Understanding the Risks and Rewards

Binary options have become increasingly popular in the world of financial trading, promising quick and potentially high returns. But behind the allure of easy profits lies a complex and risky reality. In this article, we delve into the world of binary options trading, exploring its workings, risks, and whether it truly offers the path to financial success it advertises.

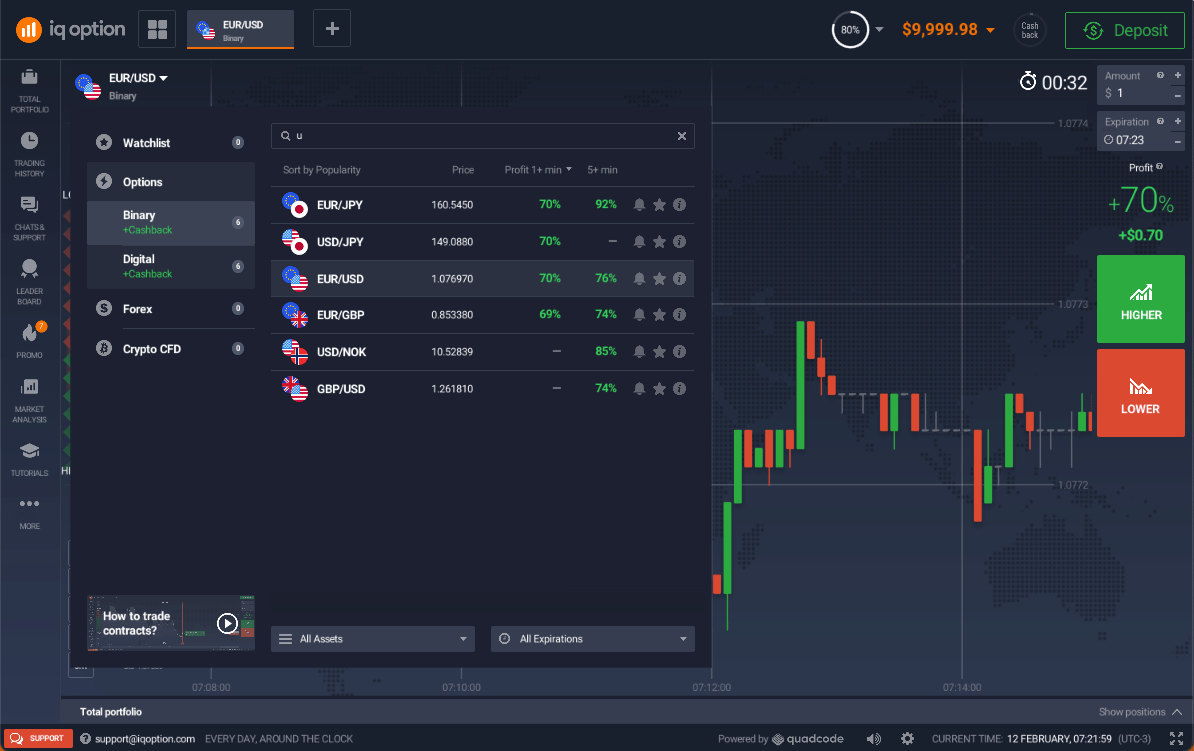

Image: iqbroker.com

What are Binary Options?

Binary options are financial instruments that involve betting on the outcome of an underlying asset, such as a stock, currency, or commodity. The trader predicts whether the asset’s price will rise or fall within a specified time frame, typically ranging from 60 seconds to a few hours. If the trader’s prediction is correct, they receive a fixed payout; if incorrect, they lose the entire investment.

How Binary Options Trading Works

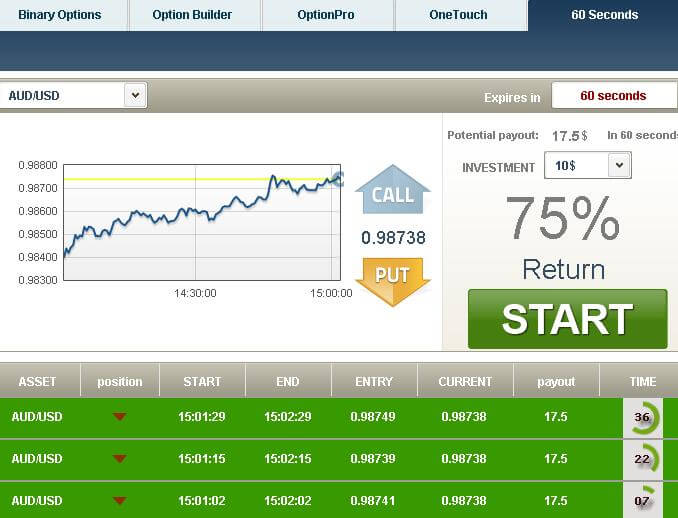

Binary options trading platforms allow traders to buy or sell an option contract, which represents their prediction on the movement of the underlying asset. Traders choose from two options: “call” or “put.” A call option represents a prediction that the asset’s price will increase, while a put option represents a prediction that it will decrease.

The payout for a successful trade is typically fixed at 70-90%, while the payout for an unsuccessful trade is usually a complete loss of the investment. The time frame of the contract can vary from as short as 60 seconds to as long as a few hours.

Risks of Binary Options Trading

While binary options trading offers the potential for high returns, it comes with significant risks that traders must be aware of:

- High Volatility: The underlying assets of binary options can be highly volatile, leading to rapid and unpredictable price fluctuations. This volatility increases the risk of losing investments.

- Limited Time Frame: The short time frame of most binary options contracts adds another layer of risk. Traders have to make quick decisions and accurately predict the direction of the asset’s price within a brief period.

- All-or-nothing Payouts: Unlike traditional options trading, binary options offer an all-or-nothing payout structure. This means that either the trader receives the fixed payout or loses the entire investment, leaving no room for partial profits.

- Unregulated Market: In many jurisdictions, binary options trading is unregulated, creating a potential for fraud and predatory practices by unscrupulous brokers.

Image: tradingstrategyguides.com

Is Binary Options Trading Legal?

The legality of binary options trading varies by jurisdiction. In some countries, including the United States and the United Kingdom, binary options are regulated and licensed financial instruments. In other countries, however, binary options trading may be illegal, and engaging in such activities could have legal consequences.

Does Binary Options Trading Really Work

Image: yourincomeadvisor.com

Conclusion

Binary options trading offers the allure of quick and potentially high returns, but it is a complex and risky endeavor that requires careful consideration. Before venturing into binary options trading, investors must thoroughly understand the financial risks involved and proceed with caution. It’s crucial to only trade with reputable and regulated brokers, thoroughly research the underlying assets, and manage expectations realistically. Ultimately, binary options trading should be approached as a high-risk activity with a potential for both profits and significant losses.