Imagine this: you’re sitting on the sidelines, watching the market fluctuate with each passing tick, knowing that there’s a powerful tool out there, a financial instrument that could potentially amplify your gains and manage risk, but you just haven’t quite grasped its complexities. This tool, my friend, is options trading. It’s a world of strategies, intricacies, and potential for both profit and loss, a dance on the razor’s edge of risk and reward. And the best way to learn this dance, to equip yourself with the knowledge to navigate the world of options, is through the wisdom shared in the pages of great books.

Image: www.pinterest.com

This guide will delve into the best books for options trading, spanning the spectrum from beginner-friendly introductions to advanced strategies, designed to equip you with the knowledge and the tools to become a confident and discerning trader. Whether you’re a novice venturing into the world of options for the first time or a seasoned trader seeking to refine your approach and expand your arsenal, these books have something valuable to offer.

The Foundation: Understanding the Language of Options

Before diving into specific strategies, it’s crucial to understand the language of options. Think of it as learning the alphabet before you can read a novel. Here are a few books that lay the foundation:

-

“Options as a Strategic Investment” by Lawrence McMillan: This classic, often considered the bible of options trading, delves into option fundamentals and introduces key concepts like intrinsic and extrinsic value, implied volatility, and option pricing models. McMillan writes with clarity and depth, making complex concepts understandable for beginners.

-

“The Options Trading Bible” by Guy Cohen: An accessible and comprehensive guide that walks you through the basics of options, covering topics like option types, option Greeks, and risk management. Cohen’s clear and engaging writing style makes the process of learning options enjoyable and approachable.

-

“Options, Futures, and Other Derivatives” by John C. Hull: While this book is a bit more academic and geared towards a finance background, it offers a deep dive into the mathematical and theoretical aspects of options, providing a solid understanding of the underlying mechanics.

Mastering Option Strategies: From Basic to Advanced

Once you’ve grasped the basics, it’s time to expand your knowledge with specific strategies. These books provide a roadmap to understanding and implementing different approaches:

-

“Trading in the Zone” by Mark Douglas: Beyond just trading strategies, this book emphasizes the psychological aspects of trading and its impact on performance. Douglas outlines strategies for managing emotions, overcoming fear and greed, and cultivating a disciplined mindset, crucial for success in trading.

-

“The Naked Option” by Mike Belleme: This book emphasizes trading options without owning the underlying asset, focusing on leveraging leverage and generating income. It covers various strategies like covered calls, cash-secured puts, and selling premium.

-

“Option Volatility & Pricing: Advanced Trading Strategies and Techniques” by Sheldon Natenberg: This book takes a deeper dive into the concept of volatility and its role in option pricing. It explores various models for predicting volatility and introduces advanced strategies for leveraging volatility.

-

“The Complete Guide to Option Strategies” by Larry McMillan: This book offers an extensive overview of various option trading strategies, from basic to advanced. It provides clear explanations, illustrative examples, and practical applications, making it a valuable resource for traders of all experience levels.

The Art of Risk Management: Protecting Your Investments

Options trading is inherently risky, and understanding how to manage that risk is essential. These books offer valuable insights:

-

“Options Trading: A Concise Guide” by Alan Hull: This book provides a practical and concise guide to options trading, focusing on risk management and the importance of defining your trading style before executing any strategies. Hull’s practical approach makes it a valuable resource for novice and experienced traders alike.

-

“The Psychology of Trading” by Brett Steenbarger: This book explores the emotional and psychological aspects of trading, helping you understand your own biases and vulnerabilities to make better trading decisions. It provides strategies for building confidence, managing emotions, and maintaining discipline in the face of market volatility.

Image: toughnickel.com

Building Your Edge: The Importance of Trading Psychology

Finally, the best trading strategies become pointless without a sound trading psychology. These books offer insights into the mental aspect of trading:

-

“The Disciplined Trader” by Mark Douglas: Building on the concepts explored in “Trading in the Zone,” this book emphasizes the importance of disciplined trading habits and mindset. Douglas explores how to develop a winning trading plan, identify and overcome emotional obstacles, and maintain focus in the face of uncertainty.

-

“Trading in the Matrix” by Mark Douglas: Exploring the intricate relationship between market dynamics and human psychology, Douglas delves into the mental processes that often lead to poor trading decisions and offers strategies to cultivate a more objective, confident, and profitable mindset.

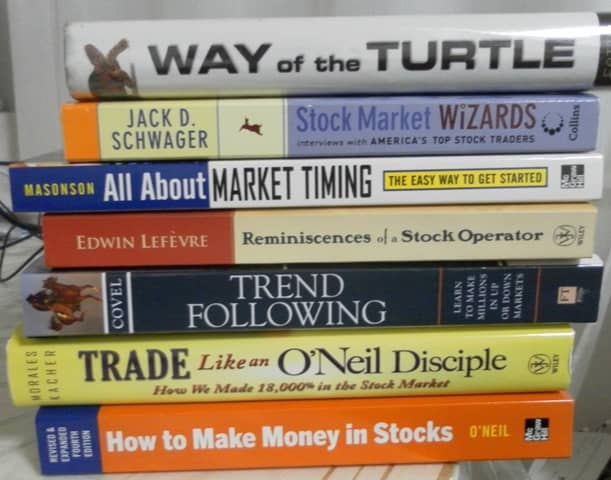

Best Books To Read For Options Trading

Navigating the Labyrinth: Finding Your Path in the World of Options

The journey into options trading isn’t always smooth. It’s a path of learning, trial and error, and continuous refinement – there are no shortcuts, no guaranteed wins. However, by immersing yourself in the knowledge shared in these books, you equip yourself with the tools and the wisdom to navigate the complexities, and discover your own distinct path in this exciting world.

As you delve into these books, remember to approach the knowledge with a spirit of exploration, an open mind, and a commitment to continuous learning. This journey isn’t just about mastering the strategies, it’s about developing the mindset, the discipline, and the resilience that will ultimately separate you as a successful, confident, and insightful trader.