Investing in options can be an exciting way to grow your portfolio, but it’s essential to understand the risks involved. Fidelity Investments offers various option trading levels to suit investors of all experience levels. In this blog, we’ll guide you through each level, providing detailed information and expert advice to help you make informed decisions about your options trading.

Image: zeyeponohey.web.fc2.com

Fidelity’s option trading levels are designed to meet the needs of different investors, from beginners to experienced traders. The four main levels are Level 1, Level 2, Level 3, and Level 4, with each level requiring a minimum account balance and experience level. To determine the appropriate level for your needs, consider your investment goals, risk tolerance, and trading knowledge.

Understanding Fidelity’s Option Trading Levels

Level 1: Getting Started

Level 1 is suitable for beginners who are new to options trading. It offers limited trading options, focusing on basic strategies such as buying and selling options by opening and closing positions.

Level 2: Expanding Your Knowledge

Once you gain some experience with Level 1, you can advance to Level 2. This level gives you access to more advanced strategies, including covered calls, cash-secured puts, and spreads. Additionally, you’ll have the ability to trade in different option types, such as American and European options.

Image: bullishbears.com

Level 3: Exploring Advanced Strategies

Level 3 is designed for experienced traders who are comfortable with the basics of options trading. It allows you to trade in more complex strategies, such as iron condors, butterflies, and straddles. You’ll also have access to more sophisticated tools for analyzing options.

Level 4: Unlocking Trading Restrictions

Level 4 is the highest level available at Fidelity and is reserved for professional traders who meet specific requirements, such as a high account balance and a proven track record of successful trading. This level grants you the ability to trade in unrestricted option strategies, including proprietary strategies and customized trades. It also provides access to advanced trading tools and dedicated support.

Tips and Expert Advice for Options Trading

Before you start trading options, it’s crucial to follow some expert advice:

- Educate yourself: Thoroughly research options trading and its risks to avoid potential pitfalls.

- Start small: Begin with small trades to minimize risk and gain experience gradually.

- Understand your risk tolerance: Acknowledge your comfort level with risk to make informed decisions.

- Monitor your positions: Keep track of your trades to identify performance and adjust strategies accordingly.

- Seek professional guidance: Consult with a financial advisor or broker if you need personalized advice or guidance.

Frequently Asked Questions (FAQs) about Fidelity’s Options Trading Levels

- Q: What is the minimum account balance required for each level?

- A: The minimum account balance requirements vary depending on the level. Contact Fidelity for details.

- Q: How do I move to a higher level?

- A: To advance to a higher level, you must meet the minimum account balance and experience requirements and pass appropriate exams.

- Q: Are there any ongoing fees associated with option trading levels?

- A: Fidelity charges standard trading fees for all option trading, regardless of the level.

Fidelity Investments Options Trading Levels

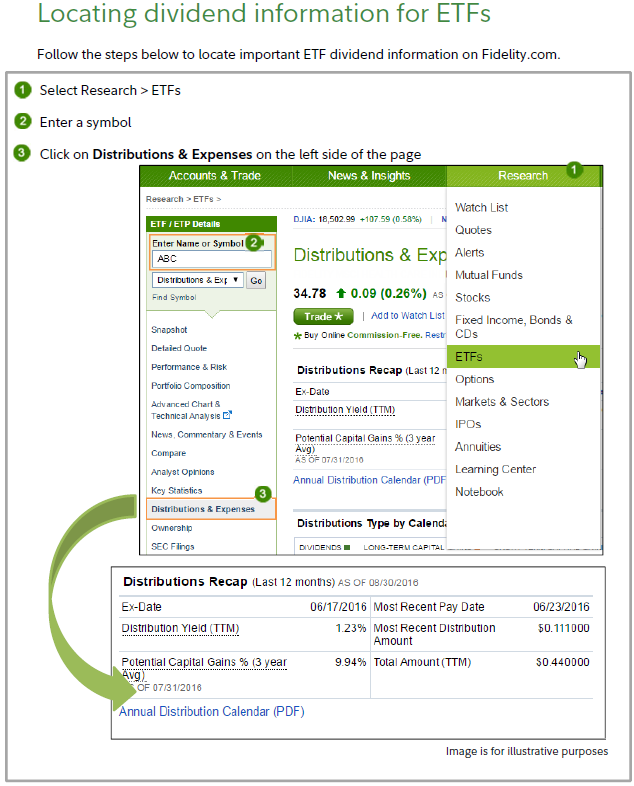

Image: www.fidelity.com

Conclusion: Harnessing the Power of Options Trading Wisely

Fidelity Investments’ option trading levels empower investors with the flexibility to tailor their trading strategies to their unique needs and experience. By understanding the different levels and adhering to the expert advice provided, you can unlock the potential of options trading while mitigating risk. Remember to approach options trading with caution, constant learning, and a clear understanding of your investment goals. Are you ready to explore the world of options trading and unlock new opportunities?