Have you ever envisioned yourself commanding the financial markets, making calculated decisions that lead to substantial gains? Join us as we delve into the captivating world of option trading, where savvy investors wield their knowledge to navigate volatility and leverage limited capital for exceptional returns. In this comprehensive guide, we will unlock the secrets of option trading, empowering you to confidently explore this lucrative domain. Whether you’re a seasoned trader or a novice eager to embark on a path of financial empowerment, this article will equip you with the essential knowledge and insights to excel in the dynamic landscape of option trading.

Image: www.warriortrading.com

Options are unique financial instruments that confer the right, but not the obligation, to buy or sell an underlying asset at a specified price within a predetermined timeframe. This flexibility empowers traders to strategically navigate market fluctuations, hedge against risk, and generate income through various strategies. Throughout this guide, we will dissect the intricacies of option contracts, exploring their components, underlying mechanics, and diverse applications.

Understanding the Nuances of Option Trading

Option contracts consist of two primary components: the option buyer and the option seller. The buyer acquires the right (but not the obligation) to exercise the contract at a specified strike price. In contrast, the seller has the corresponding obligation to fulfill the terms of the contract if the buyer chooses to exercise it. Understanding the roles and responsibilities of both parties is fundamental to successful option trading.

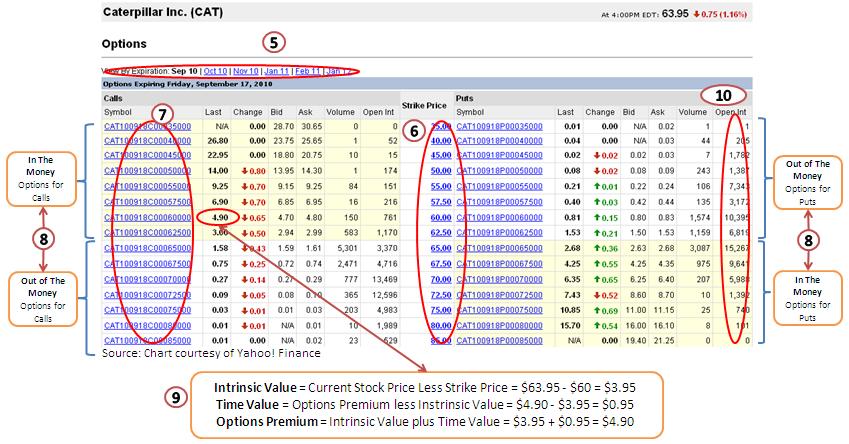

The strike price is another crucial element of option contracts, representing the predetermined price at which the underlying asset is bought or sold when the option is exercised. Traders must carefully consider the appropriate strike price based on their market analysis and trading strategy. Additionally, options have an expiration date, signifying the specific time frame within which they must be exercised. Failing to exercise an option before expiration will result in its value becoming worthless.

Types of Options and Their Applications

There are two main types of options: calls and puts. Call options grant the buyer the right to purchase the underlying asset at the strike price, while put options provide the right to sell. Traders can employ these options in various strategies:

- Bullish Strategies: Traders anticipate a rise in the underlying asset’s price and implement strategies such as buying calls or selling puts.

- Bearish Strategies: Traders foresee a decline in the underlying asset’s price and adopt strategies like buying puts or selling calls.

- Neutral Strategies: Traders aim to generate income from options’ time decay rather than speculating on the direction of the underlying asset’s price.

Mastering the Techniques of Option Trading

Navigating the complexities of option trading requires a refined skill set. Seasoned traders often deploy sophisticated strategies to manage risk and enhance their returns:

- Hedging: This strategy involves using options to mitigate risk associated with existing positions in other financial assets.

- Income Generation: Traders can earn income by selling options or implementing strategies like covered calls or cash-secured puts.

- Speculation: This approach entails capitalizing on anticipated price movements of the underlying asset through strategic option purchases or sales.

Image: www.trade-stock-option.com

Tips and Expert Advice for Enhanced Returns

To excel in option trading, incorporate the following expert tips into your strategy:

- Thoroughly Understand the Risks: Before venturing into option trading, it is imperative to comprehend the potential risks involved.

- Develop a Comprehensive Trading Plan: Outline your trading strategies, risk tolerance, and exit criteria to guide your decision-making process.

- Manage Your Emotions: The market’s inherent volatility can evoke strong emotions. Maintain a disciplined approach to avoid irrational trading decisions.

- Seek Continuous Education: Stay abreast of market trends, option trading techniques, and industry news to refine your skills and stay competitive.

Frequently Asked Questions

Q: Is option trading a viable way to make a living?

A: While option trading can be a lucrative endeavor, it requires extensive knowledge, skill, and discipline. It is generally not advisable to rely solely on option trading as a primary source of income.

Q: What is the best trading platform for options?

A: The optimal trading platform depends on individual trading needs and preferences. Consider factors such as trading fees, available markets, and user interface when selecting a platform.

Class On Option Trading 15301

Image: www.youtube.com

Conclusion

Embracing the world of option trading empowers you to diversify your portfolio, enhance your returns, and navigate market volatility. By arming yourself with the knowledge and strategies outlined in this comprehensive guide, you can confidently navigate this complex financial landscape. Remember, persistent learning, disciplined execution, and a commitment to excellence are the keys to unlocking the full potential of option trading. Are you ready to embark on this exciting journey? Start exploring the world of options today!