Understanding the Basics of Option Trading

Option trading involves speculating on the future movement of an underlying asset, such as a stock or an index. Options confer the right to buy (call) or sell (put) the asset at a predetermined price (strike price) on or before a specific date (expiration). Option traders can either exercise their right to buy or sell, or they can sell the option contract itself before its expiration.

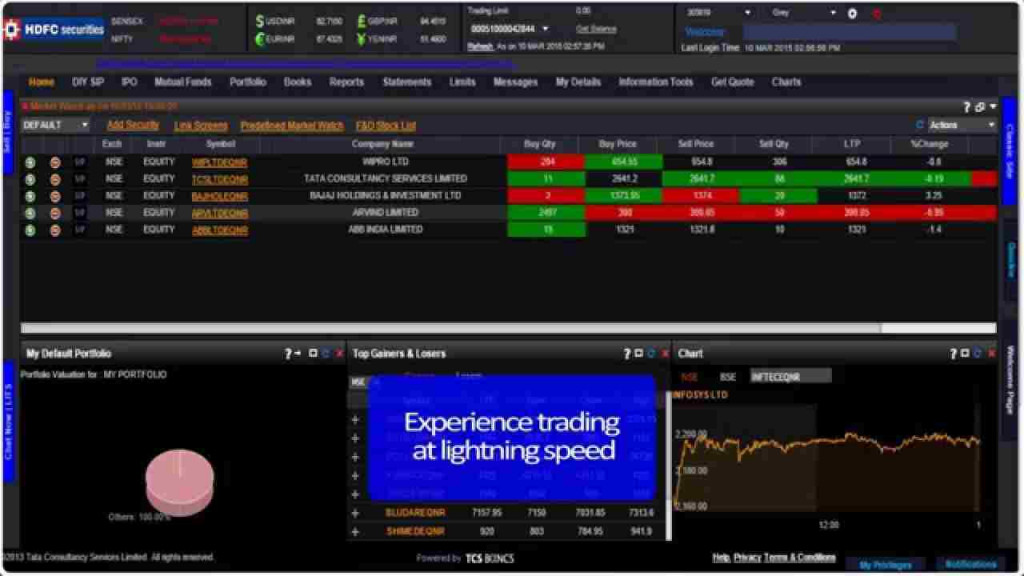

Image: www.youtube.com

Activating Option Trading in HDFC Securities

HDFC Securities, a leading Indian financial service provider, offers convenient options trading services to its clients. To activate option trading in your HDFC Securities account, follow these steps:

-

Open an HDFC Securities Demat and Trading Account: If you don’t already have an HDFC Securities account, you’ll need to open one to access option trading.

-

Enable Option Trading: Once your account is opened, contact HDFC Securities customer support or visit your nearest branch to activate option trading.

-

Complete KYC and Risk Assessment: HDFC Securities will conduct a Know Your Customer (KYC) process and assess your risk appetite before enabling option trading.

-

Understand the Risks: Carefully review the risks associated with option trading and ensure you fully comprehend them before activating this feature.

5 Key Advantages of Option Trading

Option trading offers several benefits, including:

-

Flexibility: Options provide flexibility in investment strategies, allowing you to adopt a range of positions based on your market expectations.

-

Limited Risk: Buying options limits your potential losses to the premium paid, unlike stock trading where losses can be unlimited.

-

Leverage: Options offer leverage, allowing you to potentially amplify your gains with a relatively small investment compared to buying the underlying asset outright.

-

Income Generation: Options can be used as an income-generating strategy by selling (writing) options and collecting premiums.

-

Hedging: Options can help you hedge against price fluctuations in your existing stock portfolio or reduce the risk of a long-term investment.

Latest Trends and Innovations in Option Trading

In recent years, option trading has witnessed numerous advancements:

-

Growth in Retail Participation: Retail investors are increasingly participating in option trading, leveraging its potential for both income generation and portfolio diversification.

-

Technology Enhancements: Trading platforms and mobile applications now offer user-friendly interfaces and analytical tools that simplify option trading for beginners.

-

New Product Offerings: Exchanges and brokers are rolling out innovative option contracts such as weekly options and basket options to cater to the evolving needs of traders.

-

Regulatory Changes: Regulators are actively monitoring the option market to ensure its integrity and protect investors from excessive risk-taking.

Image: unbrick.id

Expert Insights and Tips for Beginners

As a seasoned blogger who has witnessed the ups and downs of option trading firsthand, I offer these insights and tips for aspiring traders:

-

Start with a Small Investment: Begin with a small amount of capital to build confidence and gain experience before scaling up your trading.

-

Educate Yourself: Familiarize yourself with the concepts of option trading through books, articles, and online courses.

-

Paper Trade: Practice option trading through paper trading platforms before entering the live market. This allows you to simulate trades without incurring real losses.

-

Monitor the Market: Stay updated with market news and economic events that can impact option prices.

-

Seek Professional Guidance: Consult with an experienced financial advisor if you have questions or need guidance with your option trading strategies.

Frequently Asked Questions about Option Trading

Q: Can I trade options with a small capital?

A: Yes, you can start option trading with a small amount of capital. However, be mindful of the risks involved and do not overextend your trading beyond your financial capacity.

Q: How do I calculate the profit or loss in option trading?

A: Profit or loss in option trading depends on the position you take (buyer or seller), the performance of the underlying asset, and the time remaining before expiration. Various online calculators are available to assist you with this computation.

Q: Is option trading suitable for all investors?

A: Option trading is not suitable for all investors. It involves risks and requires a good understanding of market dynamics, advanced trading techniques, and risk management concepts.

How To Activate Option Trading In Hdfc Securities

Image: www.adigitalblogger.com

Conclusion

Delving into the world of option trading can enhance your investment portfolio. By leveraging the flexibility and potential for profit generation offered by options, you can navigate market fluctuations and pursue your financial goals. Activate option trading in your HDFC Securities account today and embark on this exciting journey.

Do you have any further questions about option trading or need additional guidance? I encourage you to connect with me or HDFC Securities customer support for expert assistance.