Embark on an Empowered Path of Financial Growth

Are you seeking to amplify your investment horizons and unlock the potential of options trading? This comprehensive guide will illuminate the intricacies of this captivating arena, providing you with a roadmap to informed decision-making and maximizing your financial well-being.

:max_bytes(150000):strip_icc()/BuyingCalls-7ff771dfbc724b95b8533a77948d7194.png)

Image: www.investopedia.com

Options trading presents a potent tool for astute investors seeking to enhance their portfolios and navigate the intricacies of the financial markets. By gaining a profound understanding of options strategies and their applications, you can empower yourself to tap into new opportunities, mitigate risks, and cultivate a path towards financial prosperity.

Delving into the Realm of Options Trading

Options contracts confer upon their holders the privilege, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specified date (expiration date). This flexibility empowers traders to tailor their strategies to their unique investment goals and risk tolerance.

Call options are employed when traders anticipate an upward trajectory in the underlying asset’s price, while put options are utilized when they foresee a decline. By understanding the dynamics of options premiums, which reflect the market’s assessment of the likelihood of the option being exercised, traders can make informed decisions and position themselves for potential gains.

Unveiling the Nuances of Options Strategies

The versatility of options trading stems from the diverse array of strategies available to investors. Covered calls involve selling call options against an underlying asset you already possess, generating income while maintaining exposure to potential price appreciation. Cash-secured puts entail selling put options backed by cash reserves, offering the possibility of acquiring an asset at a favorable price should the market decline.

Bullish strategies, such as long calls and bull call spreads, are employed when traders anticipate an upward surge in the underlying asset’s value. Bearish strategies, like long puts and bear put spreads, are implemented when traders foresee a downward trend. By carefully selecting and executing these strategies, investors can harness the power of options to amplify their returns and manage risk.

Harnessing the Expertise of Seasoned Traders

Navigating the complexities of options trading requires a judicious approach and the guidance of experienced professionals. Seek mentors or financial advisors who possess a deep understanding of options markets and can provide valuable insights. Their expertise can help you refine your strategies, mitigate risks, and maximize your chances of success.

Practice is paramount in mastering the nuances of options trading. Utilize paper trading platforms or simulators to test your strategies and gain practical experience without risking real capital. As you deepen your knowledge and gain confidence, you can gradually transition to live trading while adhering to prudent risk management principles.

Image: www.stockbrokers.com

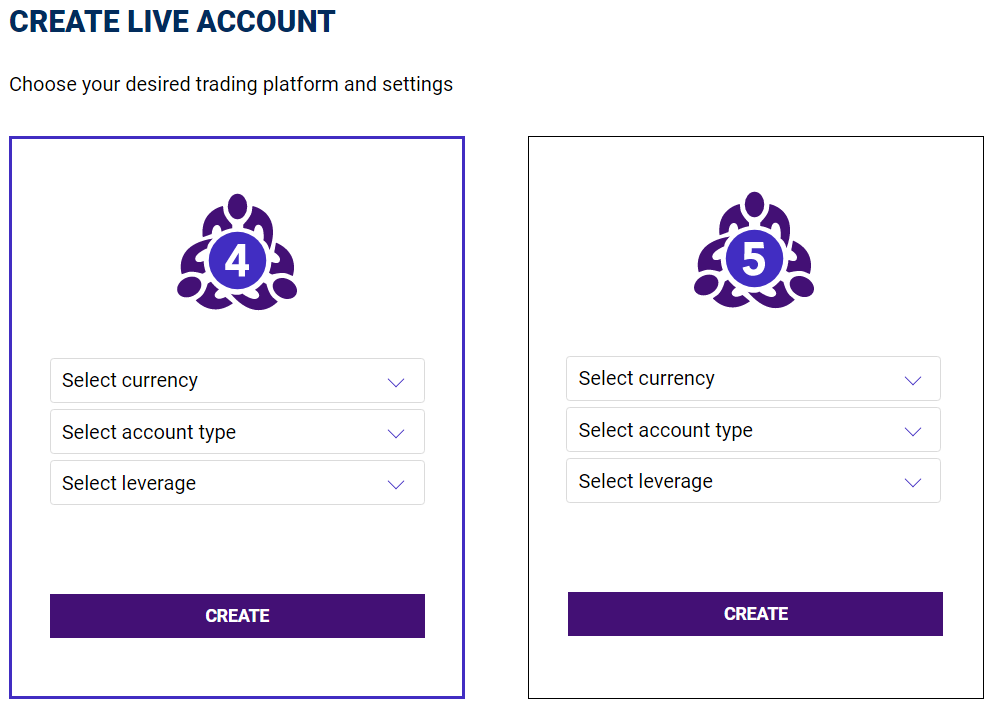

Do You Want To Add Options Trading To Your Account

Image: en.duomarkets.com

Embracing Options Trading: A Path to Financial Empowerment

Embracing options trading opens up a world of possibilities for investors seeking to expand their horizons and enhance their financial well-being. By embracing this potent tool and adhering to the principles outlined in this guide, you can unlock new avenues for growth, mitigate risks, and cultivate a path towards financial prosperity. Remember, knowledge is power, and the pursuit of financial empowerment is an ongoing journey. Embrace the learning process, seek guidance from experts when needed, and let the power of options trading propel you towards your financial goals.