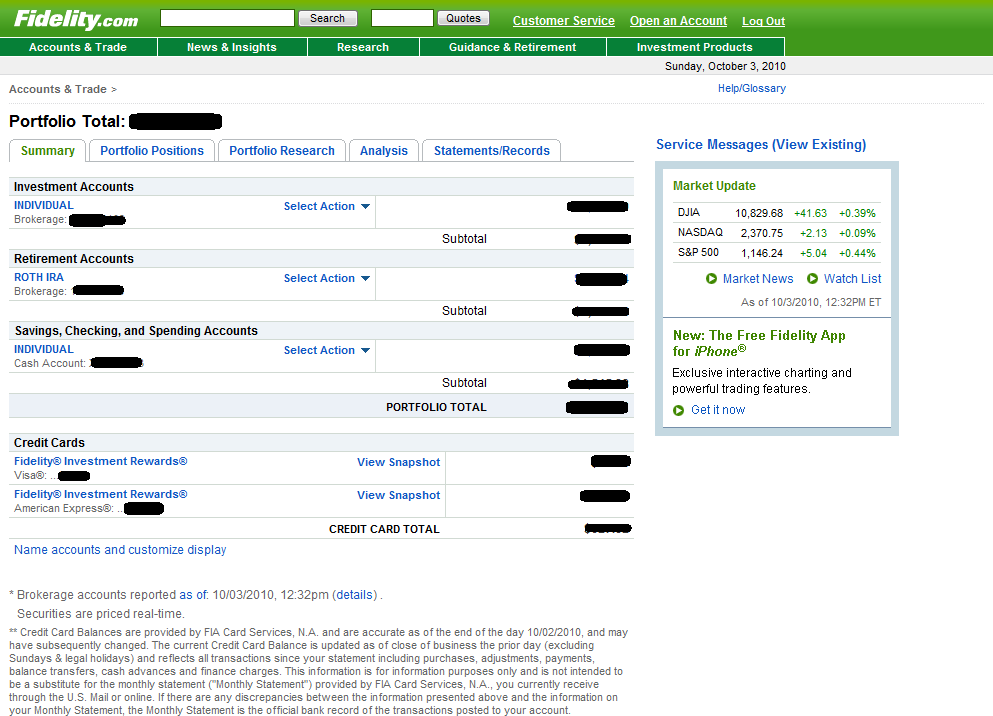

Image: www.reddit.com

Options Trading on Fidelity

Fidelity is a highly reputable brokerage firm that offers a robust platform for options trading. Their platform, Fidelity Active Trader Pro, provides advanced features tailored to experienced traders. However, for beginners, it’s recommended to start with the Fidelity website or mobile app, which offer a more user-friendly interface and educational resources.

Applying for options trading on Fidelity is a straightforward process that can be completed online. Here’s a step-by-step guide:

- Create a Fidelity account.

- Complete the Options Trading Agreement, which outlines the terms and conditions for options trading.

- Submit an Options Knowledge Assessment, which tests your understanding of options trading concepts.

- Once you pass the assessment, you will be approved for Level 1 options trading privileges.

- To trade more complex options strategies or increase your trading limits, you may apply for higher level options trading privileges by taking additional assessments and completing training.

Understanding Options Trading

Options are financial contracts that provide the buyer the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a specific price on a specified date. By purchasing an option, you are gaining the potential to profit from price movements in the underlying asset.

Key concepts in options trading include:

- Underlying asset: The stock, index, or other financial instrument on which the option is based.

- Strike price: The price at which the option can be exercised.

- Expiration date: The date by which the option must be exercised or expires.

- Option premium: The price paid to purchase an option contract.

- In-the-money options: Options that have a positive intrinsic value.

- Out-of-the-money options: Options that have no intrinsic value.

- Call options: Options that give the buyer the right to buy the underlying asset.

- Put options: Options that give the buyer the right to sell the underlying asset.

Latest Trends and Developments

Options trading has witnessed several notable trends in recent years, including:

- Increased popularity of exchange-traded options (ETOs).

- Development of new options products, such as binary options and complex multi-leg strategies.

- Advancements in options trading technology, making it more accessible and efficient.

- Growing investor interest in options as a means to hedge risk and enhance portfolio returns.

Image: thewaverlyfl.com

Tips for Success

Navigating the options market effectively requires strategic thinking and smart execution. Here are some tips to help you on your journey:

- Educate yourself: Before embarking on options trading, take the time to learn the basics and immerse yourself in the complexities of the market.

- Know your risk tolerance: Assess your financial situation and risk appetite before making any trades.

- Start small: Begin with small trades to gain experience and confidence before increasing your exposure.

- Set realistic goals: Avoid chasing overnight riches; aim for achievable profit targets.

- Manage risk: Employ stop-loss orders and other techniques to limit potential losses.

FAQs

Q: What is the minimum account balance required for options trading on Fidelity?

A: There is no set minimum account balance requirement, but it’s recommended to have sufficient funds to cover potential losses.

Q: What fees are associated with options trading?

A: Fidelity charges a commission per contract traded, which varies depending on the type of option.

Q: Can I cancel an options order after it has been placed?

A: Depending on the timing and status of the order, it may be possible to cancel it by contacting Fidelity’s trade desk.

How To Apply For Options Trading Fidelity

Image: pupuzifecose.web.fc2.com

Conclusion

Options trading offers immense opportunities and rewards, but it’s crucial to approach it with a solid understanding and a well-informed strategy. By following the steps outlined in this comprehensive guide, you can successfully apply for options trading on Fidelity and embark on your options trading journey with confidence. Remember, education, prudence, and risk management are the cornerstones of success in this dynamic and ever-evolving market.

Call to Action: Are you intrigued by the potential of options trading? Take the first step towards unlocking this exciting world by applying for options trading on Fidelity today. Your options trading journey awaits, where savvy decisions and prudent risk management will pave the way to financial empowerment.