Exotic options are not your average financial instruments. They’re a sophisticated breed of derivatives designed to cater to specific risk management needs or speculative strategies. They can resemble financial contortionists, twisting and turning in response to various market scenarios, affording investors a wide spectrum of possibilities. So, if you’re looking to venture into this intriguing realm, selecting the right exotic options trading broker becomes paramount.

Image: www.interactivebrokers.com

Understanding the Exotic Options Landscape

Exotic options differ from their run-of-the-mill counterparts in their complexity and customization. They extend beyond the realm of plain vanilla calls and puts, dancing to the tune of diverse underlying assets, ranging from commodities to indices, currencies, and even other options. Their versatility allows them to weave intricate risk management strategies or craft precisely targeted speculative positions.

The allure of exotic options does not come without caveats. Their added complexity demands a keen understanding of their intricate nuances, lest one finds themselves entangled in a labyrinth of unforeseen risks. It’s a realm where the potential rewards can be as tantalizing as the risks are formidable.

Choosing the Right Exotic Options Trading Broker

Navigating the world of exotic options trading brokers may seem like traversing a financial labyrinth, but these guiding principles will light your path:

-

Regulation and Reputation: Trust is paramount in the financial arena. Ensure your broker operates under the watchful eye of reputable regulatory bodies, ensuring transparency and ethical conduct. A solid track record and a reputation for integrity are hallmarks of a reliable broker.

-

Instrument Variety: Exotic options come in an array of flavors. Verify that your chosen broker offers the specific options you seek, matching your strategic objectives. Some brokers specialize in particular asset classes or exotic option types, so alignment is key.

-

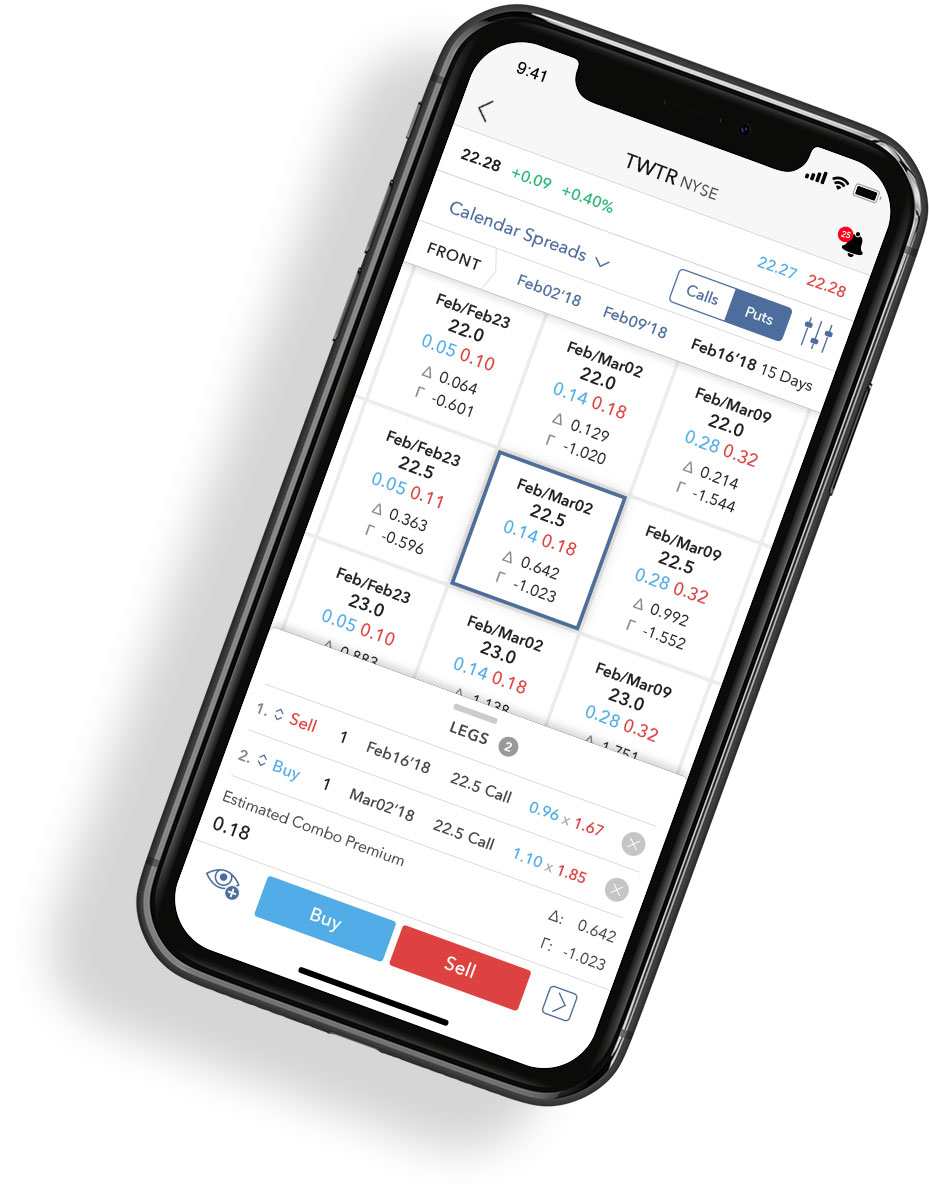

Trading Platform: The trading platform is your command center. Choose a broker that provides a user-friendly interface, robust functionality, and reliable execution capabilities. A seamless and intuitive platform empowers you to trade with confidence.

-

Fees and Commissions: Trading fees can nibble away at your potential profits. Compare the cost structures of various brokers to find one that aligns with your trading volume and budget. Transparency in fees is a sign of an ethical brokerage.

-

Customer Support: When you’re navigating the uncharted waters of exotic options, having a knowledgeable and responsive support team at your side is invaluable. Look for brokers offering attentive and timely assistance to guide you through any trading complexities.

Image: www.youtube.com

Exotic Options Trading Brokers

Image: www.scribd.com

Conclusion

Exotic options trading brokers open up a world of tailored risk management and strategic possibilities. The key lies in selecting a broker that aligns with your needs, ensuring a synergistic partnership. By adhering to these guiding principles, you can navigate the intricate pathways of exotic options trading with confidence, harnessing their potential to unlock tailored risk protection or pursue sophisticated investment strategies.