Introduction

In today’s complex and competitive financial markets, traders of all levels are seeking innovative platforms that can simplify their operations while minimizing costs. Flat fee options trading platforms have emerged as a game-changer, offering traders a cost-effective and transparent approach to options trading.

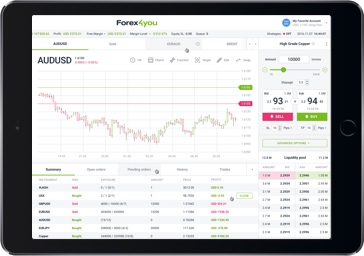

Image: www.forex4you.com

Flat fee options platforms break away from the traditional commission-based pricing model, charging traders a fixed fee per trade regardless of the size or complexity of the transaction. This streamlined approach empowers traders to execute more trades without being burdened by excessive fees, which can eat into their profits.

The advantages of utilizing flat fee options trading platforms are numerous:

- Reduced Trading Costs: Flat fee options platforms significantly reduce trading costs for traders, as the fixed fee structure eliminates the uncertainty and unpredictability associated with commission-based pricing. Traders can accurately plan their trades and make informed decisions without worrying about hidden fees or markups.

- Level Playing Field: Flat fee options trading platforms create a fair and level playing field for traders of all levels. Unlike traditional platforms that favor high-volume traders, flat fee platforms incentivize traders to focus on profitability rather than trade volume.

- Transparency and Simplicity: Flat fee options trading platforms offer transparency and simplicity, making it easy for traders to understand their costs upfront. The fixed fee structure eliminates complex pricing models, fostering trust and credibility between the trader and the platform.

- Access to Advanced Tools and Features: While some may assume that flat fee platforms compromise on features to maintain low prices, this is not the case. Many flat fee options trading platforms provide advanced tools and features, including real-time charting, technical analysis, and risk management tools.

- Increased Trading Frequency: The reduced trading costs associated with flat fee options trading platforms encourage traders to execute more trades. By eliminating the fear of high commissions, traders can confidently explore new trading opportunities and implement diversified strategies.

The flat fee options trading landscape is constantly evolving, with platforms embracing innovation and expanding their offerings:

- Multi-Asset Trading: Flat fee options trading platforms are expanding their capabilities to support multi-asset trading. This allows traders to trade various asset classes under a single platform, eliminating the need to juggle multiple accounts.

- Artificial Intelligence and Machine Learning: Flat fee options trading platforms are leveraging artificial intelligence (AI) and machine learning (ML) to enhance their platforms. By leveraging data analytics, these platforms can offer personalized trading insights, risk management tools, and trade execution algorithms.

- Increased Accessibility: Flat fee options trading is becoming more accessible to both novice and experienced traders. With the emergence of user-friendly platforms and comprehensive educational resources, traders of all levels can benefit from the advantages of flat fee pricing.

Choosing the most suitable flat fee options trading platform is paramount. By taking the following factors into consideration, you can make an informed decision:

- Comprehensive Research: Conduct thorough research to identify platforms that align with your trading strategies and requirements. Evaluate the fee structure, available trading tools, available markets, and customer support reputation.

- Platform Usability: Explore user reviews and investment blogs to assess the usability of potential trading platforms. Look for platforms with intuitive interfaces, clear documentation, and responsive customer support.

- Supported Assets and Markets: Ensure that the platform supports the asset classes and markets you are interested in trading. Verify that the platform provides the necessary options strategies and trade types to meet your goals.

- Security and Regulation: Assess the security measures and regulatory compliance of different platforms. Look for platforms with robust encryption, independent audits, and adherence to industry standards to ensure the safety of your funds and data.

Image: www.youtube.com

Here are some frequently asked questions regarding flat fee options trading:

- What is the typical fee structure for flat fee options trading platforms?

Typically, flat fee options trading platforms charge a fixed fee per trade, ranging from $0.50 to $1.00 per contract. - Are there any limitations or restrictions associated with flat fee options trading platforms?

Some platforms may impose restrictions on trade volume, contract size, or trading hours. It is important to review the specific terms and conditions of each platform before signing up. - Do flat fee options trading platforms offer educational resources or customer support?

Yes, many flat fee options trading platforms provide educational resources, including webinars, tutorials, and trading guides. They also offer customer support to assist with technical and trading-related queries.

Flat Fee Options Trading Plaform

Image: trueforexfunds.com

Flat fee options trading platforms represent a transformative force in the financial markets, empowering traders with reduced costs, increased transparency, and access to sophisticated trading tools. By embracing the benefits outlined in this article, you can elevate your trading strategy and unlock the full potential of flat fee options trading. So, are you ready to explore the world of flat fee options trading and take your trading journey to new heights?