Investing in financial markets can be a lucrative endeavor, but it also requires a deep understanding of the various trading instruments and strategies available. Futures and options are two important derivatives that enable traders to manage risk, speculate on price movements, and hedge against potential losses. In this article, we will delve into the intricacies of a futures and options trading system, exploring its key concepts, applications, and benefits.

Image: www.slideserve.com

What are Futures and Options?

Futures and options are financial contracts that derive their value from an underlying asset, such as a stock, commodity, currency, or index. A futures contract obligates the buyer to purchase (in the case of a long position) or sell (in the case of a short position) a specific quantity of the underlying asset at a predetermined price on a specified future date. In contrast, an options contract gives the buyer the right (but not the obligation) to buy (in the case of a call option) or sell (in the case of a put option) the underlying asset at a certain price, known as the strike price, within a predetermined period.

Importance of a Futures and Options Trading System

A well-structured futures and options trading system is crucial for several reasons. It provides traders with a platform to:

- Manage risk: Futures and options allow traders to mitigate risk by hedging against adverse price movements. For instance, a farmer may use futures contracts to lock in a price for their upcoming harvest, protecting against potential declines in agricultural commodity prices.

- Speculate on price movements: Futures and options can also be used to speculate on future price changes. Traders can take long or short positions based on their expectations of the underlying asset’s price trajectory.

- Pursue arbitrage opportunities: Futures and options prices are often influenced by various factors, creating opportunities for traders to capitalize on price discrepancies across different markets.

- Diversify portfolios: Investing in futures and options can help traders diversify their portfolios, reducing overall risk exposure.

How a Futures and Options Trading System Works

A futures and options trading system typically involves the following steps:

- Choosing a broker: Traders need to select a reputable broker that offers futures and options trading services, provides a suitable trading platform, and charges reasonable fees.

- Opening an account: Traders must open an account with the broker, providing necessary information and funding the account with sufficient capital.

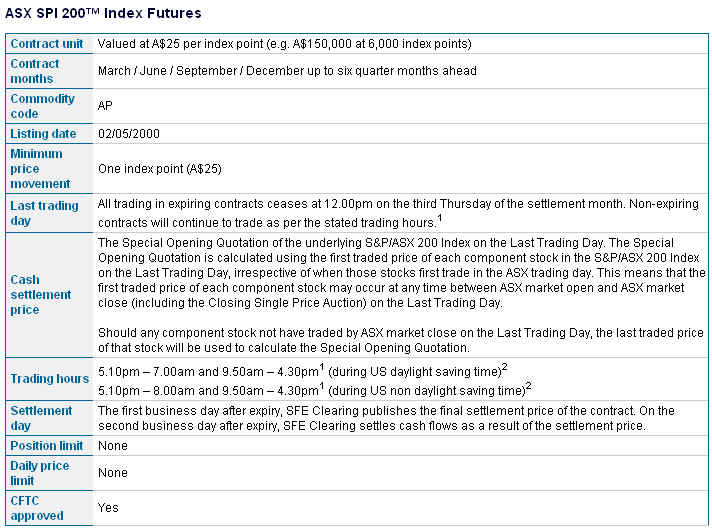

- Understanding contract specifications: Prior to trading, it is essential to understand the contract specifications for the futures or options being considered, including trading hours, contract size, and margin requirements.

- Trading: Traders can place buy or sell orders for futures or options contracts through the provided trading platform. Orders can be executed at the current market price or at a specific price (limit order).

- Monitoring positions: Traders should actively monitor their open positions, tracking price movements and adjusting their trading strategies accordingly.

- Settlement: Futures contracts are physically settled on the specified expiration date, involving the delivery or acceptance of the underlying asset. Options contracts have two main methods of settlement: exercise (taking ownership of the underlying asset) or cash settlement (paying or receiving the difference between the strike price and the underlying asset’s price).

Image: learn.financestrategists.com

Futures And Options Trading System Ppt

Image: pyqudow.web.fc2.com

Conclusion

A futures and options trading system is an essential tool for traders seeking to manage risk, speculate on price movements, and enhance their investment strategies. By understanding the concepts, applications, and inner workings of futures and options, traders can unlock the potential of these markets while mitigating potential risks. However, it is important to note that futures and options trading involves significant financial risk and should only be undertaken by knowledgeable and experienced individuals who have carefully considered their investment goals and risk tolerance.