Introduction:

Image: www.idgcdn.com.au

In the dynamic world of finance, options trading offers traders a powerful tool to navigate market uncertainties and enhance their portfolio returns. Among the multitude of options available, Cisco Systems’ (CSCO) options stand out for their potential to generate substantial profits while managing risks effectively. This comprehensive guide delves into the intricacies of Cisco options trading, empowering you to make informed decisions and seize market opportunities with confidence.

Understanding Cisco Options:

Cisco options are financial contracts that give the buyer the right, but not the obligation, to buy or sell a predefined number of Cisco shares at a specified price on or before a certain date. This flexibility allows traders to tailor their strategies to various market conditions and investment objectives.

Types of Cisco Options:

Call Options: Grant the buyer the right to purchase a specified number of Cisco shares at a predetermined price (strike price) on or before the expiration date. Traders purchase call options when they anticipate an increase in Cisco’s stock price.

Put Options: Give the buyer the right to sell a certain number of Cisco shares at a fixed strike price on or before the expiration date. Traders typically buy put options when they expect Cisco’s stock price to decline.

Understanding Key Metrics:

Several metrics are crucial for understanding Cisco options:

Strike Price: The price at which the buyer can exercise their right to buy or sell Cisco shares.

Expiration Date: The date on which the option contract expires, after which it becomes worthless.

Premium: The price paid by the buyer to acquire the option contract.

Benefits of Cisco Options Trading:

Leverage: Amplifies potential returns with a relatively small capital investment compared to purchasing Cisco shares directly.

Reduced Risk: Limits the trader’s downside risk to the premium paid for the option contract.

Flexibility: Provides traders with a versatile tool to adapt to changing market conditions and pursue various investment strategies.

Expert Insights:

“Cisco options trading offers a unique opportunity to capitalize on market volatility and generate substantial returns,” says seasoned trader Martha Goodman. “Traders need to carefully analyze the underlying fundamentals of Cisco and the overall market dynamics to make informed decisions.”

“It’s crucial to have a solid understanding of options pricing models and technical analysis to maximize profit potential and mitigate risks,” advises financial analyst Robert Spencer.

Actionable Tips:

Research Thoroughly: Before investing in Cisco options, conduct in-depth research on Cisco’s financial performance, competitive landscape, and industry trends.

Choose the Right Strategy: Identify your investment objectives and risk tolerance to select an appropriate options trading strategy, such as bullish call spreads, bearish put spreads, or straddles/strangles.

Manage Risk Effectively: Monitor your options positions regularly and consider implementing risk-management techniques, such as stop-loss orders or hedging strategies.

Conclusion:

Cisco options trading offers a multitude of opportunities for sophisticated investors seeking to enhance their portfolio returns. By leveraging the flexibility, potential leverage, and reduced risk associated with options, traders can navigate market uncertainties and seize profit opportunities. Remember, meticulous research, a solid understanding of options concepts, and prudent risk management are essential elements for success in this dynamic financial instrument.

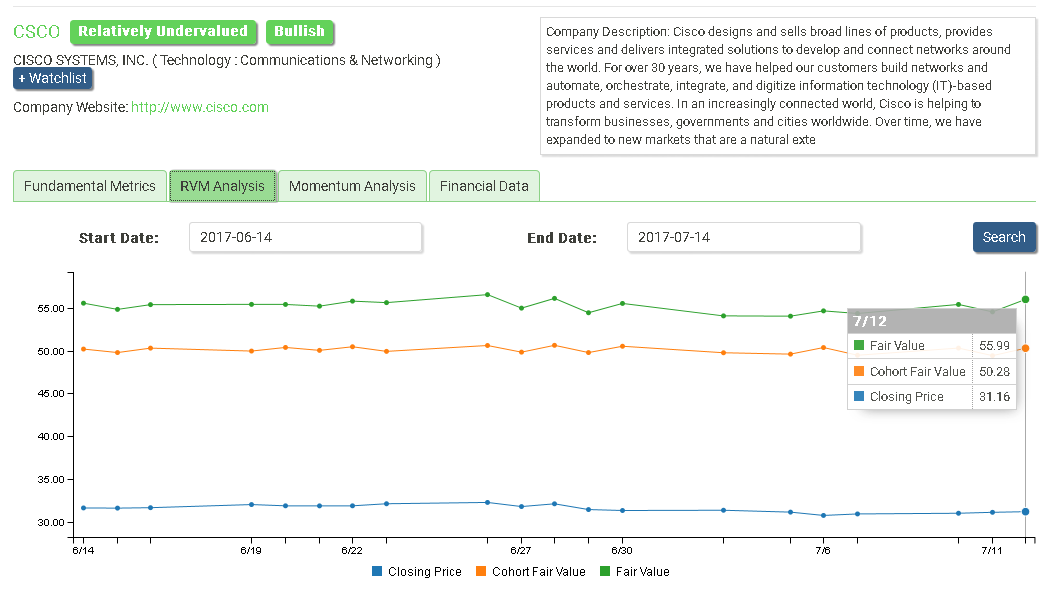

Image: www.milwaukeecolo.com

Cisco Options Trading

Image: iknowfirst.com