Introduction:

Image: tradeoptionswithme.com

Imagine a financial instrument that provides you with an intriguing blend of limited risk and substantial potential reward. Welcome to the enigmatic world of high probability option trading calendar spreads. These meticulously crafted strategies allow astute traders to leverage time decay and seasonal market patterns to enhance their chances of profit in the ever-evolving realm of equity markets.

Understanding Calendar Spreads:

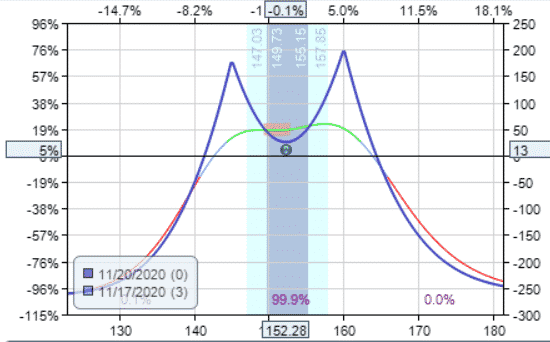

Calendar spreads, as their name suggests, involve buying (or selling) options with different expiration dates to capitalize on shifts in the underlying asset’s price. The essential components of a calendar spread are the front-month option and the back-month option. The front-month option has a closer expiration date and is generally purchased, while the back-month option has a more distant expiration date and is often sold.

Benefits of Calendar Spreads:

Seasoned traders deploy calendar spreads for several compelling reasons:

- Limited Risk: The risk of a calendar spread is typically confined to the premium outlay, providing a distinct advantage over directional trades. This makes calendar spreads a particularly attractive option for risk-averse or novice traders.

- Higher Probability: Calendar spreads exploit time decay to generate profits, even in choppy or sideways market conditions. By selling a longer-dated option against a shorter-dated one, traders harness the inherent premium erosion to their benefit.

- Seasonal Trends: By meticulously aligning the expiration dates of the options with seasonal market patterns, traders can enhance their probability of profiting from predictable price movements.

Structuring Calendar Spreads:

Designing a successful calendar spread is an art form that requires a keen eye for detail:

- Front-Month Option: The selection of the front-month option should hinge on the anticipated market direction. For bullish scenarios, traders would buy a call option; for bearish expectations, they would buy a put option.

- Back-Month Option: The back-month option serves as a counterbalance to the front-month option. Traders typically sell this option to initiate the spread, such as selling a call option to balance a purchased call option in a bullish scenario.

- Time Decay: Time decay, the gradual erosion of option premiums as they approach expiration, is a crucial component of calendar spread profitability. Traders should carefully consider the appropriate time frame for their trade to exploit this phenomenon.

Navigating Market Scenarios:

Calendar spreads can perform exceptionally well in specific market conditions:

- Time Decay Erosion: As the front-month option nears expiration, its premium rapidly decays, while the back-month option premium depreciates at a slower pace. This asymmetry creates a favorable scenario for spread holders.

