Capture the Power of Options: A Gateway to Enhanced Investments

For the ambitious investor seeking to navigate the complex but lucrative world of day trading, understanding options basics is paramount. Options trading presents an opportunity to leverage your trading acumen and capitalize on market movements, offering the potential to amplify your returns while mitigating risk.

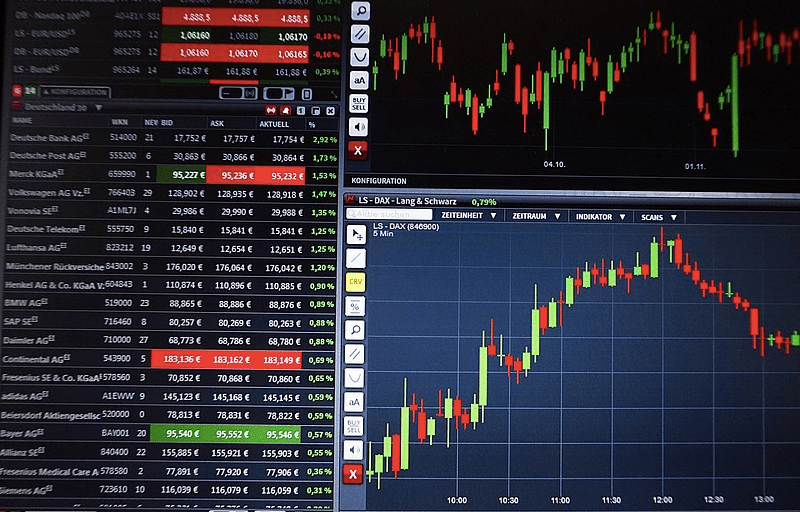

Image: roshenkov.blogspot.com

In this comprehensive guide, we will delve into the fundamentals of day trading options, empowering you with the knowledge and confidence to harness this powerful financial tool. From the nuances of options contracts to the various strategies employed by seasoned traders, we will unravel the intricacies of options trading, equipping you to make informed decisions and potentially elevate your investment journey.

Options Basics: Unlocking the Gate to Market Potential

An option is a contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a specific price (known as the strike price) on or before a specified date (expiration date). This flexibility provides traders with the option to capitalize on market movements while limiting their downside risk, making options a versatile tool for both conservative and aggressive investors.

Day trading options involves buying and selling options within a single trading day, capturing short-term market fluctuations. Unlike investing in stocks or other traditional assets, day trading options requires a keen understanding of options pricing, market dynamics, and risk management techniques. Options contracts derive their value from various factors, including the underlying asset’s price, time to expiration, volatility, and market sentiment. Understanding these factors is crucial for effective options trading.

Types of Options: Call vs. Put

In the world of options trading, there are two fundamental types of contracts: calls and puts. Call options give the buyer the right to buy the underlying asset at the strike price, while put options grant the buyer the right to sell the underlying asset at the strike price. These contracts allow traders to speculate on whether the asset’s price will rise (call option) or fall (put option) by a certain date.

Strategies for Day Trading Options: Navigating the Market Maze

Day trading options offers a diverse range of strategies tailored to varying risk appetites and market conditions. Some common strategies include:

-

Bull Call Spread: Buying a call option with a lower strike price and simultaneously selling a call option with a higher strike price, both expiring on the same date. This strategy benefits from a moderate increase in the underlying asset’s price.

-

Bear Put Spread: Selling a put option with a higher strike price and buying a put option with a lower strike price, both expiring on the same date. This strategy profits from a moderate decline in the underlying asset’s price.

-

Iron Condor: Selling a call option with a lower strike price, buying a call option with a higher strike price, selling a put option with a higher strike price, and buying a put option with a lower strike price, all expiring on the same date. This strategy benefits from a narrow range-bound movement in the underlying asset’s price.

Choosing the appropriate trading strategy depends on your market outlook, risk tolerance, and investment goals. It is essential to thoroughly research and understand each strategy before employing it in live trading.

Image: www.youtube.com

Expert Insights: Gems from the Trading Trenches

“The key to successful options trading lies in managing your risk,” advises seasoned trader Mark Douglas. “Determine your risk tolerance and trade within those boundaries to mitigate potential losses.”

“Study market trends and historical data to gain insights into potential price movements,” adds leading market analyst Sarah Allen. “This knowledge will empower you to make informed trading decisions.”

Day Trading Options Basics

Image: derivfx.com

Conclusion: A Call to Action

Day trading options presents a compelling opportunity to enhance your investment strategy, but it also demands a comprehensive understanding of market dynamics, options pricing, and risk management techniques. By embracing the principles outlined in this guide and seeking guidance from credible sources, you can unlock the potential of options trading and navigate the market with confidence.

Remember, investing involves inherent risks, and it is essential to conduct thorough research and due diligence before making any trading decisions.