<!DOCTYPE html>

Image: www.pinterest.com

Introduction: Navigating the Exciting World of Financial Trading

The allure of financial trading has captivated countless individuals seeking financial freedom and the thrill of the fast-paced markets. Among the various trading avenues, day trading and trading options stand out as distinct approaches with unique characteristics and complexities. In this comprehensive guide, we’ll delve into the realm of day trading vs. trading options, exploring their definitions, strategies, risks, and rewards to help you make an informed decision.

Day Trading vs. Trading Options: A Comparative Analysis

Day trading, as the name suggests, involves buying and selling financial instruments within the same trading day, primarily focusing on short-term price fluctuations. Day traders aim to capitalize on intraday movements, exiting their positions before the market closes. In contrast, trading options provides the flexibility to bet on the future direction of an underlying asset without the obligation to buy or sell it. Options traders have the option to exercise the right to buy or sell the asset at a predefined price on or before a specified date.

Day Trading: Risk and Reward in the Fast Lane

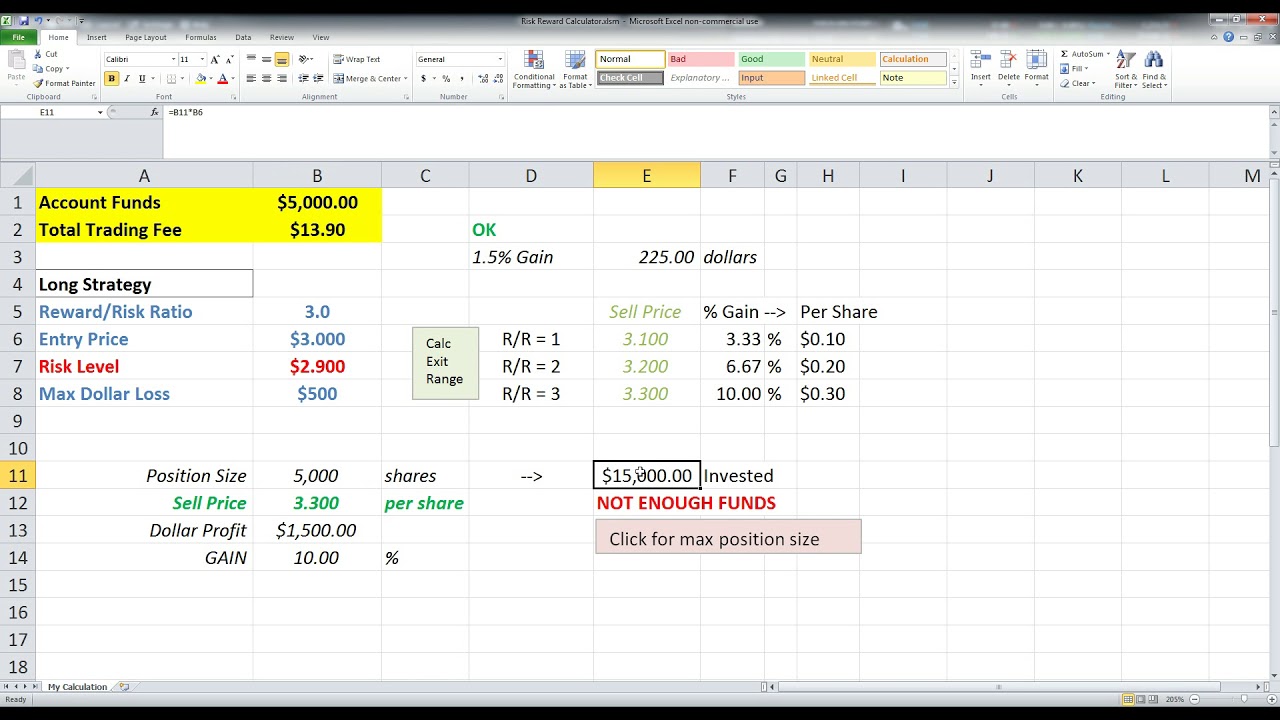

Day trading offers the potential for substantial profits due to the high frequency of trades executed. However, it also carries significant risks. Day traders must possess exceptional analytical skills, risk management capabilities, and emotional resilience. The fast-paced nature of day trading requires quick decision-making, often with limited information. Successful day traders rely on technical analysis, monitoring charts and patterns to identify trading opportunities.

Image: www.fondazionealdorossi.org

Trading Options: Flexibility, Limited Risk

Trading options offers a more structured and potentially less risky approach compared to day trading. Options buyers have limited liability, as they only risk the premium paid for the option. However, this flexibility comes at a cost. The potential profit for options traders is limited to the difference between the option’s strike price and the underlying asset’s price at expiration. Options strategies can be complex, requiring a thorough understanding of option pricing models and the factors influencing them.

Tips for Success: Embracing Best Practices

Whether you choose day trading or trading options, there are essential tips to follow for greater success. Financial education is paramount, gaining a deep understanding of market dynamics, trading strategies, and risk management techniques. Practice with a simulated trading account is highly recommended to refine your skills without risking real capital. Effective money management is crucial, allocating funds prudently and adhering to strict stop-loss orders to mitigate losses.

Common FAQs: Addressing Reader Inquiries

Q: Which approach is more suitable for beginners?

A: Trading options is generally considered more accessible for beginners due to its structured nature and limited risk. However, both approaches require significant learning and practice.

Q: What are the capital requirements for these trading methods?

A: Day trading typically requires a more substantial amount of capital compared to trading options due to margin trading practices. The minimum capital requirement varies depending on the broker and trading strategy.

Q: Is it possible to combine day trading and trading options?

A: Yes, it is possible to incorporate both approaches into a comprehensive trading strategy. However, it requires a high level of expertise and risk management skills to navigate the complexities involved.

Day Trading Vs Trading Options

Image: ditycapylal.web.fc2.com

Conclusion: Embarking on Your Trading Journey

The decision between day trading vs. trading options ultimately depends on your individual risk tolerance, financial goals, and trading style. Whether you seek the adrenaline rush of day trading or the more calculated approach of trading options, remember that success in financial markets requires dedication, perseverance, and a comprehensive understanding of the risks involved. Embark on your trading journey with a clear understanding of your objectives and a plan that aligns with your risk appetite. Are you ready to embrace the challenges and rewards of financial trading?