Unlocking the Secrets of High-Profit Potential

In the ever-evolving world of finance, options trading has emerged as a potent strategy to amplify returns and navigate market volatility. Options, versatile financial instruments, grant traders the right to buy or sell an underlying asset at a predefined price within a specific time frame. Mastering options trading requires a discerning eye for identifying stocks with optimal characteristics that enhance trading strategies. This comprehensive guide unveils the secrets to selecting the best stocks for options trading in 2018, empowering you to harness the full potential of these market gems.

Image: ijunkie.com

The Fragile Dance: Understanding Options Trading

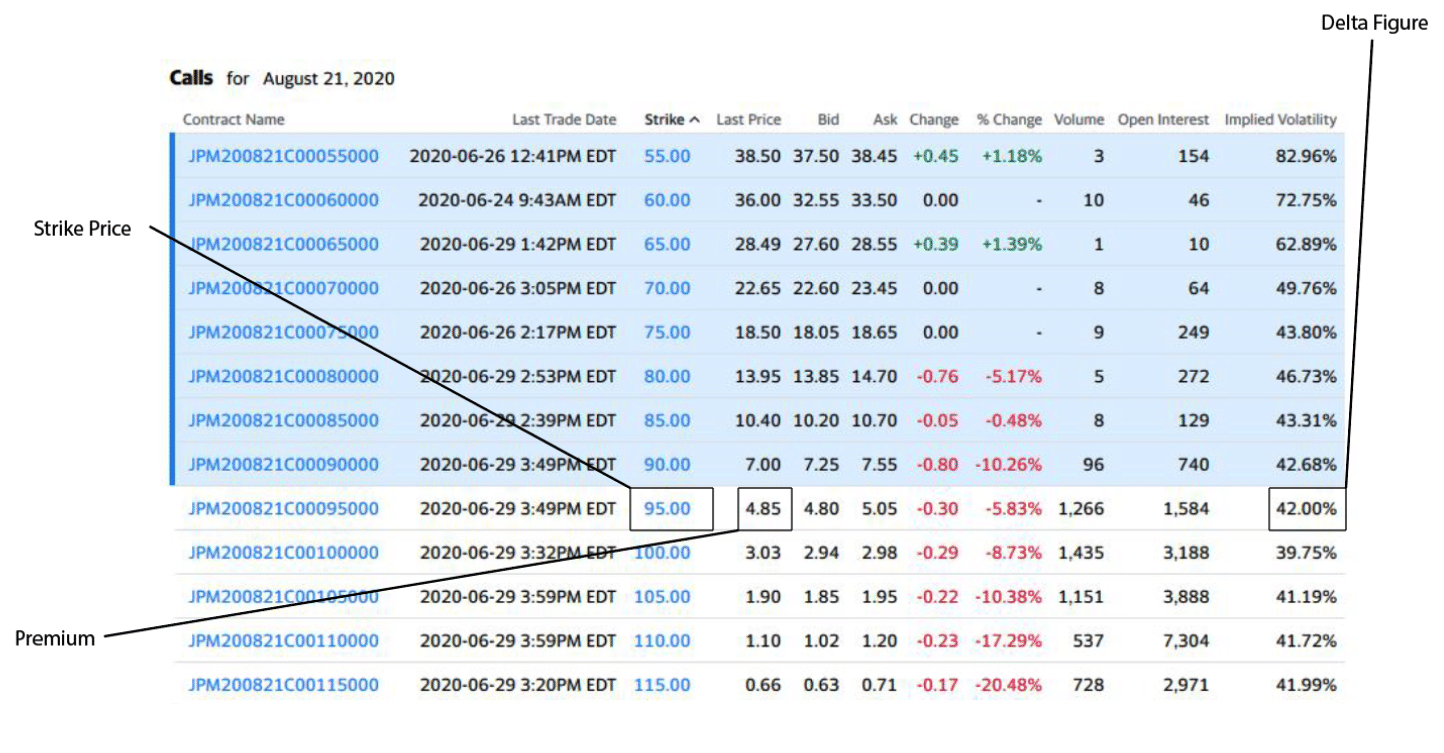

Options, unlike stocks, represent contracts that convey the right, but not the obligation, to buy or sell an underlying asset at a strike price on or before an expiration date. Traders negotiate these contracts on specialized exchanges, where buyers pay a premium to sellers in exchange for this contractual privilege. The flexibility of options allows traders to speculate on price movements, hedge against risk, or generate income through premium collection.

Discerning the Best Stocks for Options Trading

Selecting the right stocks for options trading is paramount for maximizing profitability. Consider the following criteria to refine your search:

- High Implied Volatility: Options with higher implied volatility, a measure of expected price fluctuations, offer greater potential for significant gains, as they embed a substantial component of option premium.

- Liquidity: Opt for stocks with high trading volume, as ample liquidity ensures ease of entry and exit from positions, preventing slippage and unexpected losses.

- Earnings Volatility: Companies prone to significant earnings fluctuations present opportunities for profiting from price swings induced by earnings announcements, which often lead to sharp stock price movements.

- Sector Exposure: Diversify your portfolio across sectors and industries to mitigate sector-specific risks and enhance overall return potential.

- Corporate Events: Monitor stocks with upcoming corporate events, such as mergers, acquisitions, or dividend announcements, as these events can trigger market reactions that can be leveraged through options trading.

Identifying the Stock Trading Champions of 2018

Armed with the criteria above, you can embark on selecting the best stocks for options trading in 2018. Here are some promising candidates:

Technology Sector:

- Amazon (AMZN): Technology leviathan with consistent earnings growth, high liquidity, and increasing implied volatility.

- Apple (AAPL): Premium smartphone and device maker with a loyal customer base, substantial earnings, and comparatively low implied volatility.

Financial Sector:

- JPMorgan Chase (JPM): Financial titan with a large balance sheet, steady dividend, and heightened implied volatility for its options.

- Goldman Sachs (GS): Investment banking powerhouse with global reach, solid earnings, and moderate implied volatility, ideal for income-oriented strategies.

Consumer Discretionary Sector:

- Starbucks (SBUX): Coffeehouse giant with a robust global presence, reliable earnings, and options with ample liquidity.

- Nike (NKE): Sportswear and athleisure behemoth with high consumer demand, consistent earnings, and moderate implied volatility.

Image: club.ino.com

Expert Insights: Embracing Actionable Strategies

To maximize your success in options trading, heed the advice of experienced professionals:

1. Establish Risk Management Strategies: Allocate only a small portion of your portfolio to options trading to limit potential losses and preserve capital.

2. Utilize Technical Analysis: Study stock charts and price patterns to identify trading opportunities, confirm trend direction, and gauge support and resistance levels.

3. Diversify Your Trades: Spread risk by trading options on multiple underlying assets to mitigate the impact of any single stock’s adverse performance.

4. Stay Updated on Market News: Keep abreast of global news, economic reports, and corporate announcements, as external events can influence stock prices and options premiums.

5. Seek Professional Guidance: Consider seeking advice from a financial advisor who can provide personalized guidance based on your individual financial goals and risk tolerance.

Best Stocks For Options Trading 2018

Conclusion

Options trading presents a lucrative opportunity to amplify returns and mitigate downside risks. By carefully selecting stocks with optimal characteristics and implementing sound trading strategies, you can unveil the hidden gems of the market and unleash the full potential of options trading in 2018. Remember, knowledge, discipline, and a judicious approach are the cornerstones of successful options trading. May this guide inspire you towards financial triumphs and empower you to navigate the market with confidence and finesse.