**A Developer’s Guide to Derisking Investments**

Investing in stocks can be a lucrative endeavor, but it also comes with inherent risks. As a developer, you may want to delve into options trading to enhance your investment strategy and potentially mitigate some of these risks.

Image: whumsc.wiki

Options trading involves buying or selling options contracts, which grant you the right (but not the obligation) to buy or sell an underlying asset at a specific price on or before a certain date. Options provide flexibility and can be used for various strategies, including hedging, income generation, and speculation.

**Platform Options**

Github, the popular code repository, offers a wide range of options for trading. It provides access to several brokers that specialize in options trading, allowing you to compare and select one that aligns with your needs and investment style.

Some Github-integrated brokers include:

- TradeStation: Provides an intuitive platform for both beginner and experienced traders.

- Tastyworks: Known for its low commissions and user-friendly interface.

- Interactive Brokers: Offers a comprehensive suite of trading tools and extensive market data.

**Understanding Options Basics**

Before diving into options trading, it’s crucial to grasp the fundamental concepts.

**Types of contracts:** There are two primary types of options contracts: calls (right to buy) and puts (right to sell). Each option contract has a specific strike price, expiration date, and premium.

**Premium: The price you pay to purchase an option contract. Premiums are influenced by factors such as the underlying asset’s price, volatility, and time to expiration.

**Options Strategies**

Options trading offers a wide array of strategies, each with unique risk and reward characteristics. Some common strategies include:

**Covered calls:** Selling a call option on an underlying asset you own. Generates income while potentially limiting upside potential.

**Protective puts:** Buying a put option on an underlying asset you own. Hedges against downside risk but may be expensive.

**Iron condor:** Selling both a call and a put option with different strike prices on the same underlying asset. Seeks to profit from a range of moderate price movements.

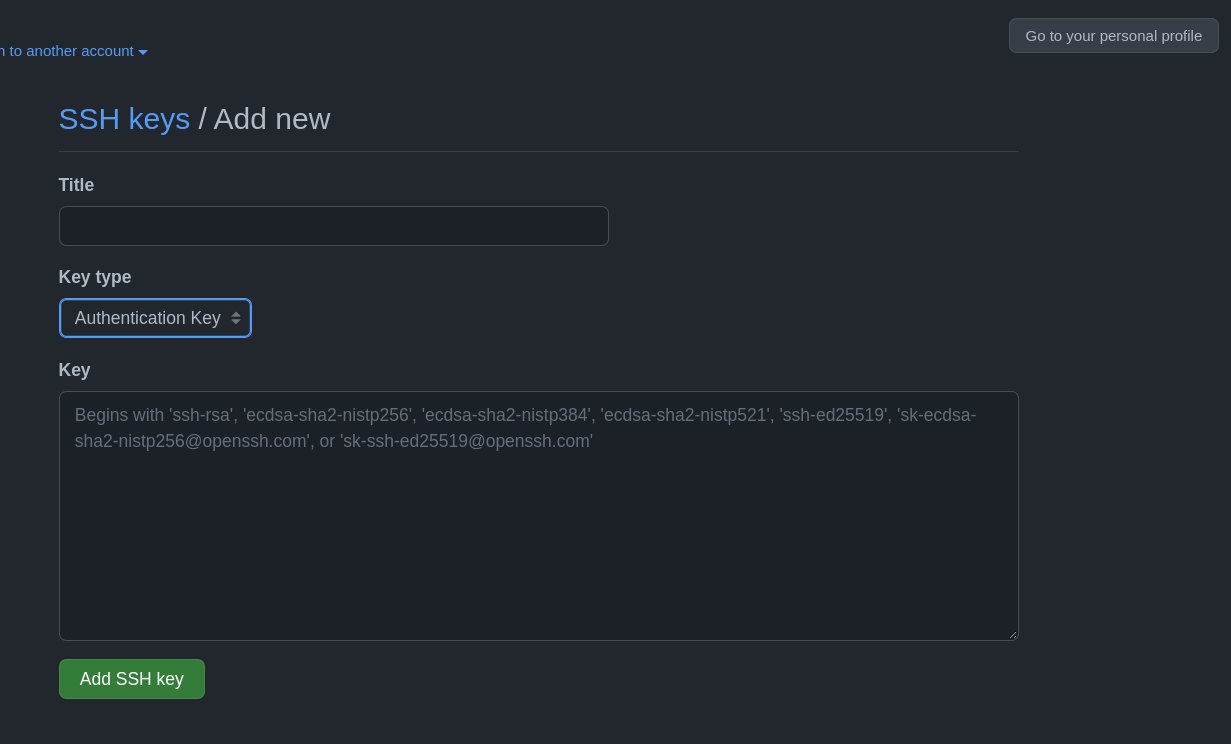

Image: github.com

**Tips and Expert Advice**

To enhance your options trading experience, consider the following tips and expert insights.

- Start cautiously:** Begin with small investments and gradually increase your exposure as you gain experience.

- Use stop-loss orders:** Set predetermined limits to minimize losses if the market moves against your position.

- Don’t bet against the trend:** Identify market trends and trade in alignment with them.

Github Options Trading

Image: gh-stats-gen.vercel.app

**Conclusion**

Github options trading provides a valuable tool for developers to enhance their investment strategies. Understanding the basics, selecting a suitable broker, and adopting risk management techniques are crucial. Whether you’re looking to generate income, hedge risks, or speculate on price movements, options trading on Github can help you navigate the complex world of investing more effectively.

Are you interested in further exploring the world of Github options trading? Let us know in the comments below!