Introduction

As a seasoned options trader, I’ve witnessed firsthand the importance of comparing options trading prices before making any decisions. One memorable trade, in particular, taught me the value of meticulous research. I had set my sights on a promising stock, but after comparing prices across multiple exchanges, I discovered a significant variance. The difference in premium was substantial enough to affect my profit margin considerably. From that day forward, I vowed to never overlook the significance of comparing options trading prices.

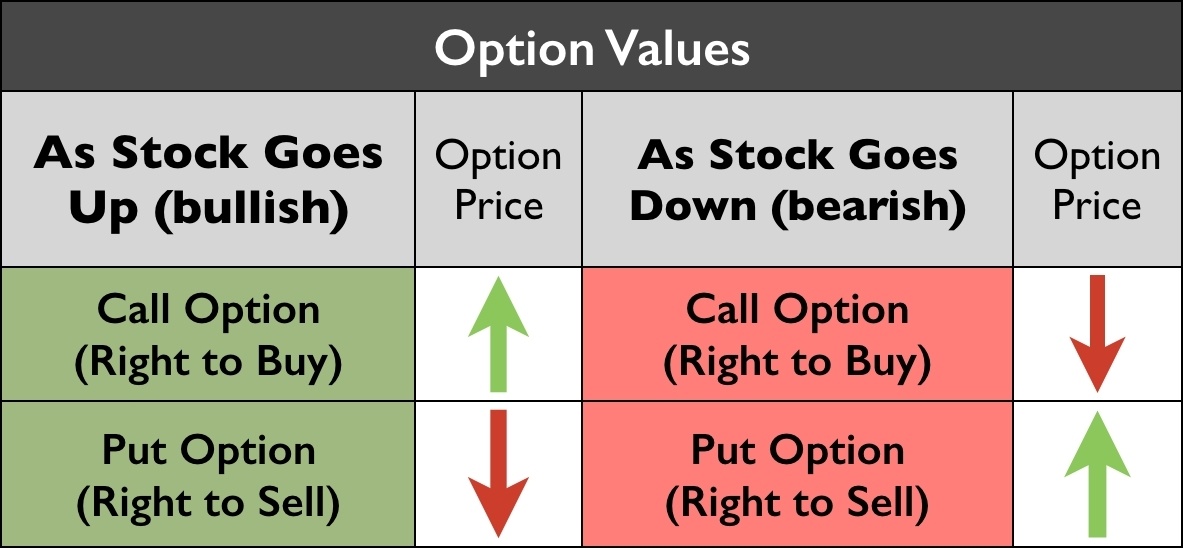

Image: tradesmartu.com

Understanding Options Trading Prices

An option is a contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. The premium is the price paid by the buyer to acquire this right. Options trading prices are influenced by a multitude of factors, including the underlying asset’s price, volatility, time to expiration, interest rates, and market sentiment.

Strategies for Comparing Options Trading Prices

The process of comparing options trading prices involves analyzing different quotes from various exchanges. The goal is to identify the most favorable price for the desired option. Here are some effective strategies:

-

Use a brokerage firm that provides real-time quotes: Reputable brokers offer platforms that display live options trading prices from multiple exchanges.

-

Take advantage of trading tools: Online trading platforms often provide tools that allow you to compare prices from different exchanges side by side.

-

Consider liquidity: Options with higher trading volume typically offer tighter spreads, resulting in lower transaction costs.

Expert Tips and Advice

As you navigate the complex world of options trading, consider these valuable tips from experienced professionals:

-

Set alerts: Establish alerts on your trading platform to notify you when options trading prices reach your desired levels.

-

Utilize broker research: Many brokerage firms employ in-house analysts who provide insightful research on options trading strategies and market trends.

-

Study historical data: Analyzing historical options trading prices can provide valuable insights into patterns and potential future movements.

Image: www.youtube.com

Commonly Asked Questions

Q: What is the difference between an option’s strike price and premium?

A: The strike price is the predetermined price at which the underlying asset can be bought or sold, while the premium is the price paid to acquire the right to do so.

Q: How does volatility affect options trading prices?

A: High volatility typically leads to higher options prices, as it increases the likelihood of significant price movements in the underlying asset.

Q: Can I find free options trading prices online?

A: Some websites offer real-time and historical options trading prices for free, albeit with limited functionality compared to paid services.

Compare Options Trading Prices

Image: mapsandmasters.com

Conclusion

Comparing options trading prices is a crucial step for maximizing profits and minimizing losses in the volatile world of options trading. By utilizing the strategies, tips, and advice outlined above, you can become a more informed and effective trader. Remember, the key to success lies in meticulous research and a deep understanding of market dynamics. Are you ready to embark on this exciting journey of options trading price comparison?