Introduction

Imagine the thrill of entering the dynamic world of options trading, where you wield the power to speculate on the potential price movements of underlying assets. However, before you delve into this exhilarating arena, there’s a crucial aspect you must master: options trading hours.

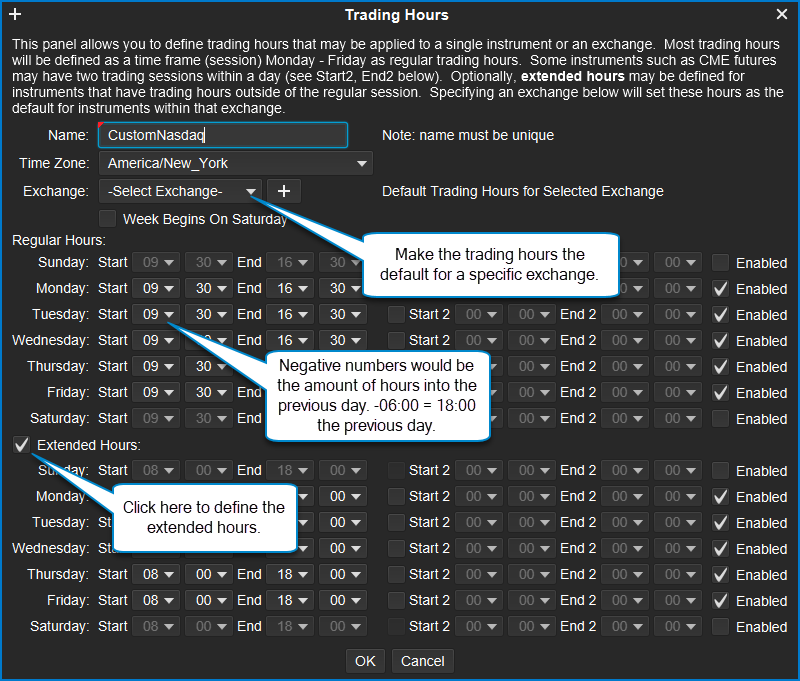

Image: support.motivewave.com

Understanding the precise timeframes during which options can be traded is essential to seize opportunities and mitigate risks effectively. In this comprehensive guide, we will embark on a time-bending journey, exploring the hours options trading takes place, their impact on strategies, and expert advice to guide you every step of the way.

Options Trading Hours: Unlocking the Marketplace Rhythm

Options trading hours are meticulously regulated to maintain a structured and orderly marketplace. The primary venue for options trading, the Options Clearing Corporation (OCC), sets these hours to ensure fair and transparent transactions.

Regular options trading hours in the United States, where the majority of options contracts are traded, are as follows:

- Sunday: Closed

- Monday-Friday: 9:30 AM to 4:00 PM Eastern Time (ET)

Extended Hours Trading: Beyond the Bell

In recent years, many options exchanges have introduced extended hours trading, offering traders the opportunity to execute trades beyond the regular market hours. These hours vary depending on the exchange, but generally encompass:

- Pre-Market Trading: 8:00 AM to 9:30 AM ET

- After-Hours Trading: 4:00 PM to 8:00 PM ET

Extended hours trading provides traders with greater flexibility, allowing them to react to news and events that may occur outside of regular trading hours. However, liquidity may be lower during these periods, so it’s crucial to proceed with caution and manage risk appropriately.

Significance of Options Trading Hours: Timing is Everything

Comprehending options trading hours is paramount for several reasons:

- Order Execution Timing: Knowing the trading hours ensures you place orders within the designated timeframes, avoiding the frustration of rejected or delayed trades.

- Strategy Planning: Understanding the market accessibility helps you plan strategies that align with your risk tolerance and trading style. Some strategies, such as scalping or day trading, require a high level of market access, while others, like long-term investing, may not be as time-sensitive.

- Risk Management: Trading outside of regular hours may expose you to increased market volatility and liquidity risks. By understanding the trading hours, you can adjust your risk management strategies accordingly.

Image: jyfyyuxy.web.fc2.com

Expert Advice for Navigating Options Trading Hours

Seasoned options traders have accumulated a wealth of knowledge over time. Here are some expert tips to guide your journey:

- Be aware of market closures: Major market holidays and events, such as Christmas and Thanksgiving, can impact options trading hours. Plan accordingly to avoid missed opportunities or unexpected trades.

- Utilize extended hours trading judiciously: While extended hours trading offers flexibility, proceed with caution due to potentially lower liquidity. Avoid making hasty decisions or placing large orders during these periods.

- Consider your risk tolerance: If you prefer to trade during times of high liquidity and market consensus, regular trading hours may be more suitable. Conversely, if you’re willing to accept increased risk in exchange for potential opportunities, extended hours trading may be an option.

Frequently Asked Questions on Options Trading Hours

Q: Can I trade options on weekends?

A: No, options exchanges are typically closed on weekends.

Q: Are all options contracts traded during the same hours?

A: Generally, yes. However, some niche options contracts, such as weekly options or currency options, may have slightly different trading hours.

Q: How does time decay impact options trading?

A: Options contracts have a limited lifespan, and their value decays over time. This decay is accelerated during periods of low market volatility.

Hours Options Trading

Image: anvawork.blogspot.com

Conclusion

Comprehending options trading hours is an integral aspect of successful options trading. By understanding the precise timeframes during which trading occurs, you can optimize your strategies, manage risk effectively, and seize opportunities as they arise. Whether you prefer the stability of regular trading hours or the flexibility of extended hours trading, knowledge is power in this ever-evolving marketplace.

The world of options trading awaits your exploration. Are you ready to unravel its mysteries and harness its potential? Dive in, master the hours, and let the options market be your playground.