Introduction

In the captivating world of finance, options trading stands out as an alluring avenue for investors seeking both potential gains and strategic risk management. Whether you’re new to the options arena or a seasoned veteran looking to refine your strategies, this comprehensive guide will equip you with the essential knowledge and actionable tips to navigate this dynamic market with confidence.

Image: www.youtube.com

Understanding Options

At its core, an option contract grants the buyer the right, but not the obligation, to buy or sell an underlying asset (such as a stock, bond, or commodity) at a specific price (the strike price) on or before a predetermined date (the expiration date). This flexibility empowers traders to tailor their trading strategies to varying market conditions and risk appetites.

Types of Options

The options market offers two primary types of contracts: calls and puts. Call options grant the buyer the right to buy an asset at the strike price, while put options convey the right to sell. Each type serves different trading purposes and can be employed in diverse market scenarios.

Benefits of Options Trading

Options trading offers several unique advantages to investors:

- Leverage: Options provide leverage, allowing traders to control a significant number of shares with a relatively small investment.

- Risk Management: Options can be used to hedge against potential losses, reduce portfolio volatility, and generate income.

- Income Generation: Options strategies such as selling premium or covered calls can provide regular income streams.

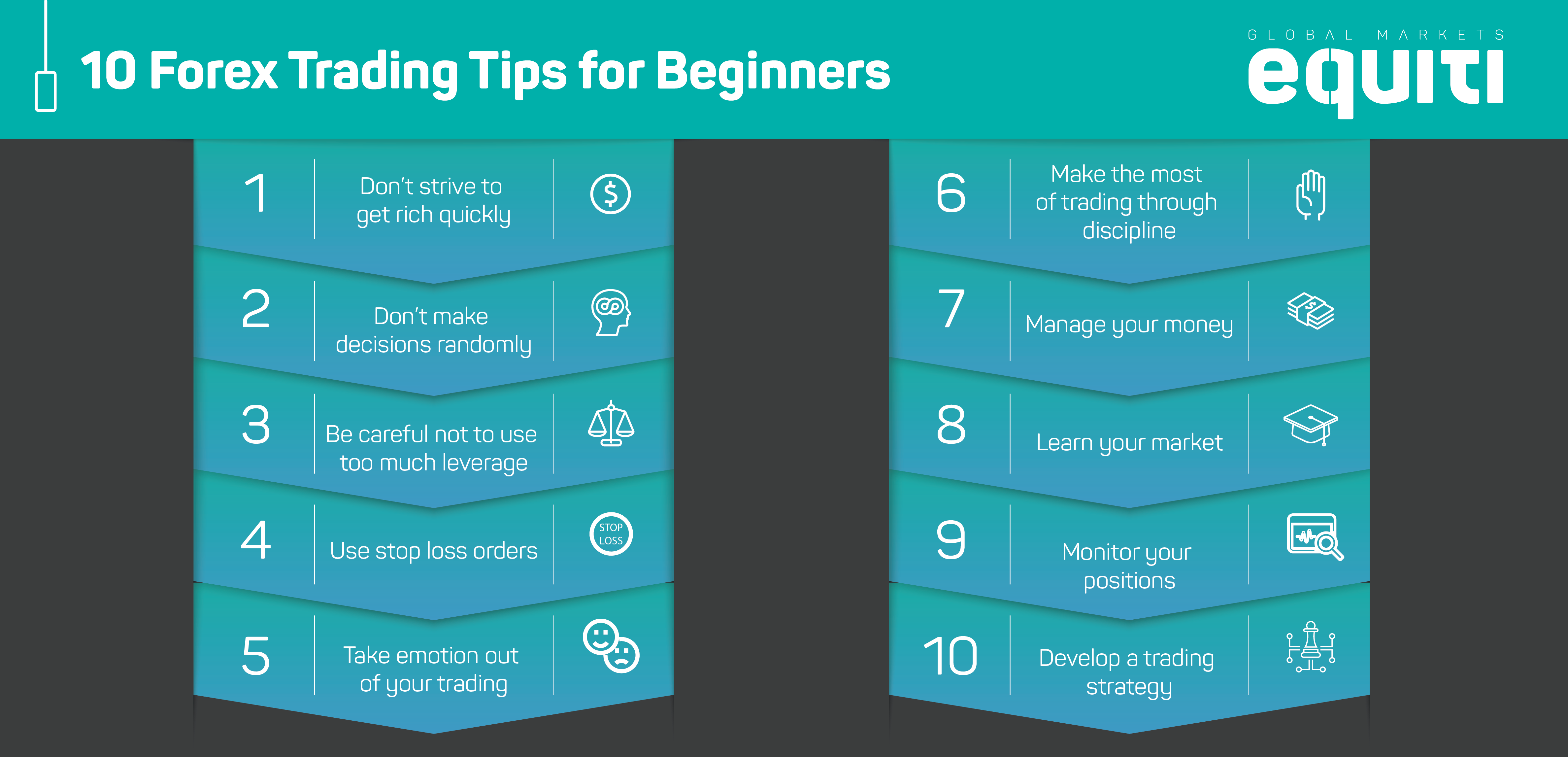

Image: www1.equiti.com

Platform and Tools

Choosing a suitable trading platform is crucial for options trading success. Consider platforms that offer advanced charting capabilities, real-time data, and risk management tools. Moreover, familiarize yourself with Greeks, statistical measures that provide insights into options behavior and pricing.

Strategies and Techniques

The world of options trading is vast, encompassing numerous strategies and techniques. Some popular approaches include:

- Covered Calls: A conservative strategy that involves selling a call option while owning the underlying asset.

- Naked Puts: A higher-risk strategy where the trader sells a put option without owning the underlying asset.

- Spreads: The simultaneous purchase and sale of multiple options contracts with different strike prices or expiration dates.

Expert Insights

“Options trading requires discipline and a comprehensive understanding of the risks involved,” advises renowned options expert Richard Dennis. “Effective traders constantly monitor market conditions and adjust their strategies accordingly.”

“Options offer tremendous opportunities, but it’s essential to approach trading with a strategic mindset,” adds veteran trader Michael Binger. “Risk management should be an integral part of every trading decision.”

Actionable Tips for Success

- Understand the Risks: Options trading carries substantial risks. Thoroughly research and comprehend the potential losses before committing capital.

- Trade with a Plan: Develop a clear trading plan that outlines your objectives, risk tolerance, and entry and exit criteria.

- Manage Your Emotions: Trading can be an emotionally charged activity. Stay disciplined and avoid letting emotions cloud your judgment.

- Stay Updated: The options market is constantly evolving. Continuously educate yourself and monitor market developments to stay ahead of the curve.

Every Thing I Need For Trading Options

Image: fity.club

Conclusion

Options trading presents both opportunities and challenges for investors. By equipping yourself with the knowledge, strategies, and expert insights outlined in this guide, you can enhance your trading prowess and navigate the options market with increased confidence. Remember, successful options trading is a continuous journey of learning and adaptation. Embrace the challenges, refine your skills, and let the allure of options trading guide you towards financial success.