Have you ever dreamt of turning a small investment into a significant profit, multiplying your capital through the magic of options trading? The potential is undeniably alluring, but the world of options can be daunting for beginners. With so many platforms and exchanges competing for your attention, choosing the right one can feel like searching for a needle in a haystack. This article will guide you through the labyrinth of options exchanges, illuminating the key features that matter most and empowering you to find the perfect fit for your trading journey.

Image: members.evolutionsedge.co.uk

But first, let’s unravel the mystery of options trading itself. Imagine having the power to buy or sell the right to trade a stock – a stock option – at a predetermined price within a set timeframe. You can choose to profit from an anticipated price increase (call option) or a potential price decrease (put option). Options trading can be a potent tool for diversification, hedging your portfolio, or generating income. While it offers significant upside potential, it also carries inherent risks, emphasizing the need to thoroughly understand the underlying mechanics and meticulously manage your financial exposure.

Unveiling the World of Options Exchanges

Each options exchange serves as a marketplace where traders buy and sell contracts, creating the dynamic price fluctuations that drive the market. The choices can feel overwhelming, but let’s break down the most popular players:

- Chicago Board Options Exchange (CBOE): Established in 1973, CBOE is the undisputed pioneer of options trading. With a robust infrastructure and a vast array of contracts, it enjoys a prestigious reputation among seasoned traders.

- Nasdaq Options Market (NOM): As a formidable competitor to CBOE, Nasdaq offers a wide range of options contracts and boasts lightning-fast execution speeds. Its focus on technology and innovation makes it a favorite among tech-savvy traders.

- Intercontinental Exchange (ICE): Having acquired the New York Stock Exchange, ICE offers a wide selection of options contracts, spanning equities, indexes, currencies, and more. It stands out for its user-friendly platform and its commitment to investor education.

- American Stock Exchange (AMEX): Primarily known for its trading of exchange-traded funds (ETFs), AMEX also offers a selection of options contracts, particularly those related to emerging markets.

- International Securities Exchange (ISE): ISE focuses on providing a transparent and efficient trading environment for retail investors, offering a platform that caters to both individual traders and institutional investors.

Finding the Right Fit: The Crucial Considerations

While each exchange boasts its unique features, certain factors are paramount in choosing the best option for your trading needs:

- Contract Availability: Determine if your chosen exchange lists contracts for the underlying assets you intend to trade. Certain instruments may only be available on specific platforms.

- Trading Fees: Fees associated with trading options can vary significantly across exchanges. Research and compare the fee structure, including transaction fees, brokerage fees, and other charges.

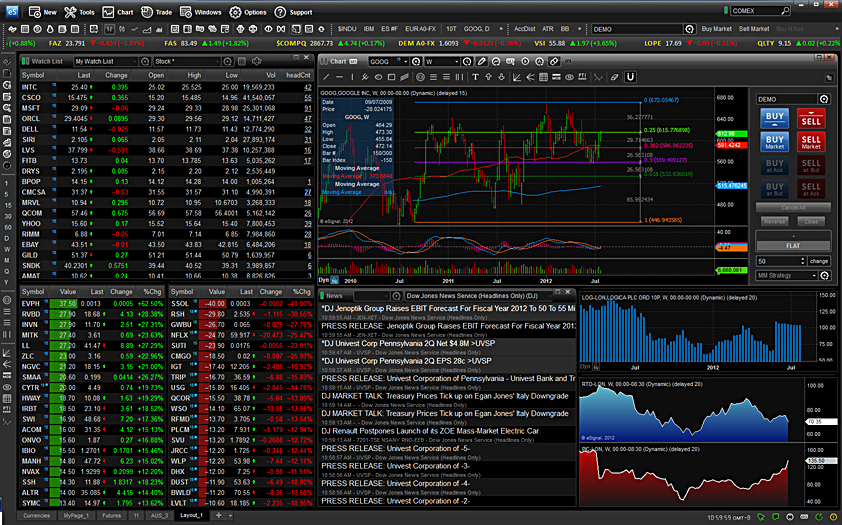

- Trading Platform: Look for a user-friendly platform that provides access to real-time market data, sophisticated charting tools, and order management features. A platform that readily facilitates research and analysis is crucial for informed decision-making.

- Liquidity: High liquidity ensures that you can readily buy or sell contracts without causing significant price fluctuations. Exchanges with higher trading volumes generally offer better liquidity.

- Technology: Reliability and speed are paramount in options trading. Choose a platform that boasts robust technology, guaranteeing seamless order execution and real-time data access.

The Power of Options: Unlocking the Potential

To harness the full potential of options trading, consider these expert tips:

- Thorough Research: Before placing your first trade, understand the nuances of options contracts and the intricacies of the underlying asset. This may involve reading books, taking courses, or consulting with experienced professionals.

- Risk Management: Implement a solid risk management strategy to mitigate potential losses. Define your maximum loss tolerance, diversify your portfolio, and never invest more than you can afford to lose.

- Patience and Discipline: Options trading requires patience and discipline to navigate the market’s volatility and make sound decisions. Avoid impulsive trading and stick to your pre-defined strategies.

Image: biconsultingpro.com

Best Exchange For Options Trading

Concluding Thoughts

Armed with this knowledge, you are now equipped to choose the best exchange for your options trading journey. Remember, the perfect exchange is not a one-size-fits-all solution. It’s about finding a platform that aligns with your individual needs, risk tolerance, and trading goals. Embark on this quest with confidence, embracing the potential of options trading while maintaining a mindful approach to the inherent risks. Let your journey be guided by thorough research, a thoughtful strategy, and a passion for mastering the intricate world of options.