The glittering allure of gold has captivated traders for centuries, and with the advent of futures and options contracts, the potential for lucrative gains has skyrocketed. Yet, behind the golden facade, a complex web of litigation has emerged, challenging the integrity of these financial instruments and the rights of traders. Dive into this comprehensive guide to gold futures and options trading litigation and equip yourself with the knowledge to navigate this intricate domain.

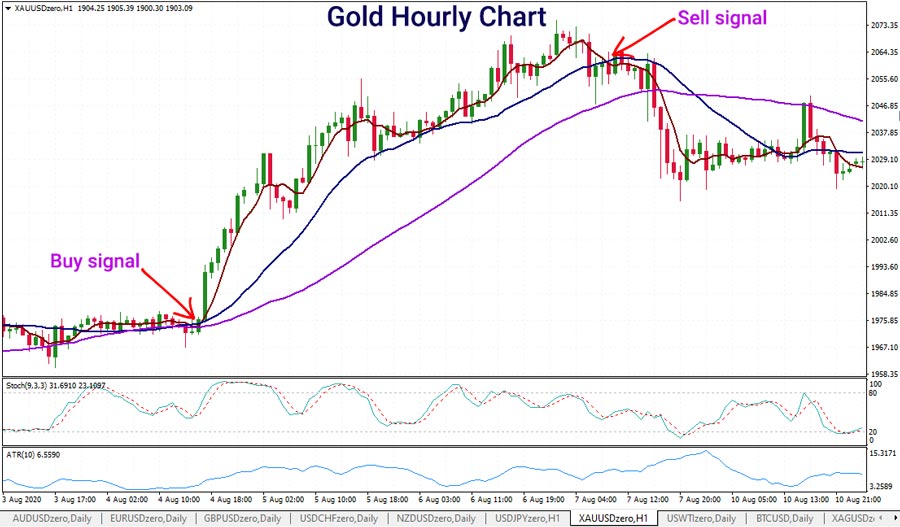

Image: www.investing.com

Unveiling the Complexities of Gold Futures and Options

Gold futures contracts are agreements to buy or sell a specified quantity of gold at a predetermined price on a future date. Options contracts grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) gold at a set price within a specific timeframe. These instruments offer traders the flexibility to hedge against price fluctuations, speculate on price movements, and leverage their capital for potentially significant gains.

Litigation Landscape: A Minefield of Legal Battles

The gold futures and options market is a battlefield of legal disputes, with cases involving allegations of price manipulation, fraud, and regulatory breaches. Some of the most notable instances include:

-

JPMorgan Chase Manipulation Case: The financial giant was accused of manipulating silver and gold futures markets through coordinated trading practices.

-

Barrick Gold Hedging Class Action Lawsuit: Shareholders brought a lawsuit against Barrick Gold, alleging the company misled investors about its gold hedging practices.

-

CFTC Fines CME Group: The Commodity Futures Trading Commission (CFTC) imposed a hefty fine on CME Group for failing to adequately supervise its gold and silver markets.

Navigating the Legal Labyrinth: Expert Insights and Practical Tips

To protect your interests in gold futures and options trading, heed the wisdom of seasoned experts:

-

Attorney Howard Schonfeld: “It’s crucial to have a clear understanding of the nature of these contracts and the risks involved before initiating any trading activity.”

-

Financial Analyst Rebecca Chen: “Due diligence is paramount. Research thoroughly, consult with financial professionals, and only trade with reputable brokers.”

-

Trader John Smith: “Stay informed about market news and regulatory changes. A lack of awareness can lead to costly mistakes.”

Image: www.ino.com

Empowering Traders: Towards a Fair and Transparent Market

Gold futures and options trading litigation has brought to light systemic issues within the market. However, it also presents opportunities for regulatory reforms and industry self-governance. By staying informed, actively participating in the legal process, and demanding transparency, traders can help create a more equitable and transparent marketplace.

Gold Futures And Options Trading Litigation

Image: news.tradingcup.com

Conclusion: Unlock the Golden Opportunity with Confidence

Gold futures and options trading can be a lucrative endeavor, but it’s imperative to navigate the legal complexities with caution. By understanding the key concepts, seeking expert guidance, and adhering to ethical practices, traders can unlock the golden opportunity while protecting their rights and interests. Knowledge is the true currency in the world of gold futures and options trading; equip yourself today to conquer this mesmerizing and challenging realm of finance.