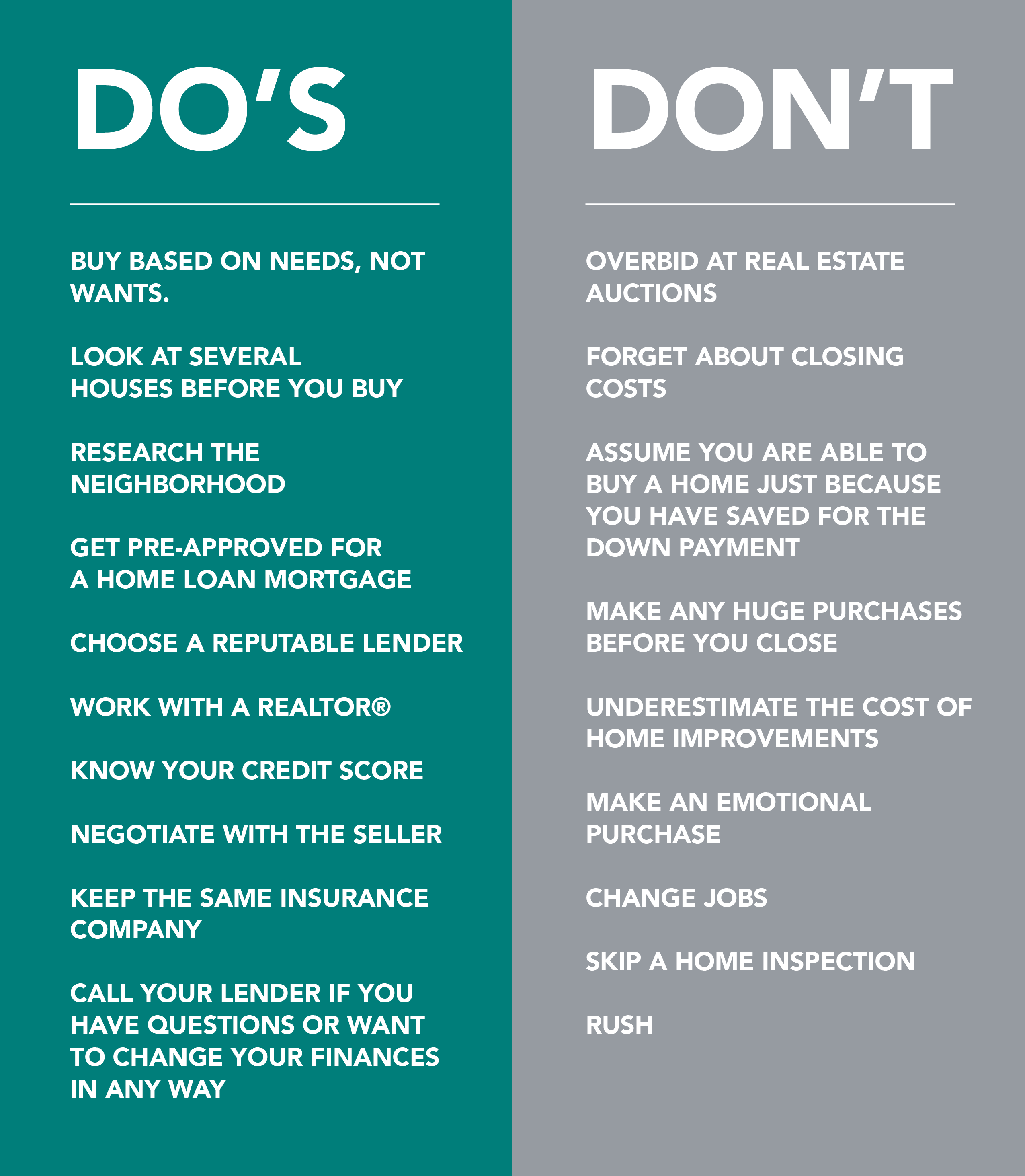

In the realm of investing, options trading presents a unique blend of opportunities and risks. Navigating this complex terrain requires a deep understanding of the do’s and don’ts that can propel you towards success while shielding you from potential pitfalls. This comprehensive guide will delve into the do’s and don’ts of options trading, empowering you with the knowledge and strategies to maximize profits and minimize losses.

Image: blog.eustismortgage.com

Do Your Research

Just as a seasoned hiker prepares thoroughly before embarking on a challenging trail, the successful options trader conducts meticulous research before executing any trades. Understand the fundamentals of options, including their types, expirations, and pricing mechanisms. Familiarize yourself with the underlying assets you intend to trade, including their historical performance, market trends, and key news events. Failure to do your due diligence can lead to impulsive trades and costly mistakes.

Understand the Risks and Rewards

Options trading, like any investment, carries inherent risks. It’s imperative to comprehend the potential for significant losses, especially when utilizing certain option strategies. Assess your risk tolerance and invest only what you can afford to lose. Simultaneously, bear in mind the substantial rewards that options can offer, particularly if you have the discipline to manage your trades diligently.

Develop a Trading Plan

A trading plan is your roadmap to success in options trading. Define your trading goals, including your profit targets, risk thresholds, and trading strategies. Determine your entry and exit points for each trade, and stick to your plan with discipline. A well-crafted trading plan ensures consistency and minimizes emotional decision-making, which can cloud your judgment.

Image: www.internetvibes.net

Master Risk Management Techniques

Risk management is the cornerstone of successful options trading. Employ stop-loss orders to limit your potential losses, and consider hedging your positions to minimize downside exposure. Utilize position sizing techniques to ensure that you never risk more than a predetermined percentage of your capital on any single trade. Prudent risk management practices safeguard your hard-earned profits and extend your trading longevity.

Avoid Common Pitfalls

The path to success in options trading is rife with common pitfalls. Curb your temptation to chase after losses, as this often leads to deeper financial turmoil. Avoid overtrading, as excessive trading without a clear plan can drain your resources and erode your confidence. Steer clear of overly complex strategies, especially if you’re new to options trading, as these can be challenging to manage and potentially harmful.

Stay Informed

Options traders must remain perpetually informed about market developments and news events that can impact their trades. Monitor real-time market data, stay abreast of economic indicators, and follow industry news to stay ahead of the curve. Leverage the insights of experienced traders and analysts to broaden your perspective and enhance your knowledge.

Practice Patience

Patience is a virtue in options trading. Allow your trades to unfold without constantly second-guessing your decisions. Be prepared to hold your positions for extended periods, especially during periods of market volatility. Resist the urge to make hasty exits or adjustments, as these can often be detrimental to your trading performance.

Continuous Learning

Options trading is an ever-evolving field, with new strategies and market conditions constantly emerging. To stay at the forefront, commit to continuous learning. Attend webinars, read books, and seek out mentors who can share their knowledge and experience. The pursuit of knowledge will empower you to adapt and thrive in the dynamic world of options trading.

Do’S And Don’Ts In Options Trading

Image: www.projectfinance.com

Conclusion

Navigating the realm of options trading requires a delicate balance of knowledge, discipline, and risk management. The do’s and don’ts outlined in this comprehensive guide will serve as a valuable compass on your trading journey. Always remember to conduct thorough research, develop a trading plan, master risk management techniques, and stay informed. By embracing the do’s and avoiding the don’ts, you can maximize your profit potential, minimize your risks, and achieve long-term success in this dynamic and rewarding financial realm.