Options trading, a sophisticated yet lucrative financial strategy, offers tremendous opportunities for investors seeking to capitalize on market fluctuations. While options trading can be challenging, it’s particularly well-suited for seasoned investors looking to navigate the stock market’s complexities. This article delves into the intricacies of options trading for 100 shares, empowering you with the knowledge and insights to make informed decisions and enhance your investment returns.

Image: www.qarya.org

What is Options Trading?

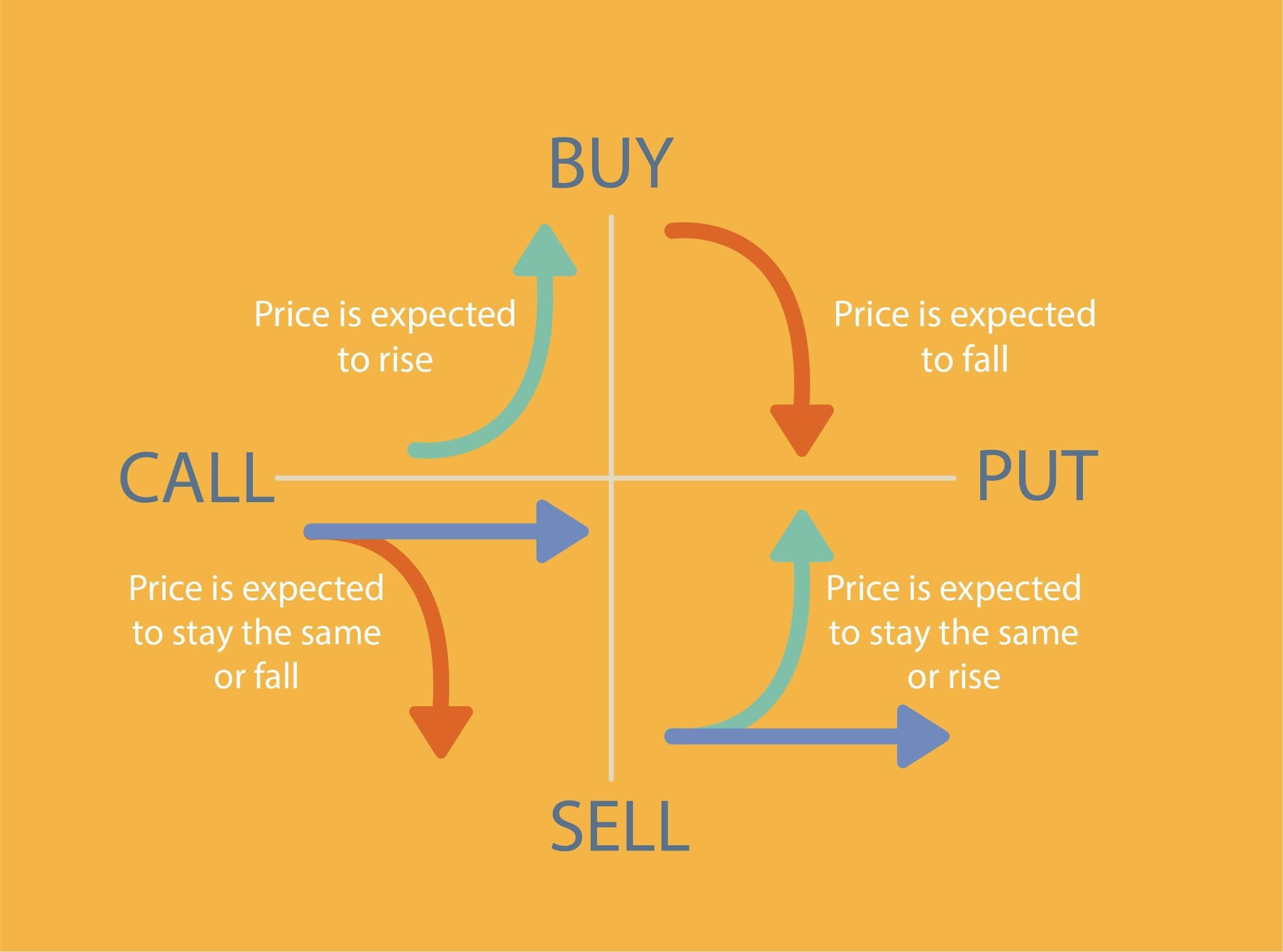

In the realm of financial markets, options trading involves contracts that grant the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) before a predetermined expiration date. Options provide leverage, allowing investors to potentially make substantial gains with limited capital outlay.

Understanding Call and Put Options:

-

Call Option: A call option grants the holder the right to buy the underlying asset at the strike price on or before the expiration date. If the asset’s price rises above the strike price, the call option becomes valuable.

-

Put Option: Conversely, a put option grants the holder the right to sell the underlying asset at the strike price on or before the expiration date. When the asset’s price falls below the strike price, the put option holds value.

Why Trade Options on 100 Shares?

Trading options on 100 shares offers unique advantages compared to larger or smaller volumes.

-

Accessibility: Buying or selling 100 shares is more accessible for investors with smaller capital, enabling them to diversify their portfolios without significant financial outlay.

-

Lower Costs: Options premiums (the price paid for an option) tend to be lower for smaller volumes like 100 shares, minimizing upfront investment while providing potential exposure to significant returns.

-

Flexibility: Trading options on 100 shares allows greater flexibility in managing risk and adjusting positions as market conditions change. It facilitates easier hedging strategies for protecting investments.

Steps for Options Trading for 100 Shares

Embarking on options trading for 100 shares requires a systematic approach:

-

Objective Definition: Clearly define your investment objectives and risk tolerance. This will guide your choice of options strategy and the underlying asset you trade.

-

Market Research: Conduct thorough research on the underlying asset, its market trends, and historical price movements. Understanding the factors influencing the asset’s price will enhance decision-making.

-

Option Selection: Carefully select the appropriate option type (call or put), strike price, and expiration date based on your market outlook and risk appetite. Choose options with sufficient time value to allow for market movement.

-

Risk Management: Options trading carries inherent risks, so implement sound risk management strategies. Set clear entry and exit points, and consider using stop-loss orders to limit potential losses.

-

Monitoring and Adjustment: Monitor your options positions regularly and make adjustments as needed, considering market fluctuations and changes in your objectives. Timely adjustments can maximize profitability and minimize losses.

Image: wallpaperide24107.blogspot.com

Advanced Strategies for Options Trading

For experienced traders, advanced options strategies offer greater sophistication and potential returns:

-

Covered Call: Involves selling a call option against a stock you own, generating additional income from the option premium while capping potential upside gains.

-

Protective Put: Provides downside protection for your stock portfolio by purchasing a put option at a lower strike price. It limits losses if the market falls below a certain level.

-

Straddle: Involves simultaneously buying both a call and a put option at the same strike price, profiting from significant market movements in either direction. However, it requires higher initial investment and carries greater risks.

For Options Trading 100 Shares

Image: howtohacks53.blogspot.com

Conclusion

Options trading for 100 shares offers immense potential for investors seeking enhanced收益. With careful research, sound strategies, and effective risk management, it’s possible to capitalize on market movements and grow your investments significantly. Remember, options trading involves risks, so always trade within your risk tolerance and seek professional guidance if needed. Embrace the challenge, explore the options market, and unlock its wealth-building opportunities for yourself.