Introduction

The world of options trading offers a spectrum of strategies, each catering to different investment goals and risk appetites. Among them lies a realm reserved for the bold, where delta values soar: high delta options trading. These potent financial instruments amplify underlying asset price movements, offering both immense profit potential and heightened risks. In this comprehensive guide, we embark on a journey to unravel the complexities of high delta options trading.

Image: www.moneyshow.com

Immerse yourself in this captivating exploration, armed with insights born from real-world experiences and the latest industry trends. Glean expert advice, grasp the intricacies of this dynamic trading strategy, and empower yourself with the knowledge to navigate the high delta options market with confidence.

High Delta Options: An Overview

Definition and Significance

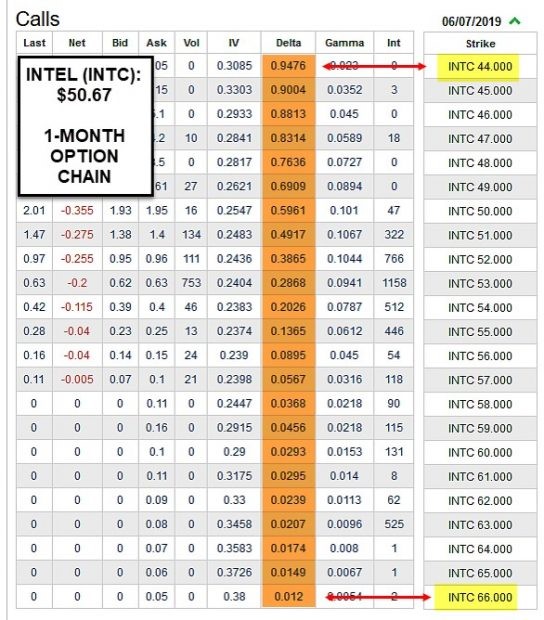

High delta options are options contracts that exhibit delta values approaching or equaling 1 or -1. Delta measures the sensitivity of an option’s price to changes in the underlying asset’s price. A delta close to 1 indicates that the option’s price will move almost in lockstep with the underlying asset, while a delta close to -1 suggests a near-inverse price relationship.

The significance of high delta options lies in their amplified leverage. As the underlying asset’s value fluctuates, so does the option’s value, offering traders the potential for significant gains (or losses) on relatively small price movements.

Historical Perspective and Relevance

High delta options have been a staple in the options trading arena for decades. Initially employed by seasoned traders seeking to capitalize on pronounced market trends, they gained wider recognition in the 1980s with the advent of sophisticated options pricing models.

Today, high delta options remain a pillar of advanced options trading strategies, favored by institutional investors, hedge funds, and sophisticated retail traders. Their allure lies in their ability to magnify returns in rapidly moving markets, enhancing both the profit potential and the inherent risk.

Image: haikhuu.com

In-Depth Explanation of High Delta Options

Implied Volatility and Time Decay

To fully comprehend high delta options, one must delve into the concepts of implied volatility and time decay. Implied volatility measures market expectations of future price volatility in the underlying asset. Higher implied volatility implies a wider range of potential price movements, amplifying the impact on high delta options.

Time decay, on the other hand, refers to the erosion of an option’s value over time as its expiration date approaches. The rate of time decay is particularly pronounced in high delta options, as they are more vulnerable to small changes in time remaining until expiration.

Option Greeks and Risk Management

The Greek values play a critical role in understanding and managing the risks and rewards of high delta options trading. Among them, delta, as discussed earlier, is pivotal. Gamma, another Greek value, measures the change in delta in relation to underlying asset price changes, providing insights into how the option’s sensitivity to price movements might evolve.

Theta, the time decay Greek, is crucial for high delta options due to their heightened vulnerability to time decay. Careful consideration of theta is paramount to effective risk management in this dynamic trading realm.

Current Trends and Developments in High Delta Options Trading

Market Volatility and Trading Strategies

The recent market volatility has propelled high delta options trading back into the spotlight. With the broader market experiencing larger and more frequent price swings, the potential for substantial gains (or losses) using high delta options has become more pronounced.

Traders have also adapted their strategies to leverage the elevated volatility. Some focus on short-term trades, capturing profits from rapid price movements, while others employ longer-term strategies, seeking to benefit from sustained market trends.

Technological Advancements and Data Analytics

Technological advancements have transformed the high delta options trading landscape, empowering traders with sophisticated data analytics tools. Real-time data feeds, advanced charting software, and algorithmic trading platforms have enhanced the ability to identify and execute high-probability trades, even in fast-paced and volatile markets.

The rise of big data analytics has further revolutionized the field. Traders can now analyze vast datasets, uncovering patterns and insights that would have been impossible to detect manually. This has led to the development of more refined and data-driven trading models.

Expert Tips and Advice for Successful High Delta Options Trading

Thorough Research and Trading Plan

“Knowledge is power” is a maxim that rings particularly true in high delta options trading. Before venturing into this dynamic arena, equip yourself with a comprehensive understanding of market trends, implied volatility, and option Greeks.

Additionally, craft a well-defined trading plan that outlines your risk tolerance, position sizing, and exit strategies. Adherence to a disciplined trading plan will help you make informed decisions in the heat of the market.

Risk Management and Position Sizing

“The greatest glory in living lies not in never falling, but in rising every time we fall.” This quote by Nelson Mandela underscores the significance of risk management in high delta options trading.

Always prioritize risk management, ensuring that your trades align with your risk appetite and financial goals. Determine appropriate position sizes based on your risk tolerance and the potential for both profits and losses. Never risk more than you can afford to lose.

Frequently Asked Questions (FAQs)

What is the difference between high delta options and low delta options?

High delta options exhibit delta values close to 1 or -1, indicating a strong relationship with the underlying asset’s price movements. Conversely, low delta options have delta values closer to zero, implying a weaker correlation with the underlying asset’s price.

Are high delta options more profitable than low delta options?

High delta options offer the potential for greater returns due to their amplified sensitivity to underlying asset price movements. However, this increased profit potential comes with heightened risk.

Is high delta options trading suitable for beginners?

High delta options trading is not recommended for beginners due to its inherent complexity and high risk. It is advisable to gain experience in options trading with lower delta options before venturing into high delta strategies.

Conclusion

Navigating the high delta options trading landscape requires a blend of strategic thinking, risk management, and market savvy. By delving into the nuances of high delta options, understanding the latest trends and developments, and heeding the advice of seasoned traders, you can harness the power of these potent financial instruments while mitigating associated risks.

Remember, the financial markets are ever-evolving. Continuous learning, ongoing research, and a disciplined approach are your steadfast companions in the pursuit of success in high delta options trading.

Call to Action

Embark on the journey to master high delta options trading today. Explore our curated resources, engage in discussions with industry experts, and dive deep into the dynamic world of delta one trading. Remember: knowledge empowers, and in the financial markets, the more you know, the more you grow.

High Delta Options Trading

Image: www.youtube.com

Are high delta options of interest to you?

Share your thoughts and experiences in the comments section below. Let’s ignite a vibrant discussion on the intricacies of high delta options trading.