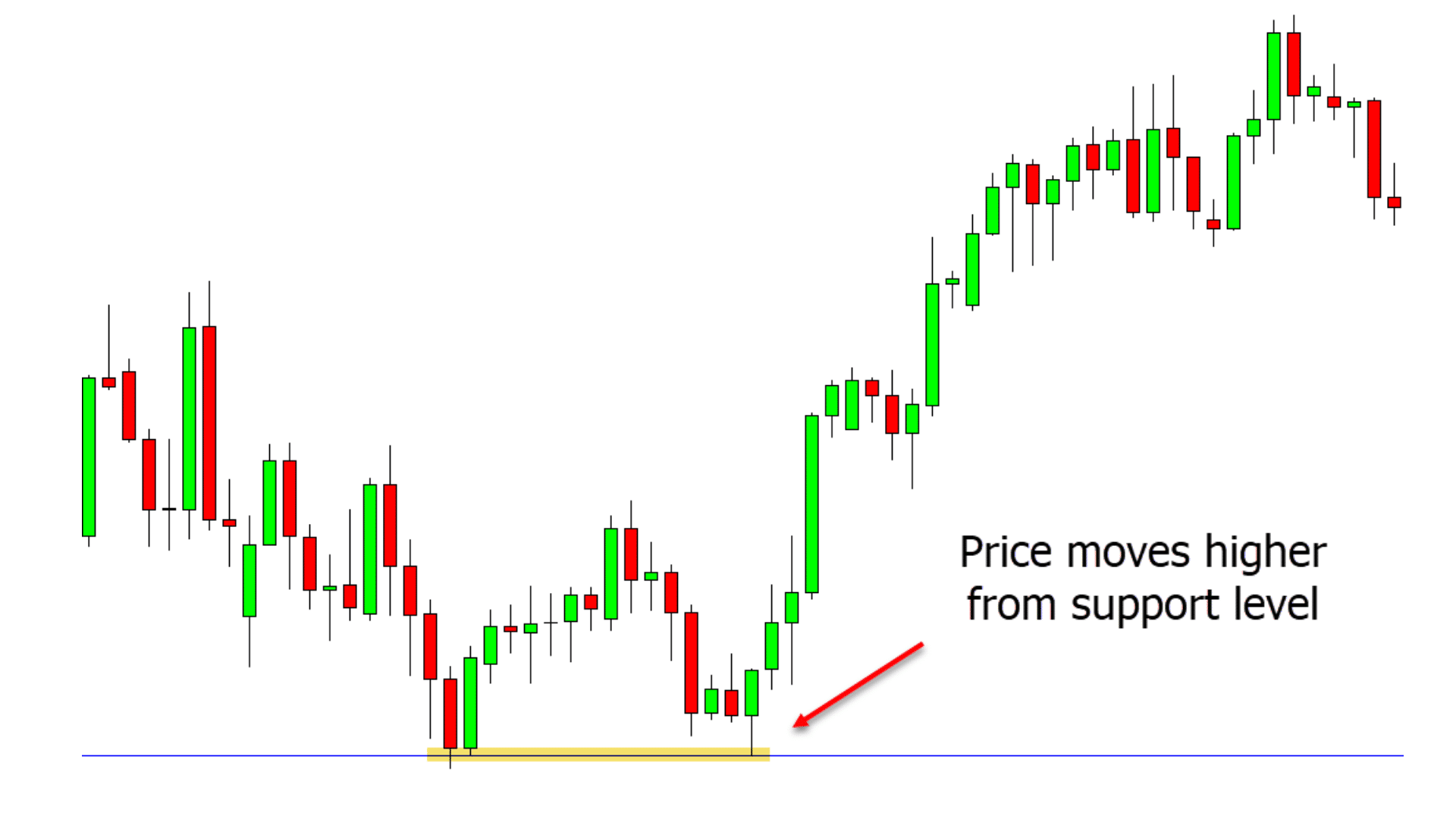

- Flat or Sideways Markets: Calendar spreads thrive in range-bound markets where prices fluctuate within a confined range. The time decay advantage allows traders to profit even in the absence of significant price movements.

- Trend Following: Calendar spreads can be modified to capture upside potential or downside protection in trending markets. Traders can adjust the strike prices and expiration dates to align with their market projections.

Practical Considerations:

Embarking on calendar spread trading requires careful planning and execution:

- Position Sizing: Determining the optimal number of spreads to trade should consider account size and risk tolerance. Smaller positions are more appropriate for new traders or those seeking to minimize potential losses.

- Monitoring: Active oversight of open calendar spreads is essential. Traders should track market conditions and assess the likelihood of achieving profit targets.

- Risk Management: As with any trading strategy, risk management is paramount. Traders should establish realistic stop-loss orders to mitigate potential losses and preserve capital.

Conclusion:

High probability option trading calendar spreads offer a tantalizing blend of risk management and potential reward that can empower traders to navigate complex market environments. By leveraging time decay and seasonal patterns, traders can enhance their chances of profitability. Remember, successful calendar spread trading demands meticulous research, strategic planning, and disciplined risk management. As you venture into this intricate world, may the markets smile upon your endeavors.

Image: optionstradingiq.com

High Probability Option Trading Calendar Spreads

Image: stockmarketsguides.com