Navigating the world of options trading can be a thrilling endeavor, but understanding the key indicators that guide decision-making is paramount for success. I’ve witnessed firsthand how relying on reliable indicators can turn the tide in an unpredictable market, helping traders optimize their strategies and maximize their potential returns.

Image: www.pinterest.co.uk

Like navigating a ship through choppy waters, having the right indicators at your disposal is like having a seasoned captain onboard. They provide invaluable insights into market behavior, helping you anticipate price movements and make informed decisions. Let’s delve into the top indicators that can elevate your options trading game.

Implied Volatility

Implied volatility (IV) is the market’s perception of the expected price volatility of a particular asset over a specified time frame. It’s a crucial indicator because it provides insights into how much the market anticipates the asset’s price to fluctuate.

When IV is high, it indicates the market expects significant price movements. This can create opportunities for traders to profit from options strategies like selling high-priced options premiums. Conversely, when IV is low, it suggests a stable market with limited price swings. This may lead to a better environment for buying options as they can be less expensive.

Open Interest

Open interest refers to the total number of options contracts that are currently outstanding for a particular underlying security. It provides information on the market’s sentiment and potential trading activity.

An increase in open interest indicates that more traders are entering or continuing positions in the underlying asset. This can signal that a potential trend is developing and may warrant further investigation. On the other hand, a decrease in open interest suggests that traders are exiting their positions, potentially indicating a trend reversal or market uncertainty.

Volume

Volume represents the number of options contracts that have been traded over a specific period. It’s an essential indicator that measures the level of trading activity and market participation.

High volume typically indicates that there is significant interest in the underlying security and that the market is liquid. This can provide opportunities for traders to execute trades more easily and at more favorable prices. Conversely, low volume can lead to less liquidity and wider spreads.

Image: tradingforexguide.com

Sentiment Analysis

Sentiment analysis involves gauging the market’s overall mood towards a particular asset or trading instrument. By analyzing public sentiment expressed on news channels, social media, and online forums, traders can make informed decisions based on the prevailing market psychology.

Positive sentiment often indicates that investors are bullish on the asset, potentially leading to higher demand and price appreciation. Negative sentiment, on the other hand, suggests that traders may be preparing for a decline or a potential reversal in trend.

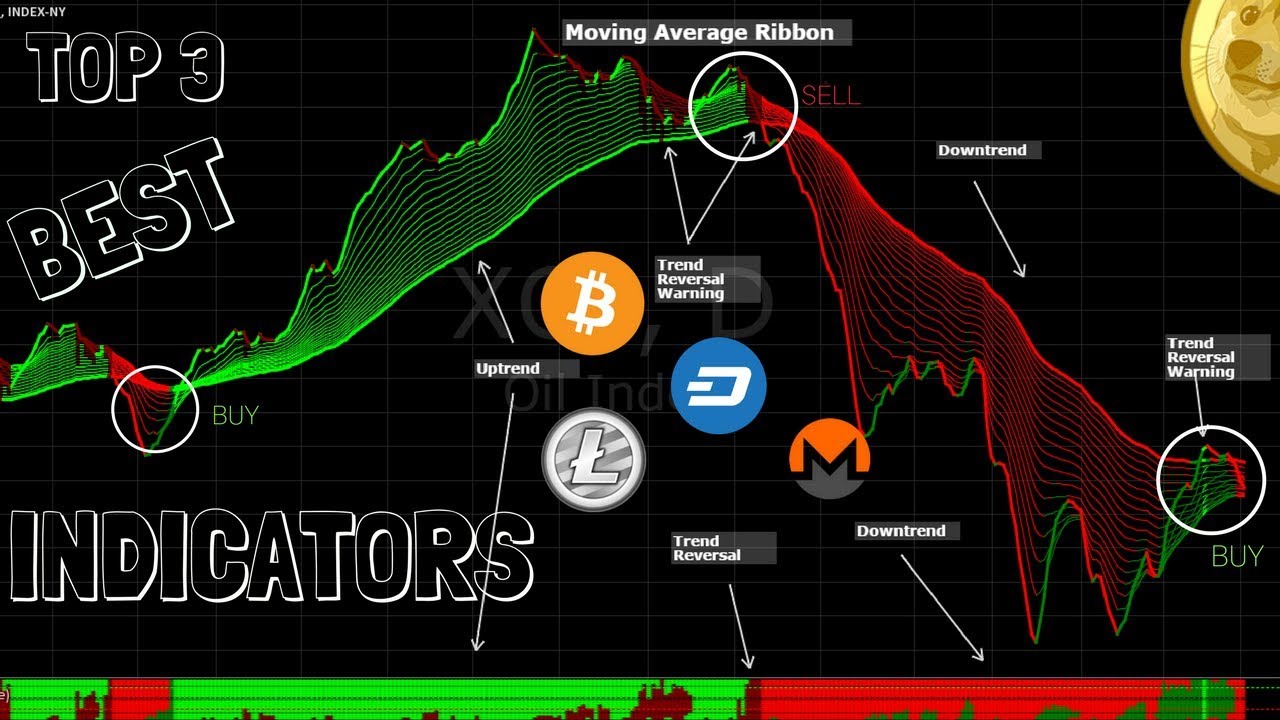

Technical Analysis

Technical analysis involves studying historical price data to identify patterns and trends that may help predict future price movements. By analyzing candlestick patterns, support and resistance levels, and moving averages, traders can gain insights into potential trend reversals, continuation, or consolidation.

Technical analysis provides a systematic approach to options trading, enabling traders to make more informed and objective decisions based on verifiable data. It’s an indispensable tool for identifying potential opportunities and understanding market dynamics.

Conclusion

Mastering the art of options trading requires a deep understanding of market dynamics and the ability to make informed decisions based on reliable indicators. By leveraging the power of indicators like implied volatility, open interest, volume, sentiment analysis, and technical analysis, traders can navigate the complexities of the market, identify potential opportunities, and ultimately increase their likelihood of success.

Remember, trading options involves inherent risks, and it’s essential to approach it with a sound understanding of the market, proper risk management techniques, and a clear trading plan. Are you ready to embark on a transformative journey into the world of options trading with the guidance of these top indicators?

Best Indicators For Options Trading

Frequently Asked Questions (FAQs)

- Q: What is the most important indicator for options trading?

A: Implied volatility (IV) is widely considered one of the most important indicators as it provides insights into the market’s expectations for price fluctuations.

- Q: How can I use open interest to my advantage?

A: By monitoring open interest, traders can gauge market sentiment and potential trading activity. An increase in open interest may indicate a developing trend, while a decrease can suggest a trend reversal or uncertainty.

- Q: What is the significance of volume in options trading?

A: Volume reflects the trading activity and liquidity of an option. High volume typically indicates a liquid market with more favorable prices and execution ease, while low volume can lead to wider spreads and lower liquidity.

- Q: How does sentiment analysis contribute to options trading?

A: Sentiment analysis helps traders understand the market’s overall mood towards an asset, which can influence price movements. Positive sentiment may lead to higher demand and price appreciation, while negative sentiment can indicate a potential decline.

- Q: Can technical analysis provide accurate predictions for options trading?

A: While technical analysis is a useful tool for identifying potential opportunities and market dynamics, it’s important to note that it does not provide guaranteed predictions. It’s best used as a complementary tool to other indicators and always consider the broader market context.