In the realm of financial markets, options and futures stand as versatile tools that allow traders to navigate the tides of volatility. While both instruments harness the power of derivatives, they exhibit unique characteristics that distinguish their roles in a trader’s toolkit. Embark on this comprehensive exploration as we delve into the intricate nuances of options and futures trading, empowering you to make informed decisions in your financial endeavors.

Image: app.fintrakk.com

Options: A Symphony of Flexibility

Options excel in offering flexibility, enabling traders to tailor their strategies to specific market conditions. An option contract bestows upon its holder the right, but not the obligation, to buy or sell an underlying asset, such as a stock or commodity, at a predetermined price within a defined period. This right comes at a cost, known as the premium, paid to the option seller. Options confer upon traders the power to speculate on future price movements, hedge against potential losses, or simply provide a layer of protection for their portfolios.

Futures: Obligatory Dance with the Underlying

In stark contrast to options, futures contracts impose a strict obligation upon both the buyer and seller to transact the underlying asset at a set price on a predetermined date. This binding commitment eliminates the flexibility of options, yet futures offer distinct advantages. By locking in the price today, traders can mitigate the risk of adverse price fluctuations in the future. Futures contracts also facilitate leverage, amplifying potential gains but simultaneously heightening the risk of substantial losses. Seasoned traders often harness futures to speculate on price trends, engage in arbitrage strategies, or manage price risk associated with physical commodities.

Deciphering the Distinctive Features

To fully grasp the differences between options and futures trading, let us delve into a meticulous examination of their salient attributes:

| Features | Options | Futures |

|---|---|---|

| Obligation | Right, but not an obligation, to buy or sell | Mandatory obligation for both buyer and seller |

| Premium | Paid by buyer to seller | Not applicable |

| Flexibility | Tailor strategies to market conditions | Limited flexibility |

| Leverage Potential | Varies based on option type | Typically higher leverage |

| Risk Management | Hedging and protection | Price risk management |

Image: www.pinterest.com

Key Considerations for Informed Trading

Embracing options or futures trading hinges upon prudent consideration. Meticulously assess your risk tolerance, investment horizon, and specific financial objectives. If you prefer flexibility, seek solace in options. Conversely, traders seeking binding commitments and the potential for enhanced leverage may find solace in futures. Regardless of your chosen path, diligent research and a disciplined approach are paramount for navigating the complexities of derivative markets.

FAQ: Unraveling Common Queries

-

Q: What is an option premium?

A: Premium represents the price paid by the option buyer to the seller in exchange for the right to buy or sell the underlying asset.

-

Q: Can I lose more than I invested in options trading?

A: Yes, the potential loss in options trading exceeds the initial investment, especially in certain option strategies.

-

Q: Are futures contracts suitable for all investors?

A: Due to their binding nature and higher leverage, futures are appropriate only for experienced traders with a robust understanding of market dynamics.

-

Q: Which trading instrument offers greater flexibility?

A: Options provide superior flexibility, allowing traders to customize strategies based on market conditions and risk tolerance.

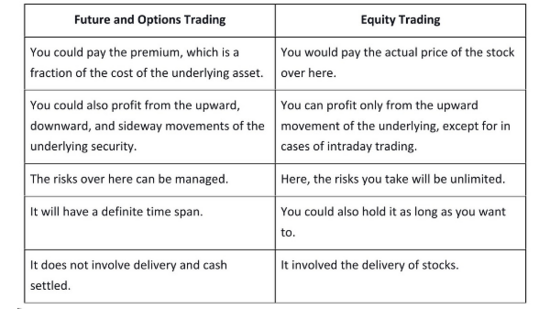

Difference Between Option And Future Trading

Image: www.hindustantimes.com

Conclusion: Embracing Informed Decisions

Navigating the labyrinth of financial markets requires a discerning eye and an unwavering commitment to continuous learning. This discourse has endeavored to shed light upon the intricacies of options and futures trading, equipping you with the knowledge to make informed decisions. Whether you choose the flexibility of options or the binding nature of futures, let prudence be your guide and meticulous research your compass. Embrace the journey of financial exploration and may the markets prove a source of both knowledge and prosperity.

Are you intrigued by the world of options and futures trading? Share your thoughts and experiences in the comments below.