In the realm of finance, options trading presents both opportunities and challenges. Navigating this complex landscape requires a deep understanding of the underlying strategies, risk factors, and practical application. For aspiring traders, stepping directly into the live market can be daunting, exposing them to significant financial risk. Enter the free options trading training simulator – a virtual playground that provides a safe and effective avenue to master this art.

Image: www.pasitechnologies.com

Delving into the Essence of Options Trading

Options, financial contracts derived from an underlying asset (e.g., stocks, commodities, currencies), offer investors versatile trading strategies. Unlike futures, options grant the holder the right but not the obligation to buy (in the case of calls) or sell (in the case of puts) the underlying asset at a specific price (strike price) on or before a particular date (expiration date). This flexibility allows traders to tailor their options strategies to specific market outlooks and risk tolerances.

The Virtues of a Free Options Trading Training Simulator

Embracing a free options trading training simulator offers a myriad of benefits for aspiring traders:

-

Risk-free environment: Simulators remove the financial risk associated with live trading, enabling traders to experiment with different strategies, learn from their mistakes, and refine their skills without fear of losing capital.

-

Hands-on experience: Simulators provide a hands-on learning experience that mimics the real-world trading environment, allowing traders to test their strategies in a realistic setting without the consequences of actual trading.

-

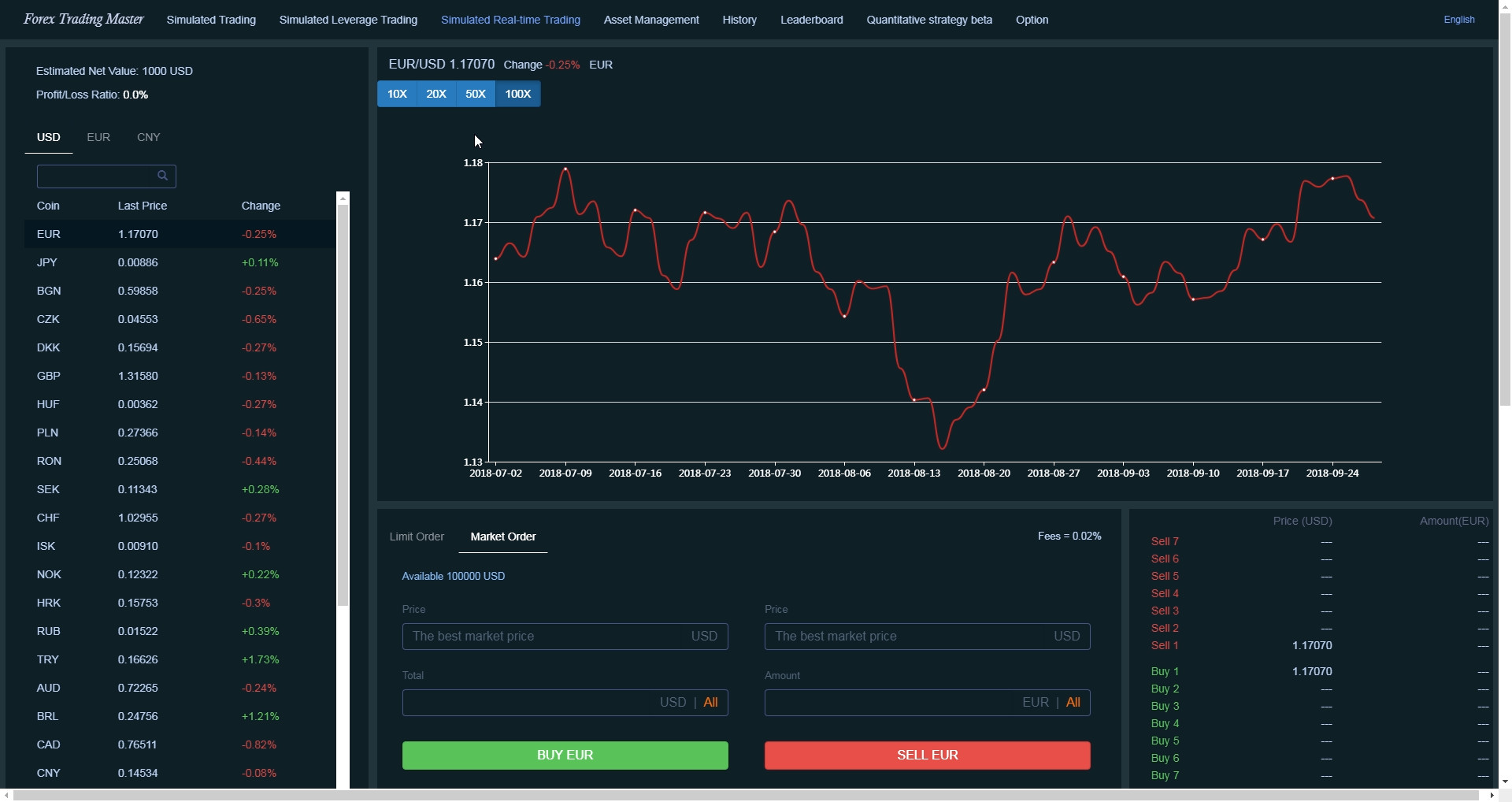

Real-time market data: Many simulators incorporate real-time market data, exposing traders to the dynamic nature of the financial markets and the impact of news and events on option prices.

-

Educational resources: Some simulators offer supplemental educational resources such as tutorials, webinars, and articles, enhancing the learning experience and promoting a deeper understanding of options trading concepts.

-

Convenience and accessibility: Simulators are readily available online, offering the convenience and flexibility to practice trading anytime, anywhere with an internet connection.

Image: www.warriortrading.com

Navigating the Options Trading Simulator Landscape

