In the ever-evolving financial landscape, options trading has emerged as a lucrative avenue for discerning investors. Within this realm, diff options trading stands out as a sophisticated strategy that can yield significant profits when executed with precision and knowledge.

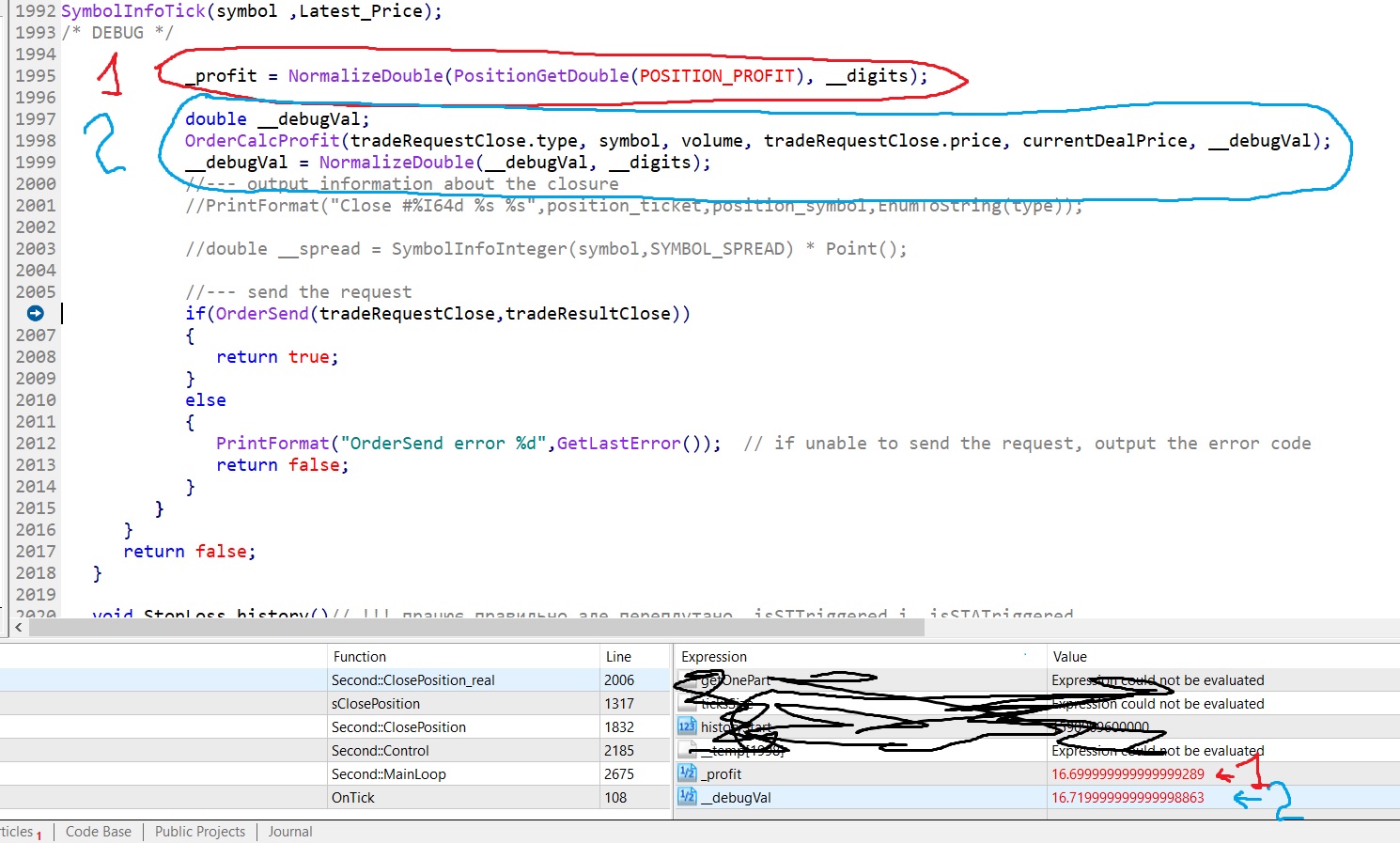

Image: www.mql5.com

Diff options trading, also known as spread trading, involves simultaneous transactions in multiple options contracts with different strike prices and expiration dates.

