Embarking on the Options Trading Journey

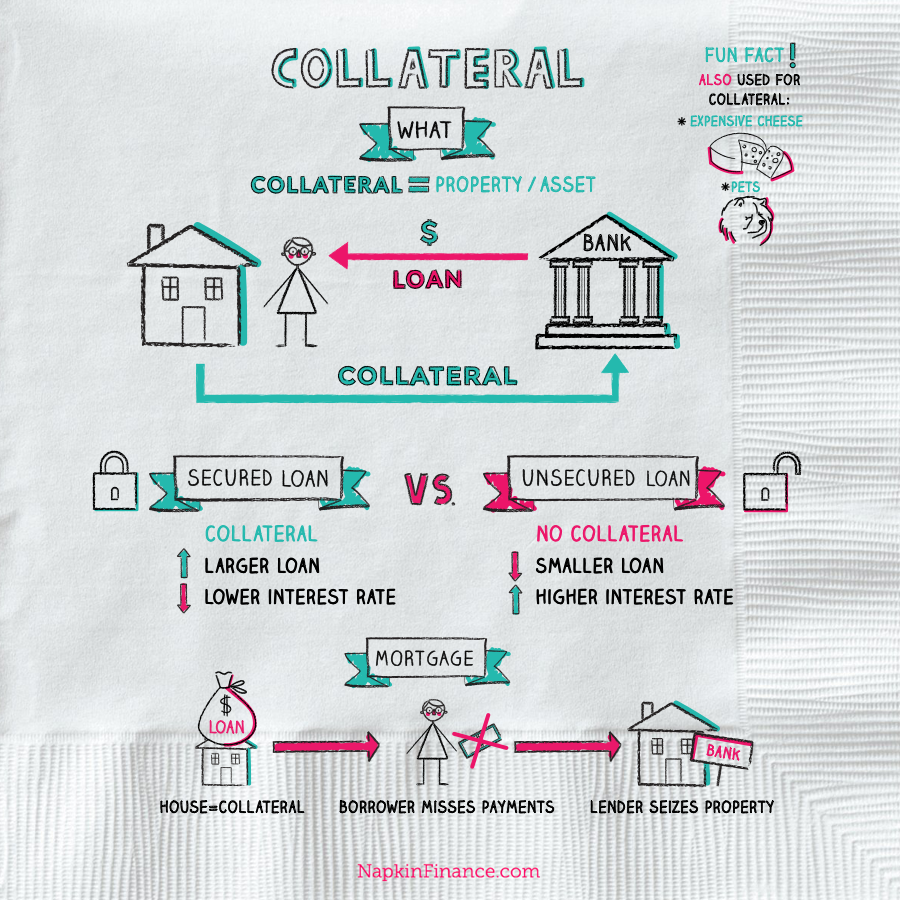

Options trading, a prominent strategy in the financial world, empowers traders to navigate market uncertainties. It involves acquiring contracts that grant the right but not the obligation to buy or sell an underlying asset at a specific price (strike price) before a predetermined date (expiration date). To mitigate potential risks associated with options trading, collateral plays a crucial role in securing the transaction between traders.

Image: www.sellbrite.com

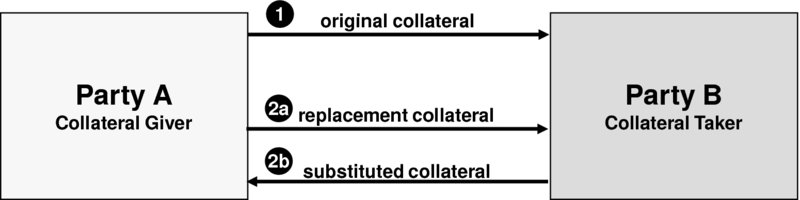

Collateral serves as a guarantee, protecting both parties involved in the options contract. It ensures that the contract’s obligations will be fulfilled, even if the underlying asset’s value experiences drastic fluctuations. Traders must maintain sufficient collateral to cover potential losses arising from adverse price movements.

Understanding Collateral in Options Trading

Definition and Significance

In options trading, collateral acts as a security deposit that traders pledge to the options clearinghouse (OCC). The OCC, a central counterparty to all U.S. exchange-traded options contracts, facilitates the clearing and settlement process. By requiring collateral, the OCC minimizes the risk of settlement failures and protects market participants.

Determination of Collateral Requirements

The amount of collateral required for options trading is determined by various factors. These include the type of option (call or put), the strike price, the time to expiration, and the volatility of the underlying asset. The OCC utilizes a complex system of calculations to assess the potential risk associated with each option contract and sets the corresponding collateral requirements.

Image: www.oreilly.com

Margin Accounts and Collateral Management

Traders typically trade options using margin accounts. Margin accounts allow traders to borrow funds from their brokerage firms to increase their buying power. However, borrowing on margin also amplifies potential risks. As such, brokerage firms require traders to maintain sufficient collateral in their margin accounts to cover potential margin calls if the value of the traded options moves against them.

Latest Trends and Developments in Collateral Management

The options trading landscape is constantly evolving, and so are the practices related to collateral management. Recent trends include:

- Increased Focus on Risk Management: Regulatory bodies and brokerage firms emphasize the importance of robust risk management practices, including proper collateralization.

- Technological Advancements: Advanced technologies, such as AI and machine learning, are being leveraged to enhance collateral optimization and reduce settlement risks.

- Innovative Collateral Types: Alternative forms of collateral, such as non-cash assets, are being explored to expand the options available for traders.

Tips and Expert Advice for Effective Collateral Management

Evaluate Your Options and Collateral Requirements

Before entering into options trades, traders should thoroughly research and understand the specific requirements and risks associated with each contract. They should also assess their financial situation and risk tolerance to determine the appropriate level of collateral they need to maintain.

Monitor Market Volatility and Adjust Collateral Accordingly

Market volatility can significantly impact collateral requirements. Traders should continuously monitor market conditions and adjust their collateral levels as needed to mitigate potential risks. When volatility increases, higher collateral may be necessary to meet margin calls.

FAQs on Collateral for Options Trading

Q: What types of assets can be used as collateral for options trading?

A: Eligible collateral for options trading typically includes cash, U.S. Treasury securities, and certain other marketable securities.

Q: Can I use borrowed funds as collateral for options trading?

A: Yes, you can use borrowed funds to increase your collateralization. However, it’s important to manage your margin account responsibly and be prepared to meet margin calls if necessary.

Collateral For Options Trading

Image: slidetodoc.com

Conclusion

Understanding and effectively managing collateral is crucial for successful options trading. By following the strategies outlined in this guide, traders can minimize risks, optimize capital allocation, and increase their chances of profitability. Remember, collateral serves as a safety net, ensuring the stability and integrity of the options trading ecosystem.

Are you interested in delving deeper into the world of options trading and enhancing your understanding of collateral management? If so, further research, consultation with financial professionals, and practical experience will empower you to navigate the complexities of this dynamic financial arena effectively.