Trading options is a thrilling yet complex undertaking that requires a solid understanding of the financial markets. The thought of risking hard-earned cash can be daunting, especially for beginners. Enter free trial options trading, the ultimate risk-free sanctuary for budding traders. In this comprehensive guide, we’ll delve into the world of free trial options trading, empowering you with the knowledge and strategies to navigate the markets like a seasoned pro.

Image: www.angelone.in

Free Trial Options Trading: Gateway to Market Mastery

Free trial options trading platforms offer a simulated trading environment, mirroring the dynamics of real-world markets. As a trader, you can place trades without putting any actual money on the line. This incredible opportunity allows you to hone your trading skills, strategize, and gain invaluable experience without incurring the potential risks associated with live trading.

Key Benefits of Free Trial Options Trading

- Risk-free learning environment for novice traders

- Real-time market simulation, mirroring real-world dynamics

- Opportunity to test trading strategies and refine techniques

- Invaluable experience in market analysis, position management, and risk control

- Transition to live trading with increased confidence and preparedness

With its myriad benefits, it’s no wonder that free trial options trading has become the launchpad for aspiring traders. It empowers you to develop a solid foundation, equipping you with the skillset to navigate the complexities of financial markets with confidence.

Mastering the Basics of Options Trading

Before delving into the intricacies of options trading, let’s establish a clear understanding of the basics. Options contracts grant you the right, but not the obligation, to buy or sell an underlying asset (e.g., a stock) at a predetermined price (strike price) before a specific date (expiration date). Options come in two primary flavors: calls and puts.

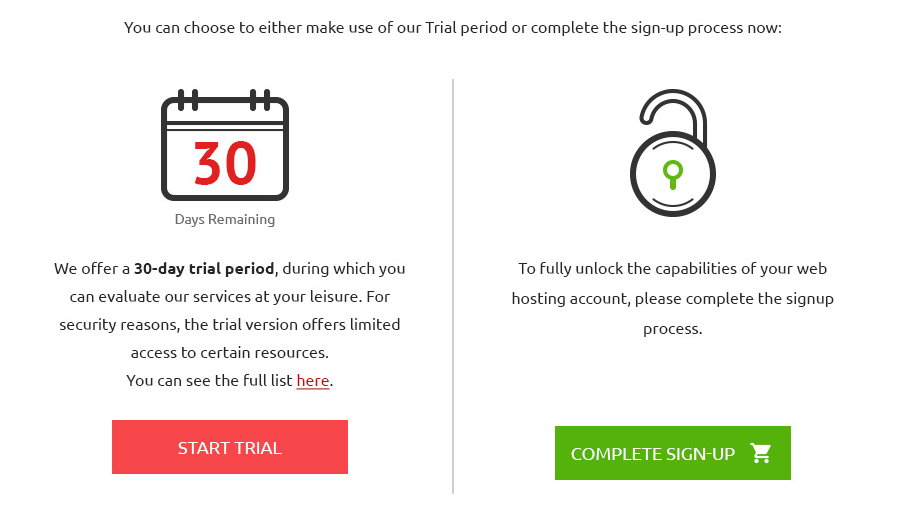

Image: blog.resellerspanel.com

Calls vs. Puts: A Blueprint for Profiting from Market Movements

Calls confer the right to buy an underlying asset. When market sentiment is bullish (positive), traders anticipate price appreciation. By buying calls, they can potentially profit from this anticipated increase in asset value. Puts, on the other hand, grant the right to sell an underlying asset. When market sentiment is bearish (negative), traders use puts to potentially benefit from asset price declines.

Navigating the Dynamics of Options Pricing

Understanding options pricing is crucial for successful trading. Factors influencing option premiums include:

- Underlying Asset Price: Higher underlying asset prices generally translate to higher option premiums.

- Time to Expiration: Options with longer expirations tend to be more expensive than near-term contracts.

- Volatility: Market volatility has a direct impact on option prices, with higher volatility leading to higher premiums.

- Interest Rates: Changes in interest rates can influence options pricing, particularly long-term options.

By analyzing these factors and studying historical market patterns, you can develop a robust understanding of options pricing and make more informed trading decisions.

Tips and Expert Advice for Free Trial Options Trading Success

Now that you have a solid understanding of free trial options trading fundamentals, let’s explore expert advice and proven strategies to maximize your chances of success:

Start Small, Trade Consistently

Begin with small position sizes to minimize potential losses even in a simulated environment. Regular trading, albeit in small increments, helps you refine your skills and build a consistent trading rhythm.

Analyze Market Trends, Set Realistic Goals

Study market trends, analyze news and economic data to make sound trading decisions. Set realistic profit targets; don’t chase unrealistic returns and protect your profits by setting intelligent stop-loss orders.

Learn from Both Wins and Losses

Embrace every trade as a learning opportunity. Analyze both winning and losing trades to identify your strengths and areas for improvement. Never stop learning, actively seek new knowledge, and enhance your trading strategies.

FAQs on Free Trial Options Trading

Q: Can I make real money with free trial options trading?

A: No, free trial options trading platforms use virtual currency. The purpose is to provide a risk-free learning environment, not to generate real profits.

Q: How long should I use a free trial before switching to live trading?

A: This depends on your individual progress and comfort level. Some traders may transition after a few weeks, while others may prefer to continue practicing for longer.

Q: What are the key factors to consider when choosing a free trial options trading platform?

A: Look for platforms that offer realistic market simulations, a wide range of underlying assets, and user-friendly interfaces. Also, consider platform reliability and security features.

Free Trial Options Trading

Image: directvortex.gr

Conclusion: Launch Your Trading Journey with Confidence

Free trial options trading is an invaluable tool for aspiring traders. By embracing this risk-free environment, you can acquire the knowledge, skills, and confidence to navigate live markets with poise and precision. Remember, success in trading requires patience, discipline, and a commitment to continuous learning. Utilize the tips and strategies outlined in this guide, and you’ll be well-equipped to unlock the potential of options trading and achieve your financial goals.

Are you ready to embark on your free trial options trading journey? Leave your questions and comments below, and let’s unlock the world of financial markets together.