Trading foreign options can be an exciting and rewarding endeavor, yet it’s crucial to grasp the complexities involved before delving into this realm. This comprehensive guide will equip you with a detailed understanding of foreign option customers trading, its intricacies, latest trends, and expert insights to empower your decision-making.

Image: s3.amazonaws.com

Foreign option customers trading entails engaging in options trading activities in markets external to one’s home country. This cross-border trading offers potential benefits, such as diversifying portfolios, hedging risks, and accessing foreign investment opportunities. However, it also presents challenges, including currency risks, regulatory differences, and cultural nuances.

Delving into Option Contracts

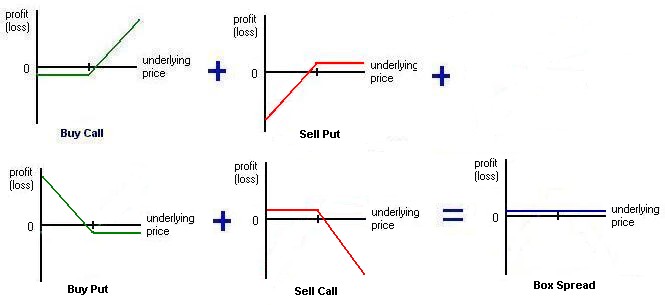

An option contract grants the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) before a specific date (expiration date). Options offer a valuable opportunity to manage risk and profit from market fluctuations while affording the flexibility to exercise the option or not.

The value of an option contract is influenced by various factors, including the underlying asset’s price, volatility, time to expiration, and interest rates. These elements play pivotal roles in determining the premium, which is the cost paid to acquire the option.

Navigating Foreign Market Dynamics

Venturing into foreign option trading requires careful consideration of the regulatory frameworks and cultural differences that may impact trading activities. Regulations governing options trading can vary across countries, particularly regarding the types of options available, margin requirements, and reporting obligations.

Además, cultural nuances can influence aspects such as communication styles, negotiation approaches, and risk appetite. By understanding and respectfully adapting to these cultural differences, foreign option traders can foster positive relationships with counterparts and increase their chances of success.

The article explains the complexities of foreign option customers trading, including the definition, history, and meaning of foreign option customers trading. Dive deep into the article to gain a comprehensive overview.

Charting the Course: Essential Tips

Embarking on foreign option trading requires both knowledge and prudence. Here are some essential tips to guide your journey:

- Research Extensively: Thoroughly investigate the foreign markets you intend to trade in, including regulations, tax implications, and cultural practices.

- Consult Experts: Engage with brokers, financial advisors, and legal professionals to gain valuable insights and ensure compliance.

- Manage Risks Prudently: Understand the potential risks involved, such as currency fluctuations, political instability, and liquidity constraints. Implement suitable risk management strategies to mitigate these risks.

These tips, coupled with thorough research and sound decision-making, will empower you to confidently navigate the complexities of foreign option customers trading.

Image: www.angelone.in

FAQs on Foreign Option Customers Trading

To further clarify the intricacies of foreign option customers trading, let’s address some frequently asked questions:

Q: What are the advantages of foreign option customers trading?

A: It offers portfolio diversification, risk hedging, and access to global investment opportunities.

Q: What are the challenges to consider?

A: Currency risks, regulatory differences, and cultural nuances require careful attention.

Q: How can I mitigate risks?

A: Research extensively, implement risk management strategies, and consult with experts.

Forign Option Customers Trading

Image: www.wionews.com

Conclusion

Foreign option customers trading presents opportunities and challenges, demanding a thorough understanding of the complexities involved. By embracing the knowledge outlined in this article, aspiring traders can navigate the global marketplace with confidence. So, are you ready to explore the dynamic world of foreign option trading?