One crisp autumn evening, I found myself engrossed in a thrilling trading session. The market was alive with volatility, presenting tantalizing opportunities for both gains and losses. In this electrifying atmosphere, I witnessed the power of combination strategies in option trading firsthand. By skillfully combining options with different strike prices and expiration dates, I was able to mitigate risks and maximize profits.

Image: www.pinterest.com

Combination strategies are an intricate, yet powerful technique that allows traders to craft customized positions that align with their specific goals and risk tolerance. This article will delve into the intricacies of this sophisticated approach, providing a comprehensive guide to help you unlock the full potential of combination strategies in option trading.

The Concept of Combination Strategies

At their core, combination strategies involve simultaneously trading two or more options contracts that share an underlying asset and expiration date but differ in strike price.

By combining options with different characteristics, traders can tailor positions that exhibit specific risk-reward profiles. For instance, combining a long call with a short put creates a synthetic long position that offers limited profit potential but also limits risk exposure.

Key Components of a Combination Strategy

To effectively craft a combination strategy, it is crucial to understand its key components:

- Underlying Asset: The security (stock, index, etc.) that the options contracts are based on.

- Strike Price: The price at which the underlying asset can be bought or sold.

- Expiration Date: The date on which the options contracts expire.

- Option Type: Call (the right to buy) or put (the right to sell).

Benefits of Combination Strategies

Combination strategies offer a range of benefits that make them an attractive option for traders:

• Risk Management: Combination strategies allow traders to spread their risk across multiple contracts, reducing the impact of any single position.

• Tailored Positions: Traders can customize combination strategies to align with their unique trading goals and risk tolerance, creating positions that suit their specific needs.

• Profit Potential: While combination strategies generally offer lower profit potential compared to single-option positions, they also come with reduced risk.

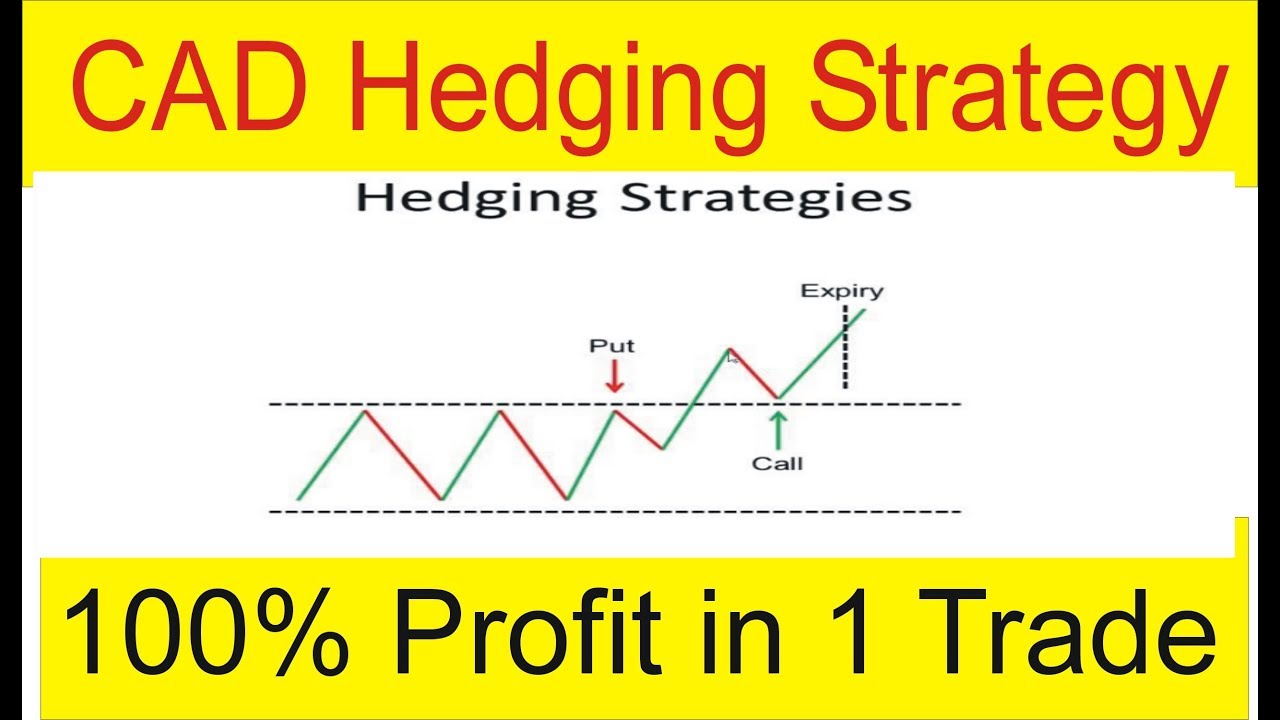

Image: www.projectfinance.com

Popular Combination Strategies

There are several popular combination strategies that traders employ:

• Bull Call Spread: A bullish strategy that combines a long call at a lower strike price with a short call at a higher strike price.

• Bear Put Spread: A bearish strategy that combines a short put at a higher strike price with a long put at a lower strike price.

• Straddle: A neutral strategy that combines a long call and a long put with the same strike price.

Expert Tips and Advice

• Start Small: Begin by practicing combination strategies with small position sizes until you become comfortable with their complexities.

• Manage Risk: Always carefully calculate the potential risk and reward of any combination strategy before implementing it.

Frequently Asked Questions

Q: What is the difference between a combination strategy and a single-option position?

A: A combination strategy involves trading multiple options contracts simultaneously, while a single-option position involves trading only one contract.

Q: How can I determine the profit potential of a combination strategy?

A: The profit potential of a combination strategy depends on the prices of the underlying asset and the option contracts, as well as the option’s expiration date.

Combination Strategy In Option Trading

Image: aytoo.ma

Conclusion

Mastering combination strategies in option trading empowers traders with advanced tools to navigate complex market environments. Whether it’s managing risk, tailoring positions, or seeking specific payoffs, combination strategies offer a versatile approach that can enhance trading portfolios.

Are you ready to explore the exciting world of combination strategies and unlock your trading potential? Remember, trading involves risk, so always proceed with caution and seek professional guidance when necessary.