In the fast-paced world of financial markets, options trading stands out as a powerful tool for sophisticated investors seeking to enhance their returns. ETRADE, a leading online brokerage platform, empowers traders with a robust suite of tools and resources to navigate this complex landscape. This comprehensive guide delves into the intricacies of adjusting option trades on ETRADE, equipping you with the strategies and techniques to optimize your trading performance.

Image: mimevagebasoh.web.fc2.com

Understanding Option Adjustments: A Path to Strategic Advantage

Option adjustments are crucial maneuvers that allow traders to modify the characteristics of their existing option contracts to align with evolving market conditions or investment objectives. By leveraging E*TRADE’s intuitive trading interface, you can seamlessly execute various adjustment strategies to enhance your trading outcomes.

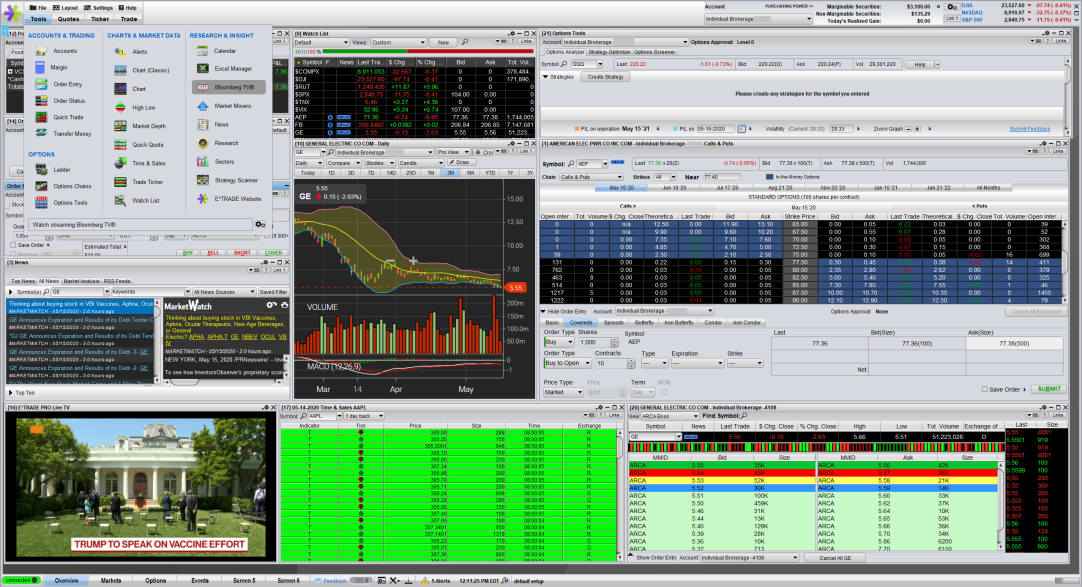

Adjusting Options on E*TRADE: A Step-by-Step Guide

-

Locate Your Open Positions: Log in to your E*TRADE account and navigate to the “Options” tab. Select “My Options” to view a list of your current positions.

-

Identify the Option to Adjust: Choose the specific option contract you wish to adjust from the list of open positions. Click on the “Adjust” button located in the corresponding row.

-

Choose Your Adjustment Strategy: E*TRADE offers a range of adjustment strategies, including closing the position, rolling it over, or converting it to a different type of option. Carefully consider the goals and risks associated with each strategy before making a selection.

-

Execute the Adjustment: Once you have determined the desired adjustment, enter the necessary parameters, such as the adjustment price or the new expiration date. Review the details thoroughly before confirming the transaction.

-

Track Your Adjustments: Keep a record of all adjustments made to your option positions. This documentation aids in monitoring your trading activity, evaluating performance, and optimizing future trading decisions.

Common Option Adjustment Strategies: Empowering Informed Decisions

Closing a Position: Terminating an existing option contract by buying or selling it back to the market. This strategy can be employed to lock in profits, limit losses, or simply exit the trade.

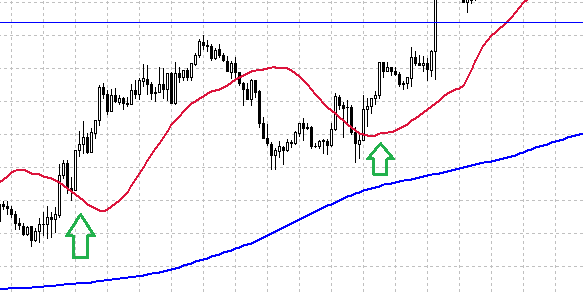

Rolling Over: Extending the expiration date of an option while simultaneously adjusting its strike price. Rolling over allows traders to maintain exposure to the underlying asset while modifying the risk profile of the trade.

Converting a Position: Transforming an existing option contract into a different type, such as switching from a call to a put option. Conversions provide traders with the flexibility to alter their market positioning without initiating entirely new trades.

Image: forextradingstrategy80profits1.blogspot.com

Risk Management Considerations: Safeguarding Your Investments

Adjusting option trades involves inherent risks that prudent traders must acknowledge and manage effectively. Consider the following precautions to mitigate potential losses:

- Volatility: Understand the impact of volatility on option premiums and adjust your trades accordingly to manage risk.

- Time Decay: Factor in the time value component of options and adjust positions before significant time decay erodes their value.

- Liquidity: Ensure that the option contracts you trade maintain adequate liquidity to facilitate timely execution at fair prices.

- Margin Requirements: Be aware of any margin requirements associated with your adjustments and ensure you have sufficient account equity to cover potential losses.

How To Adjust Option Tradings On Etrade

Image: www.warriortrading.com

Conclusion: Enhancing Trading Prowess with E*TRADE’s Option Adjustment Capabilities

Mastering the art of adjusting option trades on ETRADE empowers you with the ability to fine-tune your trading strategies, optimize performance, and navigate market fluctuations with greater confidence. By leveraging the comprehensive suite of tools and resources available on the ETRADE platform, you gain the edge to maximize returns and achieve your financial objectives. Remember to approach adjustments with sound risk management principles, and you will find yourself well-equipped to capitalize on the opportunities inherent in the dynamic world of options trading.