Selecting the most suitable free options trading training simulator hinges on individual preferences and learning styles. Reputable brokers and financial institutions offer their own simulators, each catering to specific needs:

-

TD Ameritrade’s thinkorswim: A comprehensive simulator with robust charting tools, advanced order types, and a vast library of educational content.

-

Interactive Brokers’ Trader Workstation: A powerful platform tailored for experienced traders, boasting real-time data, advanced charting capabilities, and the ability to trade multiple asset classes.

-

OANDA’s fxTrade Practice Account: A simulator primarily designed for forex trading, but also incorporates options on currencies.

-

Tastyworks’ paperMoney: A feature-rich simulator with realistic market conditions, backtesting capabilities, and a user-friendly interface.

-

The Options Industry Council’s OptionsPlay: A simplified simulator focused on educating beginners about options trading basics.

Empowering Traders with Strategic Knowledge

Before delving into the free options trading training simulator, it’s vital to arm oneself with fundamental knowledge:

-

Option terminology: Comprehend basic option terminology such as call, put, strike price, expiration date, premium, and intrinsic value.

-

Underlying assets: Familiarize yourself with the underlying assets options are based on, their characteristics, and market behavior.

-

Option pricing models: Understand the concepts of option pricing models such as the Black-Scholes model, which determine the theoretical value of options based on factors like volatility, interest rates, and time to expiration.

-

Trading strategies: Explore various options trading strategies, including covered calls, cash-secured puts, vertical spreads, and butterfly spreads, each with distinct risk and reward profiles.

-

Risk management: Develop a thorough understanding of risk management techniques, such as position sizing, stop-loss orders, and hedging strategies, to minimize potential losses.

Free Options Trading Training Simulator

Image: store.steampowered.com

Conclusion: Unleashing Your Trading Potential

Free options trading training simulators provide an invaluable platform for aspiring traders to hone their skills, gain confidence, and prepare for the intricacies of live trading without risking capital. By embracing the learning opportunities and strategic knowledge outlined in this article, you can embark on the path to becoming a successful options trader, equipped with the skills to navigate market complexities and maximize profit potential.