Understanding Diff Options Trading

At its core, diff options trading capitalizes on the differences in premiums between two or more closely related options contracts. By combining a long position in one contract with a short position in another, traders seek to capture profit from the varying premiums rather than relying on underlying asset price movements.

Diff options trading strategies can be classified into two main types: vertical spreads and horizontal spreads. Vertical spreads involve options with the same expiration date but different strike prices, while horizontal spreads involve options with different expiration dates but the same strike price.

Key Concepts and Strategies

Understanding the following key concepts is crucial for successful diff options trading:

- Option Premium: The price paid to purchase an options contract.

- Strike Price: The predetermined price at which the underlying asset can be bought (call option) or sold (put option) upon contract exercise.

- Expiration Date: The date on which the options contract expires.

- Bull Spread: A strategy designed to profit from an anticipated increase in the underlying asset’s price.

- Bear Spread: A strategy designed to profit from an anticipated decrease in the underlying asset’s price.

Diff options trading involves meticulous risk management strategies, including understanding potential pitfalls and utilizing stop-loss orders to limit losses.

Current Trends and Expert Perspectives

Diff options trading has gained traction in recent years due to its flexibility, risk-adjusted return potential, and the emergence of online trading platforms that facilitate seamless execution.

Seasoned options traders emphasize the importance of thorough market research, option chain analysis, and proper position sizing to enhance profit potential. They also advise traders to stay informed about economic and market developments that can impact option premiums.

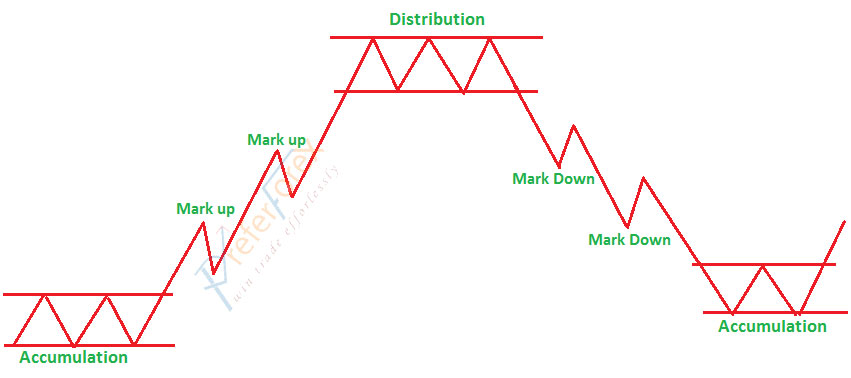

Image: tutorstips.com

Tips and Expert Advice

To thrive in diff options trading, consider the following tips from experienced traders:

- Identify Trading Opportunities: Study market trends, news, and company fundamentals to identify potential trading situations.

- Choose Options Wisely: Select options contracts with suitable strike prices, expiration dates, and liquidity.

- Manage Risk: Use stop-loss orders and position sizing strategies to mitigate losses.

- Monitor Positions: Closely monitor open positions and adjust as market conditions change.

Remember, diff options trading involves inherent risks and requires a sound understanding of options trading principles and market dynamics.

Frequently Asked Questions (FAQs)

Here are answers to common questions about diff options trading:

- Q: What is the difference between a vertical and a horizontal spread?

A: Vertical spreads involve options with different strike prices but the same expiration date, while horizontal spreads involve options with the same strike price but different expiration dates. - Q: How do I determine the potential profit/loss of a diff options spread?

A: Calculate the difference between the premiums of the options contracts and factor in the potential price movement of the underlying asset. - Q: What are the risks involved in diff options trading?

A: Potential losses include premium erosion, widening spreads, and underlying asset price fluctuations.

Diff Options Trading

Image: preferforex.com

Conclusion

Diff options trading can be a rewarding endeavor for savvy investors seeking to harness market opportunities. By embracing sound strategies, managing risks prudently, and staying informed about market developments, traders can enhance their chances of success.

Are you interested in exploring the world of diff options trading and unlocking its profit potential?